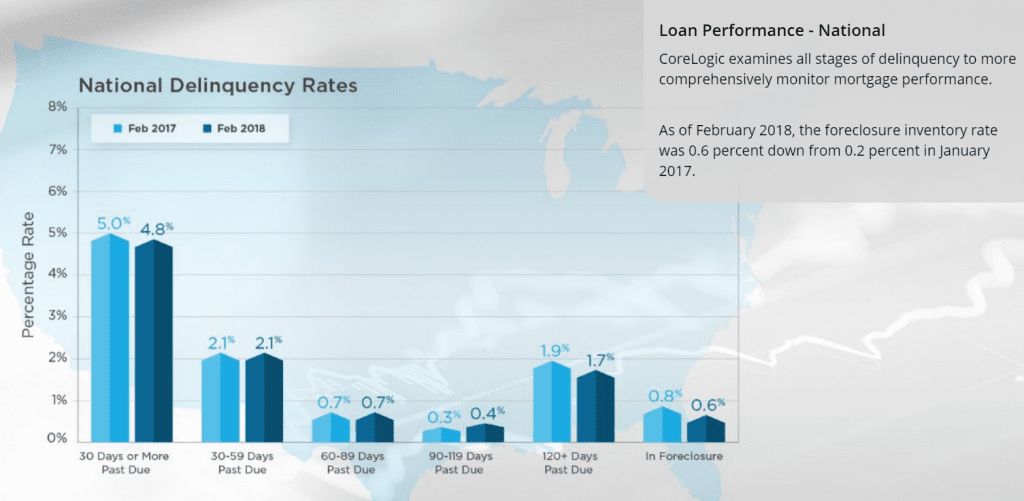

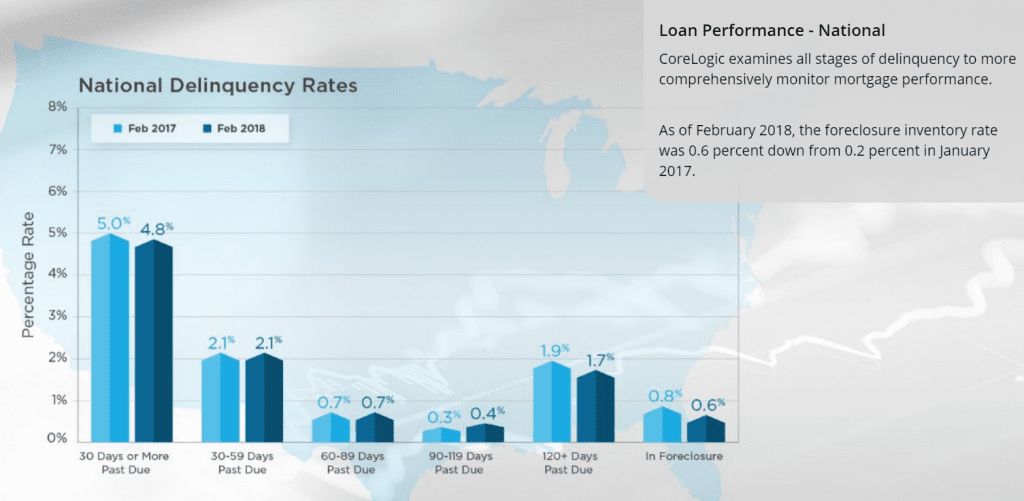

The stock market registered solid gains for the week propelled by solid corporate earnings reports, economic news, and geopolitical events. In fact, the S&P 500 Index recorded its best weekly advance in two months, closing above its 100-day moving average for the first time since the middle of March. Meanwhile, the yield on the benchmark 10-year Treasury note briefly touched the psychologically important 3% barrier for the first time since April 26, but ended 1.80 basis points lower for the week at 2.97%. The volume of first quarter corporate earnings reports is winding down, and overall, they have been very favorable for the stock market. Data and analytics firm FactSet is projecting overall earnings for the S&P 500 have grown by 24.9% for the quarter over the prior year with nearly four out of five companies beating analysts’ earnings and revenue estimates. Rising oil prices have also pushed energy sector stocks higher during the week. Oil prices jumped on President Trump's decision to pull the U.S. out of the Iran nuclear agreement while restoring sanctions on Iran. Military actions between Iran and Israel further supported oil prices when Israel struck Iran's military installations in Syria in response to an Iranian missile attack on the Israeli-held Golan Heights. Iran is OPEC's third-largest oil exporter, and the threat of continuing military conflict within the oil-rich Middle East prompted speculators to bet on a disruption to crude oil supply on the global market. West Texas Intermediate crude oil reached a new three-and-a-half year high at $71.26 per barrel. On the economic front, investors received some welcome inflation data on Thursday from the April Consumer Price Index (CPI) report. Total inflation at the consumer level was reported at +0.2% and came in slightly below the consensus estimate of +0.3%. The Core CPI, which excludes food and energy, increased only 0.1% and was below the consensus forecast of 0.2%. This data may prompt the Federal Reserve to be less aggressive in raising interest rates this year. There were only a couple housing related reports released this past week. CoreLogic released their Loan Performance Insights Report for February 2018 showing the number of loans 30 or more days past due declined from 4.9% to 4.8%. The number of seriously delinquent loans of 90 or more days past due remained stable at 2.1% while those in foreclosure remained stable at 0.6%. Dr. Frank Nothaft, chief economist for CoreLogic, stated “Last year’s hurricanes continue to have an effect on loan performance in affected markets, showing up in statewide data. Serious delinquency rates in February were 50% higher than in August 2017 in Texas, and nearly double in Florida, even though the wind and flood damage was primarily in coastal markets. In Puerto Rico, the damage was widespread. Serious delinquency rates were up five-fold over the August-to-February period, with a significant increase in all metropolitan areas there.”  