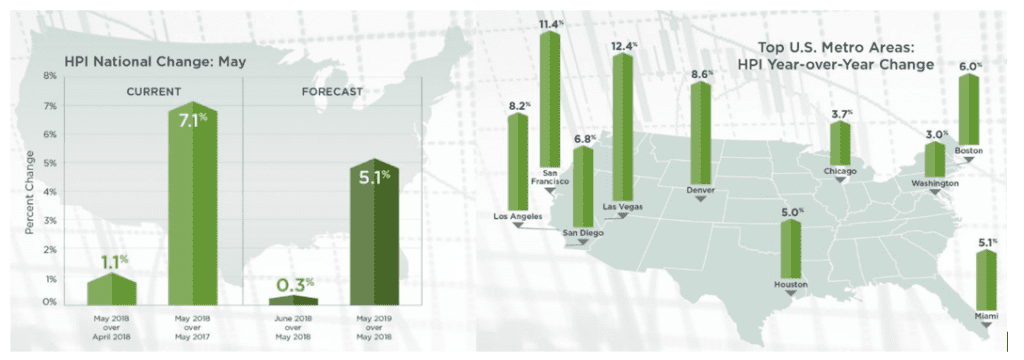

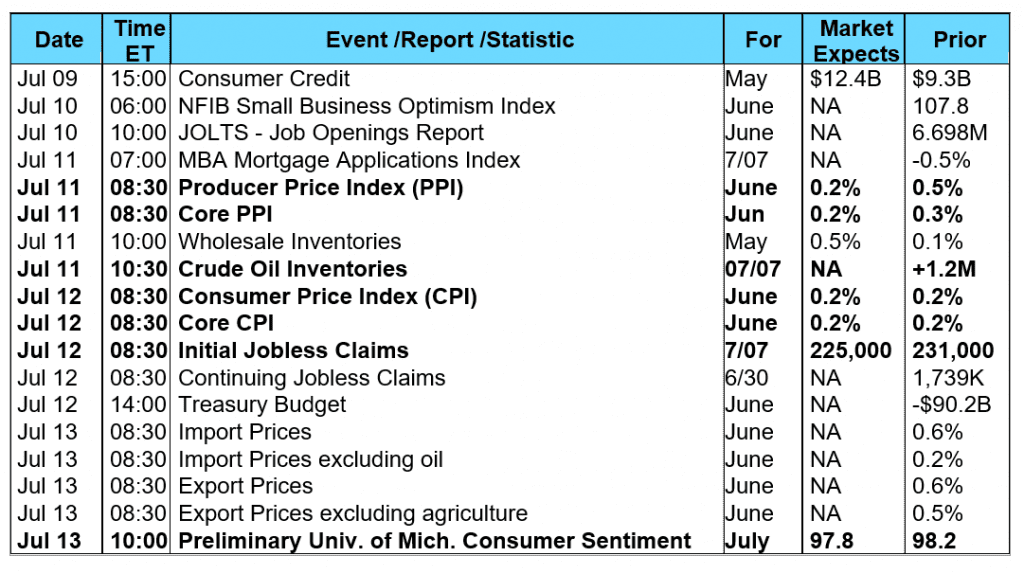

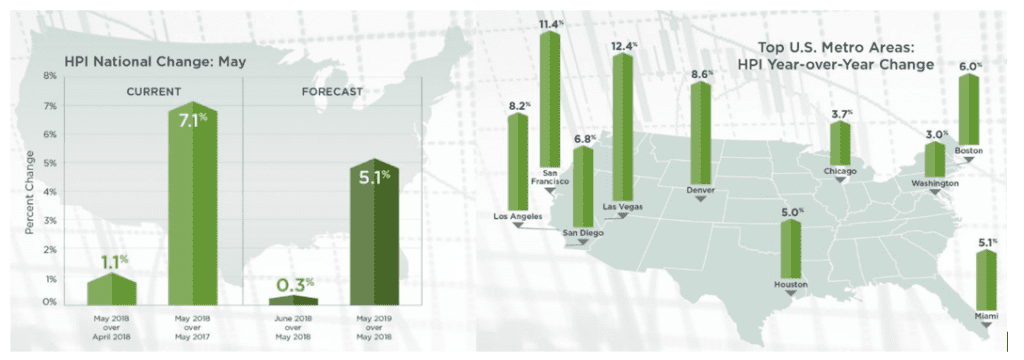

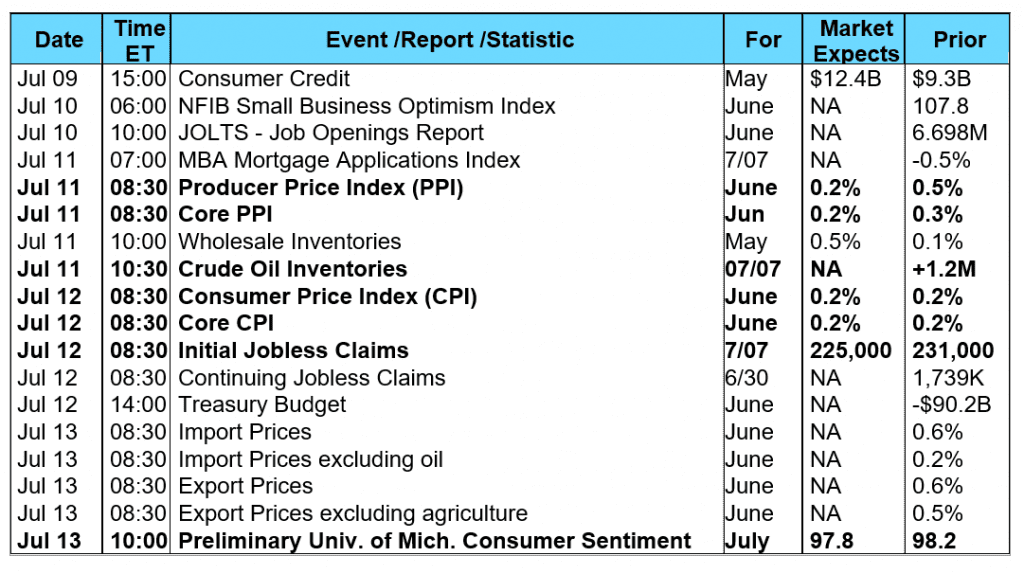

This past holiday-shortened week was good for both the broad stock market indexes and mortgage bonds as both asset classes finished the week moderately higher. Trading volumes were lower than usual due to the 4 th of July holiday, although active investors had to wade through ongoing news of a “trade war” between the U.S. and China; the release of Fed minutes from their latest policy meeting; and data from the June Employment Report. Thursday, the Fed released the minutes from its June 12-13 policy meeting revealing officials are aware of the possibility that growing trade tensions could have a negative impact on future business sentiment and investment spending. Friday brought a “not too hot, not too cold” “Goldilocks” employment report featuring solid nonfarm payrolls growth of +213,000 jobs coupled with a restrained 2.7% year-over-year gain in average hourly earnings that kept inflation and aggressive rate-hike worries at arms’ length. Nevertheless, neither the Fed minutes nor the key jobs data had much of an impact on long-term interest rates, with the yield on the benchmark 10-year Treasury note decreasing slightly for the week. In housing news, CoreLogic reported Tuesday their Home Price Index (HPI) showed home prices increased by 1.1% in May and by 7.1% on a year-over-year basis. May’s one-year appreciation of 7.1% was stronger than April’s reading of 6.9% and was the strongest number in four years. Moving forward, CoreLogic is forecasting homes will appreciate 5.1% in the coming year which is slightly below their forecast of 5.3% last month.  