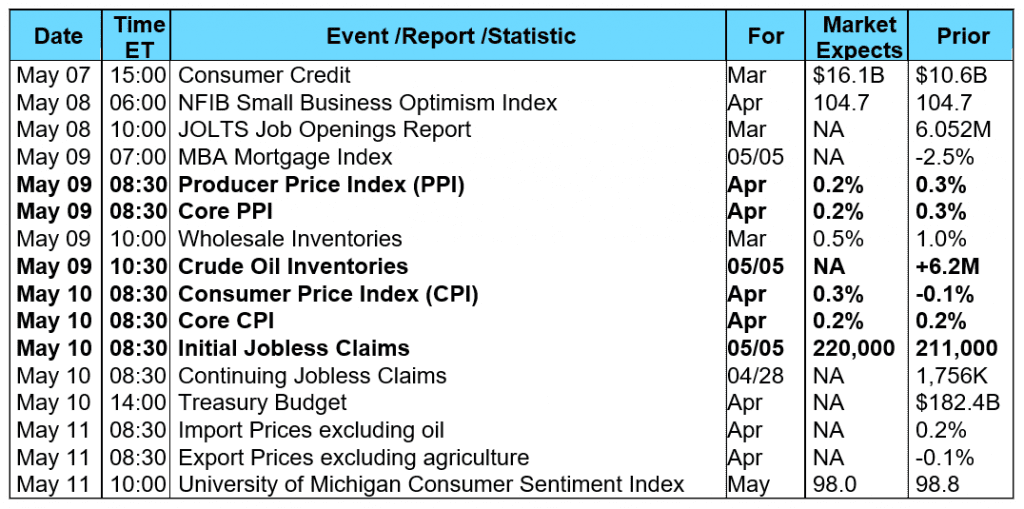

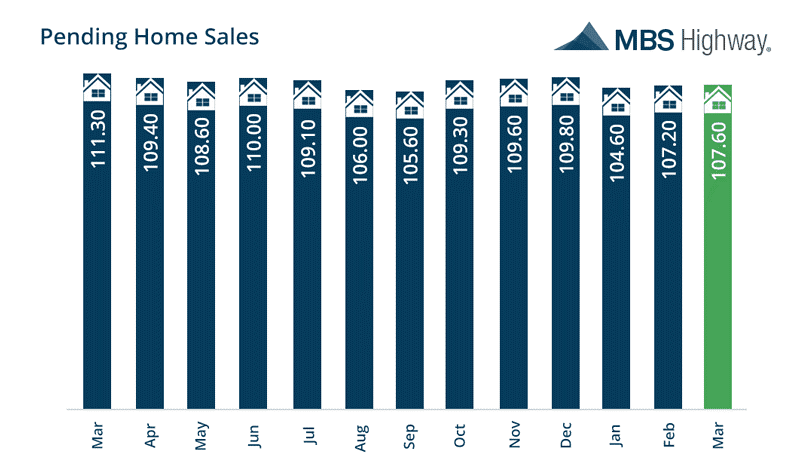

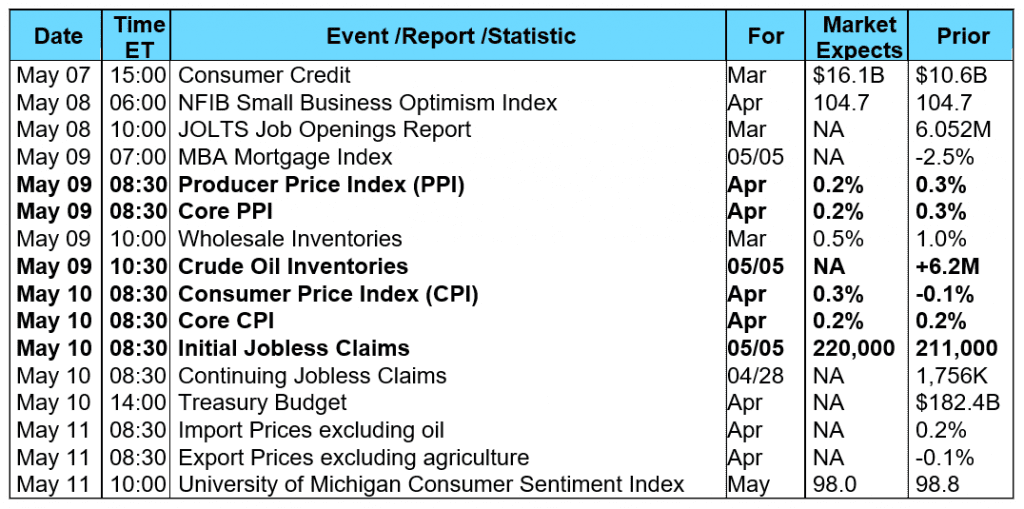

The stock market seemed to lack conviction this past week as investors had to wade through a plethora of corporate earnings, including technology giant Apple's quarterly report, in addition to the latest monetary policy decision from the Fed and the Employment Situation report for April. As a result, the major stock indexes ended “mixed” for the week with the Dow Jones Industrial Average and S&P 500 Index edging lower while the NASDAQ Composite Index moved slightly higher. The 10-year Treasury yield slipped slightly lower at 2.95% after approaching 3% on Wednesday. The Fed's latest monetary policy decision arrived Wednesday afternoon without any real surprises. As expected, Fed officials unanimously decided to leave the federal funds target range unchanged at 1.50% to 1.75%. However, the Fed’s policy statement led investors to believe there will be a rate hike at their June meeting with the possibility for another one to two rate hikes before the end of the year. Indeed, the latest probability reading from the Fed Fund Futures market now stands at 100% for a 25 basis point rate hike at the Fed’s June 13 FOMC meeting. The Employment Situation (Jobs) report for April was released Friday morning, showing a lower than forecast 164,000 increase in nonfarm payrolls. Although this was lower than the consensus estimate of 190,000, upwardly revised readings for the prior two months balanced the shortfall. Average hourly earnings growth of +0.2% matched expectations while the unemployment rate fell to 3.9%, the lowest it has been in 17.5 years. The reason the unemployment rate fell below 4% was not due to new job formation, but as a result of 236,000 people dropping out of the labor force during the month. There were several housing related reports released this past week. The National Association of Realtors® (NAR) reported Pending Home Sales edged higher in March by 0.4%. This was below the consensus forecast calling for a 1.5% gain, and was constrained by continuing tight inventory levels and appreciating