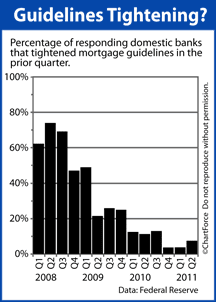

Mortgage guidelines appear to be tightening with the nation's largest banks.

Mortgage guidelines appear to be tightening with the nation's largest banks.

In its quarterly survey to senior loan officers nationwide, the Federal Reserve uncovered that a small, but growing, portion of its member banks is making mortgage approvals more scarce for "prime" borrowers.

A prim...

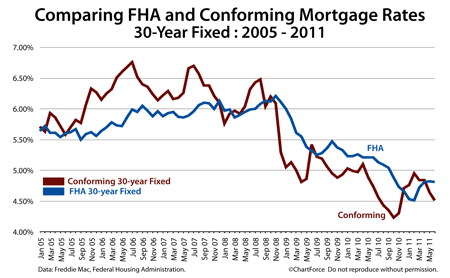

The FHA is insuring a greater percentage of loans than during any time in recent history. In 2006, it insured roughly 5 percent of the purchase mortgage market. Today, it insures one-quarter. "Going FHA" is more common than ever before -- but is it better?

The answer -- like most ...

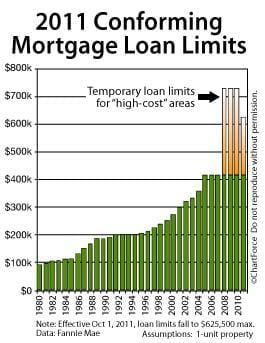

If you live in a high-cost area, keep an eye on your calendar. Effective October 1, 2011, temporary conforming loan limits will be lowered nationwide. Perhaps by as much as 14 percent.

If you live in a high-cost area, keep an eye on your calendar. Effective October 1, 2011, temporary conforming loan limits will be lowered nationwide. Perhaps by as much as 14 percent.

These limits range up to $729,750 currently.

"Temporary loan limits" were enacted as part of the government...

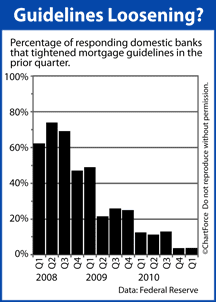

Another quarter, another sign that mortgage lending may be easing nationwide.

Another quarter, another sign that mortgage lending may be easing nationwide.

The Federal Reserve's quarterly survey of senior loan officers revealed that an overwhelming majority of U.S. banks have stopped tightening mortgage requirements for "prime borrowers".

A prime borrower is one with ...

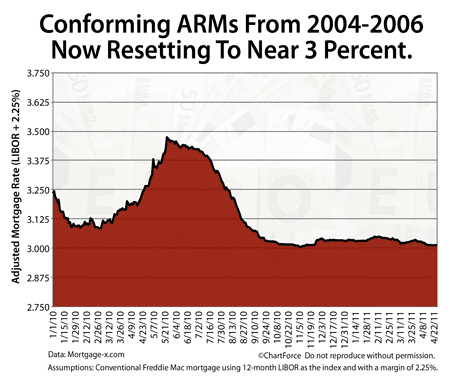

When a mortgage applicants chooses an adjustable-rate mortgage over a fixed-rate one, he accepts a risk that -- at some point in the future -- the mortgage's interest rate will rise. Lately, though, that hasn't been the outcome. Since mid-2010, conforming mortgages have adjusted below their initial...

When a mortgage applicants chooses an adjustable-rate mortgage over a fixed-rate one, he accepts a risk that -- at some point in the future -- the mortgage's interest rate will rise. Lately, though, that hasn't been the outcome. Since mid-2010, conforming mortgages have adjusted below their initial...By Paul Cantor

After this week ends, the FHA is raising mortgage insurance premiums on its new Midlothian borrowers. It's the FHA's third such increase in the last 12 months.

Beginning with FHA Case Numbers assigned April 18, 2011, mortgage insurance premiums will be higher by 25 basis points per year, or 0.25%.

Aga...

FHA Streamline Refinance guidelines are changing. For the better.

FHA Streamline Refinance guidelines are changing. For the better.

In an effort to improve its loan portfolio, the FHA is loosening approval standards on its popular refinance program, rendering large groups of homeowners suddenly FHA Streamline-eligible.

Now, that may seem counter-intuitive -- lo...

Beginning April 1, 2011, Fannie Mae is increasing its loan-level pricing adjustments. Conforming mortgage applicants in Virginia should plan for higher loan costs in the months ahead.

Beginning April 1, 2011, Fannie Mae is increasing its loan-level pricing adjustments. Conforming mortgage applicants in Virginia should plan for higher loan costs in the months ahead.

If you've never heard of loan-level pricing adjustments, you're not alone; they're an obscure mortgage pricing m...

For the third time in 12 months, the FHA is changing its mortgage insurance costs.

For the third time in 12 months, the FHA is changing its mortgage insurance costs.

Effective for all FHA case numbers assigned on, or after, April 18, 2011, annual mortgage insurance premiums (MIP) will increase 25 basis points.

The change will add $250 to an FHA-insured homeowner's annual loan ...

(1)

(3)

(8)

(1)

(5)

(9)

(3)

(227)

(2)

(1)

(3)

(1)

(50)

(185)

(5)

(1)

(57)

(1)

(7)

(13)

(29)

(373)

(4)

(14)

(20)

(8)

(22)

(53)

(3)

(7)

(37)