The highest price gains in metro areas were seen in Denver, Las Vegas, and San Francisco. CoreLogic Chief Economist Frank Nothaft remarked “The lean supply of homes for sale is leading to higher sales prices and fewer days on market, and the supply shortage is more acute for entry-level homes. Wednesday, the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey showed a decrease in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) fell 0.5% during the week ended June 29, 2018. The seasonally adjusted Purchase Index increased 1.0% from the week prior while the Refinance Index decreased by 2.0% from a week earlier. Overall, the refinance portion of mortgage activity decreased to 37.2% from 37.6% of total applications from the prior week. The adjustable-rate mortgage share of activity increased to 6.7% from 6.5% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance decreased to 4.79% from 4.84% with points decreasing to 0.41 from 0.42. For the week, the FNMA 4.0% coupon bond gained 14.1 basis points to close at $102.063 while the 10-year Treasury yield decreased 3.60 basis points to end at 2.824%. The Dow Jones Industrial Average gained 185.07 points to close at 24,456.48. The NASDAQ Composite Index advanced 178.09 points to close at 7,688.39. The S&P 500 Index added 41.45 points to close at 2,759.82. Year to date on a total return basis, the Dow Jones Industrial Average has lost 1.06%, the NASDAQ Composite Index has gained 11.37%, and the S&P 500 Index has advanced 3.22%. This past week, the national average 30-year mortgage rate decreased to 4.65% from 4.66%; the 15-year mortgage rate rose to 4.13% from 4.11%; the 5/1 ARM mortgage rate decreased to 3.99% from 4.00% while the FHA 30-year rate fell to 4.37% from 4.38%. Jumbo 30-year rates decreased to 4.59% from 4.69%. Economic Calendar - for the Week of July 9, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

