For decades, now, we have been dealing with humans being replaced by streamlined processes or machines that end up making them dispensable. But what about eliminating the friendly face at the front door there to appraise your home? It appears appraisers may no longer be required to get formal proper...

For decades, now, we have been dealing with humans being replaced by streamlined processes or machines that end up making them dispensable. But what about eliminating the friendly face at the front door there to appraise your home? It appears appraisers may no longer be required to get formal proper... The Federal Housing Finance Agency (FHFA) recently announced a new, streamlined home loan modification program to help Midlothian home owners who are behind in their payments or own a home with a mortgage that is under water.

The Federal Housing Finance Agency (FHFA) recently announced a new, streamlined home loan modification program to help Midlothian home owners who are behind in their payments or own a home with a mortgage that is under water.

The purpose of the recently announced program continues to focus on helping...

Although the financial markets have tightened lending guidelines and financing requirements over the last few years, the right advice when applying for your loan can make a big difference. Not all loans are approved. And even when they aren't approved immediately, it doesn't have to be the end of yo...

Although the financial markets have tightened lending guidelines and financing requirements over the last few years, the right advice when applying for your loan can make a big difference. Not all loans are approved. And even when they aren't approved immediately, it doesn't have to be the end of yo...

Have you heard the term Private Mortgage Insurance (PMI) when looking to finance real estate?

You may be wondering what PMI is and how you know when you need to purchase it.

These answers can be hard to find among all the real estate jargon you might be hearing lately.

Below is the short version ...

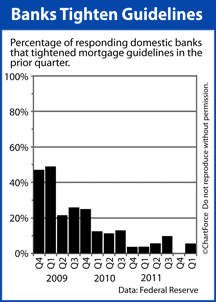

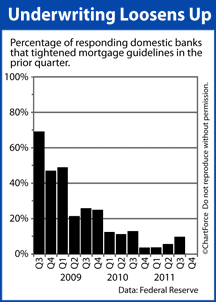

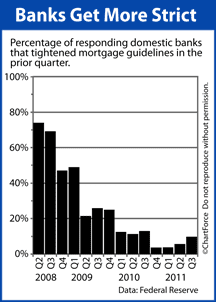

According to the Federal Reserve's quarterly Senior Loan Officer Survey, it's getting easier to get approved for a home loan.

According to the Federal Reserve's quarterly Senior Loan Officer Survey, it's getting easier to get approved for a home loan.

Between July - September 2012, fewer than 6% of banks tightened mortgage guidelines -- the fourth straight quarter that's happened-- and roughly 10% of banks actually loosened...

As another signal of an improving U.S. economy, the nation's biggest banks have started to loosen mortgage lending guidelines.

As another signal of an improving U.S. economy, the nation's biggest banks have started to loosen mortgage lending guidelines.

As reported by the Federal Reserve, last quarter, no "big banks" reported stricter mortgage standards as compared to the quarter prior and "modest fractions...

Beginning Monday, June 11, the FHA is changing its mortgage insurance premium schedule for the second time this year.

Beginning Monday, June 11, the FHA is changing its mortgage insurance premium schedule for the second time this year.

Some FHA mortgage applicants will pay lower mortgage insurance premiums going forward. Others will pay more. The new premiums apply to all FHA mortgages, both purchase and refinance.

T...

Despite several big-name banks pulling the product from their respective home loan offerings, reverse mortgages remain a popular mortgage choice among homeowners aged 62 or over.

A reverse mortgage is exactly what it sounds like -- a mortgage in reverse. Rather than borrow a fixed amount of money the...

Despite an improving U.S. economy, the nation's banks remain cautious about what they will lend, and to whom.

Despite an improving U.S. economy, the nation's banks remain cautious about what they will lend, and to whom.

Last quarter, by a margin of 3-to-2, more banks tightened residential mortgage lending standards for "prime borrowers" than did loosen them.

A "prime borrower" is defined a...

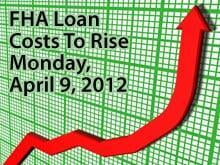

Planning to use an FHA-backed mortgage for your next home loan? You might want to get your application in gear today.

Planning to use an FHA-backed mortgage for your next home loan? You might want to get your application in gear today.