From the mortgage industry, the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey showed a slight decline in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) decreased 0.4% during the week ended May 4, 2018. The seasonally adjusted Purchase Index fell 0.2% from the week prior while the Refinance Index decreased by 1.0%. Overall, the refinance portion of mortgage activity fell to 36.3% from 36.5% of total applications from the prior week, its lowest level since September 2008. The adjustable-rate mortgage share of activity decreased to 6.5% from 6.7% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance decreased to 4.78% from 4.80% with points decreasing to 0.50 from 0.53. For the week, the FNMA 4.0% coupon bond lost 18.8 basis points to close at $101.656 while the 10-year Treasury yield decreased 1.80 basis points to end at 2.9695%. The major stock indexes moved higher for the week. The Dow Jones Industrial Average advanced 568.66 points to close at 24,831.17. The NASDAQ Composite Index gained 193.26 points to close at 7,402.88. The S&P 500 Index added 64.30 points to close at 2,727.72. Year to date on a total return basis, the Dow Jones Industrial Average has added 0.45%, the NASDAQ Composite Index has gained 7.24%, and the S&P 500 Index has advanced 2.02%. This past week, the national average 30-year mortgage rate increased to 4.65% from 4.62%; the 15-year mortgage rate rose to 4.05% from 4.00%; the 5/1 ARM mortgage rate increased to 3.84% from 3.78% while the FHA 30-year rate stayed unchanged at 4.45%. Jumbo 30-year rates were also unchanged at 4.68%. Economic Calendar - for the Week of May 14, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

From the mortgage industry, the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey showed a slight decline in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) decreased 0.4% during the week ended May 4, 2018. The seasonally adjusted Purchase Index fell 0.2% from the week prior while the Refinance Index decreased by 1.0%. Overall, the refinance portion of mortgage activity fell to 36.3% from 36.5% of total applications from the prior week, its lowest level since September 2008. The adjustable-rate mortgage share of activity decreased to 6.5% from 6.7% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance decreased to 4.78% from 4.80% with points decreasing to 0.50 from 0.53. For the week, the FNMA 4.0% coupon bond lost 18.8 basis points to close at $101.656 while the 10-year Treasury yield decreased 1.80 basis points to end at 2.9695%. The major stock indexes moved higher for the week. The Dow Jones Industrial Average advanced 568.66 points to close at 24,831.17. The NASDAQ Composite Index gained 193.26 points to close at 7,402.88. The S&P 500 Index added 64.30 points to close at 2,727.72. Year to date on a total return basis, the Dow Jones Industrial Average has added 0.45%, the NASDAQ Composite Index has gained 7.24%, and the S&P 500 Index has advanced 2.02%. This past week, the national average 30-year mortgage rate increased to 4.65% from 4.62%; the 15-year mortgage rate rose to 4.05% from 4.00%; the 5/1 ARM mortgage rate increased to 3.84% from 3.78% while the FHA 30-year rate stayed unchanged at 4.45%. Jumbo 30-year rates were also unchanged at 4.68%. Economic Calendar - for the Week of May 14, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.  Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($101.656, -18.8 bp) traded within a slightly wider 53.1 basis point range between a weekly intraday high of 101.922 on Monday and a weekly intraday low of $101.392 on Friday before closing the week at $101.656 on Friday. The bond looks like it will continue to be range-bound this coming week, trading between the dual bands of support and resistance shown on the chart below. As a result, mortgage rates should remain relatively stable this week.

Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($101.656, -18.8 bp) traded within a slightly wider 53.1 basis point range between a weekly intraday high of 101.922 on Monday and a weekly intraday low of $101.392 on Friday before closing the week at $101.656 on Friday. The bond looks like it will continue to be range-bound this coming week, trading between the dual bands of support and resistance shown on the chart below. As a result, mortgage rates should remain relatively stable this week.

From the mortgage industry, the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey showed a slight decline in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) decreased 0.4% during the week ended May 4, 2018. The seasonally adjusted Purchase Index fell 0.2% from the week prior while the Refinance Index decreased by 1.0%. Overall, the refinance portion of mortgage activity fell to 36.3% from 36.5% of total applications from the prior week, its lowest level since September 2008. The adjustable-rate mortgage share of activity decreased to 6.5% from 6.7% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance decreased to 4.78% from 4.80% with points decreasing to 0.50 from 0.53. For the week, the FNMA 4.0% coupon bond lost 18.8 basis points to close at $101.656 while the 10-year Treasury yield decreased 1.80 basis points to end at 2.9695%. The major stock indexes moved higher for the week. The Dow Jones Industrial Average advanced 568.66 points to close at 24,831.17. The NASDAQ Composite Index gained 193.26 points to close at 7,402.88. The S&P 500 Index added 64.30 points to close at 2,727.72. Year to date on a total return basis, the Dow Jones Industrial Average has added 0.45%, the NASDAQ Composite Index has gained 7.24%, and the S&P 500 Index has advanced 2.02%. This past week, the national average 30-year mortgage rate increased to 4.65% from 4.62%; the 15-year mortgage rate rose to 4.05% from 4.00%; the 5/1 ARM mortgage rate increased to 3.84% from 3.78% while the FHA 30-year rate stayed unchanged at 4.45%. Jumbo 30-year rates were also unchanged at 4.68%. Economic Calendar - for the Week of May 14, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

From the mortgage industry, the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey showed a slight decline in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) decreased 0.4% during the week ended May 4, 2018. The seasonally adjusted Purchase Index fell 0.2% from the week prior while the Refinance Index decreased by 1.0%. Overall, the refinance portion of mortgage activity fell to 36.3% from 36.5% of total applications from the prior week, its lowest level since September 2008. The adjustable-rate mortgage share of activity decreased to 6.5% from 6.7% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance decreased to 4.78% from 4.80% with points decreasing to 0.50 from 0.53. For the week, the FNMA 4.0% coupon bond lost 18.8 basis points to close at $101.656 while the 10-year Treasury yield decreased 1.80 basis points to end at 2.9695%. The major stock indexes moved higher for the week. The Dow Jones Industrial Average advanced 568.66 points to close at 24,831.17. The NASDAQ Composite Index gained 193.26 points to close at 7,402.88. The S&P 500 Index added 64.30 points to close at 2,727.72. Year to date on a total return basis, the Dow Jones Industrial Average has added 0.45%, the NASDAQ Composite Index has gained 7.24%, and the S&P 500 Index has advanced 2.02%. This past week, the national average 30-year mortgage rate increased to 4.65% from 4.62%; the 15-year mortgage rate rose to 4.05% from 4.00%; the 5/1 ARM mortgage rate increased to 3.84% from 3.78% while the FHA 30-year rate stayed unchanged at 4.45%. Jumbo 30-year rates were also unchanged at 4.68%. Economic Calendar - for the Week of May 14, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.  Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($101.656, -18.8 bp) traded within a slightly wider 53.1 basis point range between a weekly intraday high of 101.922 on Monday and a weekly intraday low of $101.392 on Friday before closing the week at $101.656 on Friday. The bond looks like it will continue to be range-bound this coming week, trading between the dual bands of support and resistance shown on the chart below. As a result, mortgage rates should remain relatively stable this week.

Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($101.656, -18.8 bp) traded within a slightly wider 53.1 basis point range between a weekly intraday high of 101.922 on Monday and a weekly intraday low of $101.392 on Friday before closing the week at $101.656 on Friday. The bond looks like it will continue to be range-bound this coming week, trading between the dual bands of support and resistance shown on the chart below. As a result, mortgage rates should remain relatively stable this week.