It’s terrifying but it’s true. One minute you think you own a property and the next, it has been recorded in someone else’s name. Fraud in real estate is alive and well, with authorities all over the country saying homes are illegally taken without owners’ consent. Because of the ever-growing...

It’s terrifying but it’s true. One minute you think you own a property and the next, it has been recorded in someone else’s name. Fraud in real estate is alive and well, with authorities all over the country saying homes are illegally taken without owners’ consent. Because of the ever-growing... There is a lot of misleading and incorrect information about Richmond real estate short sales.

There is a lot of misleading and incorrect information about Richmond real estate short sales.

Many people don't have a clear understanding of the purpose of short sales or how they actually work.

Essentially, a short sale is when one sells their home for less than the balance remaining on the mortgag...

Buying Henrico real estate doesn't just give you a place to live; it can also be a very smart financial move.

Buying Henrico real estate doesn't just give you a place to live; it can also be a very smart financial move.

This is because owning a home can be like having a forced savings account, which you are committed to for the long term.

Consistent Saving On Autopilot

Sometimes saving money on our own each mo...

Paying off the mortgage on your Richmond home faster not only means that you'll be able to enjoy the peace of mind that comes with completely owning your property sooner, but you may also save thousands of dollars in mortgage interest payments over time.

Paying off the mortgage on your Richmond home faster not only means that you'll be able to enjoy the peace of mind that comes with completely owning your property sooner, but you may also save thousands of dollars in mortgage interest payments over time.

Below are seven clever tips to help you get yo...

Older Henrico homes sometimes offer more charm and character than the newer houses of today. They boast gabled roofs, crown moldings, hardwood floors and antique fixtures.

Older Henrico homes sometimes offer more charm and character than the newer houses of today. They boast gabled roofs, crown moldings, hardwood floors and antique fixtures.

Buying an old house is like buying a piece of local history. Its beautiful period features can give it a timeless beauty and grac...

As a home buyer in Richmond , you can get a feel for whether a home's systems and appliances are in working order. However, you can't know for certain until after the home's been inspected.

As a home buyer in Richmond , you can get a feel for whether a home's systems and appliances are in working order. However, you can't know for certain until after the home's been inspected.

This is why real estate agents recommend that buyers hire a licensed home inspectors immediately after going in...

It's January, but home sales in golf communities remain strong like in the rest of the country.

It's January, but home sales in golf communities remain strong like in the rest of the country.

If you're looking to buy a home in a golf course community, either as a primary residence or as a vacation or retirement home, there are additional home traits which make buying on a golf course different ...

Experienced home sellers in Henrico know that reaching a sales agreement with a potential buyer can be just the start of the negotiation process. There are often inspection issues to resolve, among other items.

One particular negotiation point which can present difficulties for both buyers and seller...

The process of buying a foreclosed home is slightly different from the process of buying a non-foreclosure home. If you want to invest in Midlothian foreclosures, therefore, it is important to understand the different ways by which to purchase a foreclosed home.

The process of buying a foreclosed home is slightly different from the process of buying a non-foreclosure home. If you want to invest in Midlothian foreclosures, therefore, it is important to understand the different ways by which to purchase a foreclosed home.

There are three main ways to buy...

A short sale is when a property is sold for less than its remaining mortgage principal balance, and executed as a way for both the existing homeowner and mortgage lender to reduce their respective losses.

A short sale is when a property is sold for less than its remaining mortgage principal balance, and executed as a way for both the existing homeowner and mortgage lender to reduce their respective losses.

Typically, although not always, short sales are reserved for situations of extreme financial har...

In the aftermath of Hurricane Sandy, stories have emerged of homeowners whose hazard insurance coverage was too low to cover the damage to their respective properties.

In the aftermath of Hurricane Sandy, stories have emerged of homeowners whose hazard insurance coverage was too low to cover the damage to their respective properties.

Unfortunately, this scenario is common among U.S. homeowners, and is not just limited to damage from natural disasters. Ho...

As a home buyer or refinancing household in Henrico , you have choices with respect to your mortgage.

As a home buyer or refinancing household in Henrico , you have choices with respect to your mortgage.

You can choose a loan with accompanying discount points in exchange for lower mortgage rates; you can choose adjustable-rate loans over fixed rate ones; and, you can choose loans with principal + int...

To refinance a mortgage means to pay off your existing loan and replace it with a new one.

There are many reasons why homeowners opt to refinance, from obtaining a lower interest rate, to shortening the term of the loan, to switching mortgage loan types, to tapping into home equity.

Each has its consi...

Nationwide, mortgage rates are low in Virginia and home prices remain relatively low, too. This combination, plus rising rents, is pushing renters in some cities -- including Richmond -- toward first-time homeownership.

Nationwide, mortgage rates are low in Virginia and home prices remain relatively low, too. This combination, plus rising rents, is pushing renters in some cities -- including Richmond -- toward first-time homeownership.

Buying your first home can be exciting, but you should also do your research...

The U.S. housing market recovery is underway. New home sales are at a multi-year high, housing starts are at pre-recession levels, and home builders plan for a strong 2013.

Since late-2011, falling mortgage rates have boosted buyer purchasing power. Now, today, in many U.S. markets, the number of act...

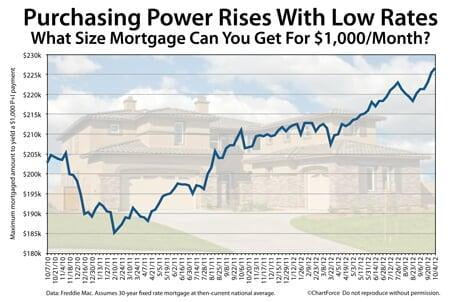

Mortgage rates in Virginia continue to troll near all-time lows, boosting the purchasing power of home buyers statewide.

According to Freddie Mac's most recent Primary Mortgage Market survey, the average 30-year fixed rate mortgage is now 3.39 percent nationwide, just three ticks off an all-time low....

With mortgage rates at all-time lows, purchase and refinance activity is climbing.

With mortgage rates at all-time lows, purchase and refinance activity is climbing.

Home sales are at their highest levels since May 2010 as home buyers take advantage of favorable economic conditions. Home prices are low, household income is rising, and rents are up in many U.S. cities.

Low rates have...

Home values are rising in many U.S. markets. The S&P/Case-Shiller Index has home values up 1.2 percent as compared to last year, and the government's Home Price Index shows an increase of 3.7 percent.

This has been partially evidenced by rising median home sales prices nationwide. Versu...

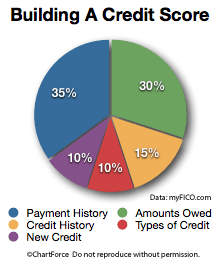

For today's home buyers and refinancing households, the value of "good credit" has never been higher. Mortgage approvals hinge on your FICO score, as does your final mortgage pricing. If you're shopping for a home in Virginia , therefore, or contemplating a refinance, be aware of how every...

For today's home buyers and refinancing households, the value of "good credit" has never been higher. Mortgage approvals hinge on your FICO score, as does your final mortgage pricing. If you're shopping for a home in Virginia , therefore, or contemplating a refinance, be aware of how every...(1)

(3)

(8)

(1)

(5)

(9)

(3)

(227)

(2)

(1)

(3)

(1)

(50)

(185)

(5)

(1)

(57)

(1)

(7)

(13)

(29)

(373)

(4)

(14)

(20)

(8)

(22)

(53)

(3)

(7)

(37)