Beginning next week, the Federal Housing Administration (FHA) is changing the way it charges mortgage insurance to U.S. homeowners. For the fourth time since 2010, FHA mortg...

The new, revamped HARP program is now available in Virginia and nationwide. It was officially released Saturday, March 17, 2012 by Fannie Mae and Freddie Mac.

HARP is an acronym. It stands for Home Affordable Refinance Program. HARP is the conforming mortgage loan product meant for "under...

The FHA is making more changes to its flagship FHA Streamline Refinance program.

The FHA is making more changes to its flagship FHA Streamline Refinance program.

Beginning mid-June 2012, certain current, FHA-backed homeowners will be able to refinance their existing FHA mortgage into a new one, without having to pay the government-backed group's new, costly mortgage insurance pre...

Beginning April 1, 2012, the FHA is once again raising mortgage insurance premiums (MIP) on its newly-insured borrowers throughout Midlothian and the country.

Beginning April 1, 2012, the FHA is once again raising mortgage insurance premiums (MIP) on its newly-insured borrowers throughout Midlothian and the country.

It's the FHA's fourth such increase in the last two years.

Beginning April 1, 2012, upfront mortgage insurance premiums will be higher by 75 ba...

The government's new, revamped HARP program is 6 weeks from release. Homeowners in Virginia and nationwide are gearing up to refinance.

HARP is an acronym. It stands for Home Affordable Refinance Program. HARP is the government's loan product for "underwater homeowners". HARP makes current ...

After a half-decade of tightening mortgage guidelines, banks are starting to "loosen up".

The Federal Reserve conducts a quarterly survey of its member banks and, last quarter, not a single responding bank reported having tightened its mortgage guidelines for prime borrowers.

A "pr...

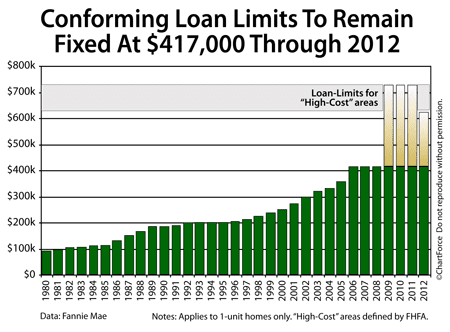

A conforming mortgage is one that, literally, conforms to the mortgage guidelines as set forth by Fannie Mae and Freddie Mac.

Conforming mortgage guidelines are Fannie's and Freddie's eligibility standards; an underwriter's series of check-boxes to determine whether a given loan should be ...

After a brief return to lower, pre-2009 levels, FHA loan limits have been restored. As signed into law last Friday, maximum FHA loan limits are -- once again -- as high as $729,750.

After a brief return to lower, pre-2009 levels, FHA loan limits have been restored. As signed into law last Friday, maximum FHA loan limits are -- once again -- as high as $729,750.

The move creates additional mortgage financing possibilities in more than 650 U.S. counties, and promises to increase t...

Tuesday, Fannie Mae and Freddie Mac unveiled lender instructions for the government's revamped HARP program, kick-starting a potential refinance frenzy across Virginia and nationwide.

HARP stands for Home Affordable Refinance Program. The updated program is meant to give "underwater homeowners...

As part of its quarterly survey to member banks nationwide, the Federal Reserve asked senior loan officers whether last quarter's "prime" residential mortgage guidelines have tightened, loosened, or remained as-is.

A "prime" borrower is defined as one with a well-documented, high-...

The Federal Home Finance Agency announced big changes to its Home Affordable Refinance Program Monday. More commonly called HARP, the Home Affordable Refinance Program is meant to give "underwater homeowners" opportunity to refinance.

The Federal Home Finance Agency announced big changes to its Home Affordable Refinance Program Monday. More commonly called HARP, the Home Affordable Refinance Program is meant to give "underwater homeowners" opportunity to refinance.

With average, 30-year fixed rate mortgages still hoverin...

(1)

(3)

(8)

(1)

(5)

(9)

(3)

(227)

(2)

(1)

(3)

(1)

(50)

(185)

(5)

(1)

(57)

(1)

(7)

(13)

(29)

(373)

(4)

(14)

(20)

(8)

(22)

(53)

(3)

(7)

(37)