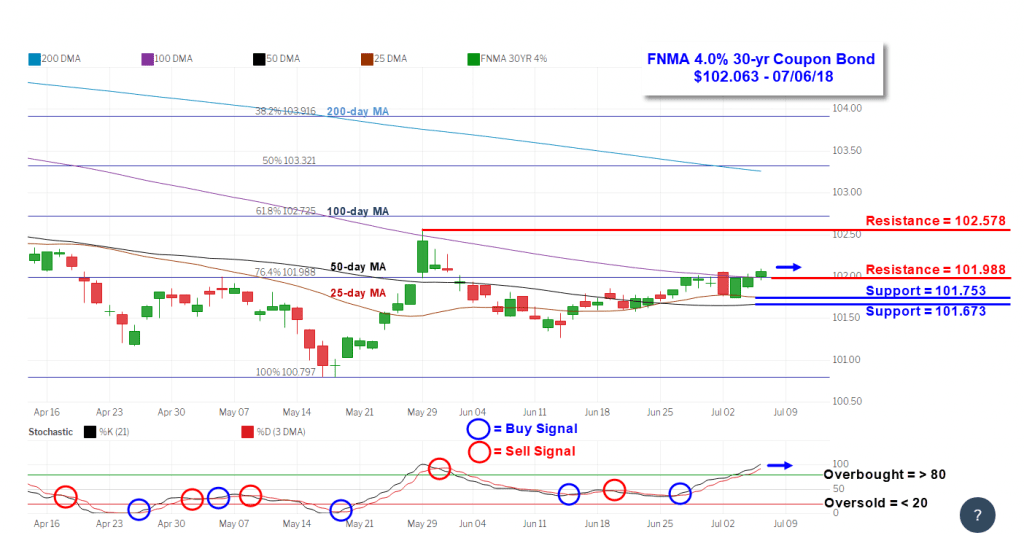

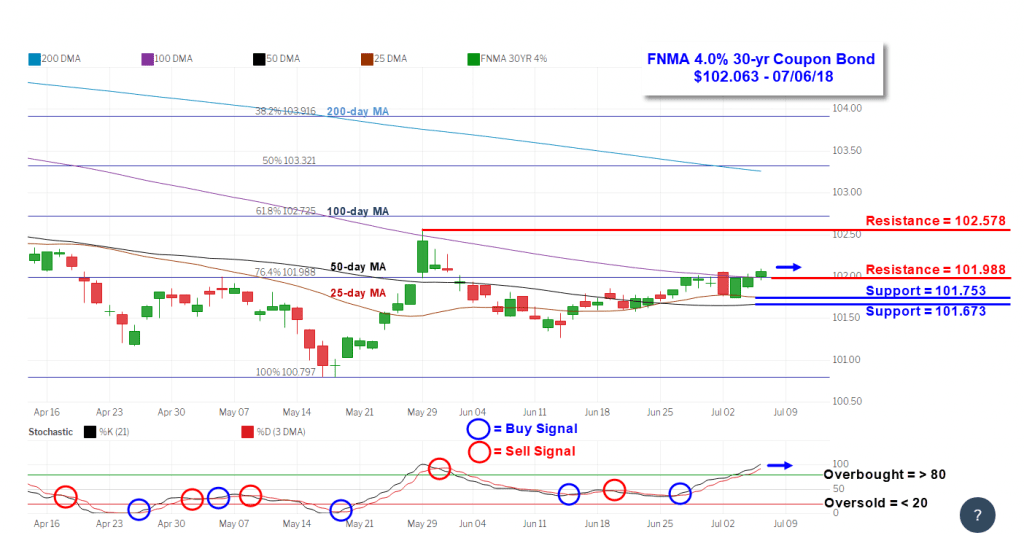

The highest price gains in metro areas were seen in Denver, Las Vegas, and San Francisco. CoreLogic Chief Economist Frank Nothaft remarked “The lean supply of homes for sale is leading to higher sales prices and fewer days on market, and the supply shortage is more acute for entry-level homes. Wednesday, the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey showed a decrease in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) fell 0.5% during the week ended June 29, 2018. The seasonally adjusted Purchase Index increased 1.0% from the week prior while the Refinance Index decreased by 2.0% from a week earlier. Overall, the refinance portion of mortgage activity decreased to 37.2% from 37.6% of total applications from the prior week. The adjustable-rate mortgage share of activity increased to 6.7% from 6.5% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance decreased to 4.79% from 4.84% with points decreasing to 0.41 from 0.42. For the week, the FNMA 4.0% coupon bond gained 14.1 basis points to close at $102.063 while the 10-year Treasury yield decreased 3.60 basis points to end at 2.824%. The Dow Jones Industrial Average gained 185.07 points to close at 24,456.48. The NASDAQ Composite Index advanced 178.09 points to close at 7,688.39. The S&P 500 Index added 41.45 points to close at 2,759.82. Year to date on a total return basis, the Dow Jones Industrial Average has lost 1.06%, the NASDAQ Composite Index has gained 11.37%, and the S&P 500 Index has advanced 3.22%. This past week, the national average 30-year mortgage rate decreased to 4.65% from 4.66%; the 15-year mortgage rate rose to 4.13% from 4.11%; the 5/1 ARM mortgage rate decreased to 3.99% from 4.00% while the FHA 30-year rate fell to 4.37% from 4.38%. Jumbo 30-year rates decreased to 4.59% from 4.69%. Economic Calendar - for the Week of July 9, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.  Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($102.063, +14.1 bp) traded within a slightly wider 34.4 basis point range between a weekly intraday high of 102.094 on Friday and a weekly intraday low of $101.750 on Tuesday before closing the week at $102.063 on Friday. Mortgage bonds traded mostly between resistance and support levels during a holiday-shortened week, but did manage to close just above nearest resistance located at $101.988 on Friday. However, the bond is currently extremely “overbought” and will be susceptible to a slight pull-back or sideways trading this coming week. With the stock market seemingly “shrugging off” the latest trade news with China on Friday, we could see bond prices consolidate leading to stable or very slightly higher mortgage rates this coming week.

Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($102.063, +14.1 bp) traded within a slightly wider 34.4 basis point range between a weekly intraday high of 102.094 on Friday and a weekly intraday low of $101.750 on Tuesday before closing the week at $102.063 on Friday. Mortgage bonds traded mostly between resistance and support levels during a holiday-shortened week, but did manage to close just above nearest resistance located at $101.988 on Friday. However, the bond is currently extremely “overbought” and will be susceptible to a slight pull-back or sideways trading this coming week. With the stock market seemingly “shrugging off” the latest trade news with China on Friday, we could see bond prices consolidate leading to stable or very slightly higher mortgage rates this coming week.

