|

Big Day for Mortgage Rates?

https://paulcantor.present.me/embed/625/300/2958 We have been waiting for months for today's Fed decision on tapering Quantitative Easing. Yesterday's CPI numbers indicate that inflation remains almost non-existent. The percentage the employable population actu...

There was potentially good news for mortgage rates on Wednesday as the Fed's Federal Open Market Committee (FOMC) announced that its quantitative easing (QE) program would remain unchanged for the present.

Economists expect the Fed to begin tapering the amount of QE toward the end of the year in acco...

FOMC Minutes Suggest QE Tapering by Year-End

FOMC Minutes Suggest QE Tapering by Year-End

The minutes for June's meeting of the Federal Open Market Committee (FOMC) suggest that committee members are mostly in agreement that the current quantitative easing program (QE) should begin winding down by year end, but the committee minutes are very cl...

By Paul Cantor

The Federal Open Market Committee (FOMC) of the Federal Reserve decided to continue its current policy of quantitative easing (QE) based on current economic conditions. The Fed currently purchases $40 billion in mortgage-backed securities (MBS) and $45 billion in Treasury securities monthly.

The Federal Open Market Committee (FOMC) of the Federal Reserve decided to continue its current policy of quantitative easing (QE) based on current economic conditions. The Fed currently purchases $40 billion in mortgage-backed securities (MBS) and $45 billion in Treasury securities monthly.

Objectiv...

Minutes of the April/May Federal Open Market Committee (FOMC) recently released may have a significant impact on mortgage rates going forward. One significant development from the meeting suggests that the present quantitative easing (QE) program may be modified in the near future.

Minutes of the April/May Federal Open Market Committee (FOMC) recently released may have a significant impact on mortgage rates going forward. One significant development from the meeting suggests that the present quantitative easing (QE) program may be modified in the near future.

...

Wednesday's Federal Open Market Committee (FOMC) statement indicates the Federal Reserve's commitment to keeping long term interest rates and inflation under control.

Wednesday's Federal Open Market Committee (FOMC) statement indicates the Federal Reserve's commitment to keeping long term interest rates and inflation under control.

The Fed will continue monitoring inflation, but does not expect inflation to rise more than 0.50 percent above its target rate of 2.00...

The minutes for the Federal Open Market Committee (FOMC) meeting held March 19 and 20 were released on Wednesday April 10, 2013.

The minutes for the Federal Open Market Committee (FOMC) meeting held March 19 and 20 were released on Wednesday April 10, 2013.

These periodic meetings by the FOMC cover a wide ranging group of topics that impact the overall economy in the United States.

The decisions made and acted upon from the FOM...

The Federal Reserve's statement after yesterday's Federal Open Market Committee (FOMC) meeting left no doubt as to the Fed's dual commitment to keeping long term interest rates down and encouraging economic growth.

The Federal Reserve's statement after yesterday's Federal Open Market Committee (FOMC) meeting left no doubt as to the Fed's dual commitment to keeping long term interest rates down and encouraging economic growth.

No changes to the Fed's current bond-buying program were made during today's FOMC meet...

The Federal Open Market Committee (FOMC) released minutes from its January meeting last Wednesday, as it generally does three weeks following the most recent meeting.

The Federal Open Market Committee (FOMC) released minutes from its January meeting last Wednesday, as it generally does three weeks following the most recent meeting.

The FOMC is a committee within the Federal Reserve System tasked with overseeing the purchase and sale of US Treasury securitie...

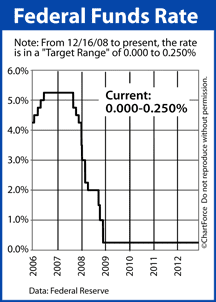

The Federal Reserve's Federal Open Market Committee (FOMC) voted to maintain the Federal Funds Rate within its current range of zero to 0.25 percent, and to continue its current stimulus program of purchasing $85 billion monthly in Treasury bonds and mortgage-backed securities (MBS).

The Federal Reserve's Federal Open Market Committee (FOMC) voted to maintain the Federal Funds Rate within its current range of zero to 0.25 percent, and to continue its current stimulus program of purchasing $85 billion monthly in Treasury bonds and mortgage-backed securities (MBS).

Citing weather-r...

The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Wednesday.

The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Wednesday.

For the tenth consecutive meeting, the FOMC vote was nearly unanimous. Richmond Federal Reserve President Jeffrey Lacker was the lone dissenter in the 9-1 vo...

The Federal Open Market Committee (FOMC) begins a 2-day meeting today, its last of 8 scheduled meetings this year.

The Federal Open Market Committee (FOMC) begins a 2-day meeting today, its last of 8 scheduled meetings this year.

The Federal Open Market Committee is a 12-person subcommittee within the Federal Reserve. It's the group which votes upon U.S. monetary policy.

The monetary policy action for w...

The Federal Reserve released its October Federal Open Market Committee (FOMC) meeting minutes last week, revealing a Fed in disagreement about the future of the U.S. economy and about what, if any, stimulus may be warranted in the next 12 months.

The Federal Reserve released its October Federal Open Market Committee (FOMC) meeting minutes last week, revealing a Fed in disagreement about the future of the U.S. economy and about what, if any, stimulus may be warranted in the next 12 months.

The "Fed Minutes" recaps the conversations a...

The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Wednesday.

The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Wednesday.

For the ninth consecutive meeting, the vote was nearly unanimous. And, also for the ninth consecutive meeting, Richmond Federal Reserve President Jeffre...

The minutes from the Federal Reserve's September Federal Open Market Committee meeting were released Thursday.

The minutes from the Federal Reserve's September Federal Open Market Committee meeting were released Thursday.

The Fed Minutes detail the discussions and debates which shaped the central banker's launch of its third round of qualitative easing since 2008. The minutes also give Wall Street insight int...

The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Thursday. For the eighth consecutive meeting, the vote was nearly unanimous.

The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Thursday. For the eighth consecutive meeting, the vote was nearly unanimous.

Just one FOMC member, Richmond Federal Reserve President Jeffrey Lacker, dissented in the 9...

The Federal Open Market Committee ends a 2-day meeting today, the group's sixth of 8 scheduled meetings this year. As a Henrico home buyer or would-be refinancer, be ready for mortgage rates to change.

The Federal Open Market Committee is a 12-person sub-committee of the Federal Reserve. Led by Fed C...

Eariler this week, the Federal Reserve released the minutes from its 2-day meeting which ended August 1, 2012. Since the release, mortgage rates have dropped.

Eariler this week, the Federal Reserve released the minutes from its 2-day meeting which ended August 1, 2012. Since the release, mortgage rates have dropped.

The Fed Minutes are released on a schedule, three weeks after the FOMC adjourns from one of its 8 scheduled meetings of the year.

The Fed ...

(1)

(3)

(8)

(1)

(5)

(9)

(3)

(227)

(2)

(1)

(3)

(1)

(50)

(185)

(5)

(1)

(57)

(1)

(7)

(13)

(29)

(373)

(4)

(14)

(20)

(8)

(22)

(53)

(3)

(7)

(37)