The highest price gains in metro areas were seen in Denver, Las Vegas, and San Francisco. CoreLogic Chief Economist Frank Nothaft remarked “The lean supply of homes for sale is leading to higher sales prices and fewer days on market, and the supply shortage is more acute for entry-level homes. Wednesday, the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey showed a decrease in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) fell 0.5% during the week ended June 29, 2018. The seasonally adjusted Purchase Index increased 1.0% from the week prior while the Refinance Index decreased by 2.0% from a week earlier. Overall, the refinance portion of mortgage activity decreased to 37.2% from 37.6% of total applications from the prior week. The adjustable-rate mortgage share of activity increased to 6.7% from 6.5% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance decreased to 4.79% from 4.84% with points decreasing to 0.41 from 0.42. For the week, the FNMA 4.0% coupon bond gained 14.1 basis points to close at $102.063 while the 10-year Treasury yield decreased 3.60 basis points to end at 2.824%. The Dow Jones Industrial Average gained 185.07 points to close at 24,456.48. The NASDAQ Composite Index advanced 178.09 points to close at 7,688.39. The S&P 500 Index added 41.45 points to close at 2,759.82. Year to date on a total return basis, the Dow Jones Industrial Average has lost 1.06%, the NASDAQ Composite Index has gained 11.37%, and the S&P 500 Index has advanced 3.22%. This past week, the national average 30-year mortgage rate decreased to 4.65% from 4.66%; the 15-year mortgage rate rose to 4.13% from 4.11%; the 5/1 ARM mortgage rate decreased to 3.99% from 4.00% while the FHA 30-year rate fell to 4.37% from 4.38%. Jumbo 30-year rates decreased to 4.59% from 4.69%. Economic Calendar - for the Week of July 9, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

The highest price gains in metro areas were seen in Denver, Las Vegas, and San Francisco. CoreLogic Chief Economist Frank Nothaft remarked “The lean supply of homes for sale is leading to higher sales prices and fewer days on market, and the supply shortage is more acute for entry-level homes. Wednesday, the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey showed a decrease in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) fell 0.5% during the week ended June 29, 2018. The seasonally adjusted Purchase Index increased 1.0% from the week prior while the Refinance Index decreased by 2.0% from a week earlier. Overall, the refinance portion of mortgage activity decreased to 37.2% from 37.6% of total applications from the prior week. The adjustable-rate mortgage share of activity increased to 6.7% from 6.5% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance decreased to 4.79% from 4.84% with points decreasing to 0.41 from 0.42. For the week, the FNMA 4.0% coupon bond gained 14.1 basis points to close at $102.063 while the 10-year Treasury yield decreased 3.60 basis points to end at 2.824%. The Dow Jones Industrial Average gained 185.07 points to close at 24,456.48. The NASDAQ Composite Index advanced 178.09 points to close at 7,688.39. The S&P 500 Index added 41.45 points to close at 2,759.82. Year to date on a total return basis, the Dow Jones Industrial Average has lost 1.06%, the NASDAQ Composite Index has gained 11.37%, and the S&P 500 Index has advanced 3.22%. This past week, the national average 30-year mortgage rate decreased to 4.65% from 4.66%; the 15-year mortgage rate rose to 4.13% from 4.11%; the 5/1 ARM mortgage rate decreased to 3.99% from 4.00% while the FHA 30-year rate fell to 4.37% from 4.38%. Jumbo 30-year rates decreased to 4.59% from 4.69%. Economic Calendar - for the Week of July 9, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.  Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($102.063, +14.1 bp) traded within a slightly wider 34.4 basis point range between a weekly intraday high of 102.094 on Friday and a weekly intraday low of $101.750 on Tuesday before closing the week at $102.063 on Friday. Mortgage bonds traded mostly between resistance and support levels during a holiday-shortened week, but did manage to close just above nearest resistance located at $101.988 on Friday. However, the bond is currently extremely “overbought” and will be susceptible to a slight pull-back or sideways trading this coming week. With the stock market seemingly “shrugging off” the latest trade news with China on Friday, we could see bond prices consolidate leading to stable or very slightly higher mortgage rates this coming week.

Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($102.063, +14.1 bp) traded within a slightly wider 34.4 basis point range between a weekly intraday high of 102.094 on Friday and a weekly intraday low of $101.750 on Tuesday before closing the week at $102.063 on Friday. Mortgage bonds traded mostly between resistance and support levels during a holiday-shortened week, but did manage to close just above nearest resistance located at $101.988 on Friday. However, the bond is currently extremely “overbought” and will be susceptible to a slight pull-back or sideways trading this coming week. With the stock market seemingly “shrugging off” the latest trade news with China on Friday, we could see bond prices consolidate leading to stable or very slightly higher mortgage rates this coming week.