home values that are making it difficult for prospective buyers to find affordable homes to buy. NAR chief economist, Lawrence Yun, remarked "Healthy economic conditions are creating considerable demand for purchasing a home, but not all buyers are able to sign contracts because of the lack of choices in inventory. Steady price growth and the swift pace listings are coming off the market are proof that more supply is needed to fully satisfy demand.”  From the mortgage industry, the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey showed a decline in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) decreased 2.5% during the week ended April 27, 2018. The seasonally adjusted Purchase Index fell 2.0% from the week prior while the Refinance Index decreased by 4.0%. Overall, the refinance portion of mortgage activity fell to 36.5% from 37.2% of total applications from the prior week, its lowest level since September 2008. The adjustable-rate mortgage share of activity increased to 6.7% from 6.5% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.80% from 4.73%, its highest level since September 2013. Points increased to 0.53 from 0.49. For the week, the FNMA 4.0% coupon bond gained 3.1 basis points to close at $101.844 while the 10-year Treasury yield decreased 0.72 of one basis point to end at 2.9515%. The major stock indexes ended “mixed” for the week. The Dow Jones Industrial Average fell 48.68 points to close at 24,262.51. The NASDAQ Composite Index gained 89.82 points to close at 7,209.62. The S&P 500 Index lost 6.49 points to close at 2,663.42. Year to date on a total return basis, the Dow Jones Industrial Average has fallen 1.85%, the NASDAQ Composite Index has gained 4.44%, and the S&P 500 Index has dropped 0.38%. This past week, the national average 30-year mortgage rate decreased to 4.62% from 4.64%; the 15-year mortgage rate fell to 4.00% from 4.02%; the 5/1 ARM mortgage rate remained unchanged at 3.78% while the FHA 30-year rate stayed unchanged at 4.45%. Jumbo 30-year rates were also unchanged at 4.68%. Economic Calendar - for the Week of May 7, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

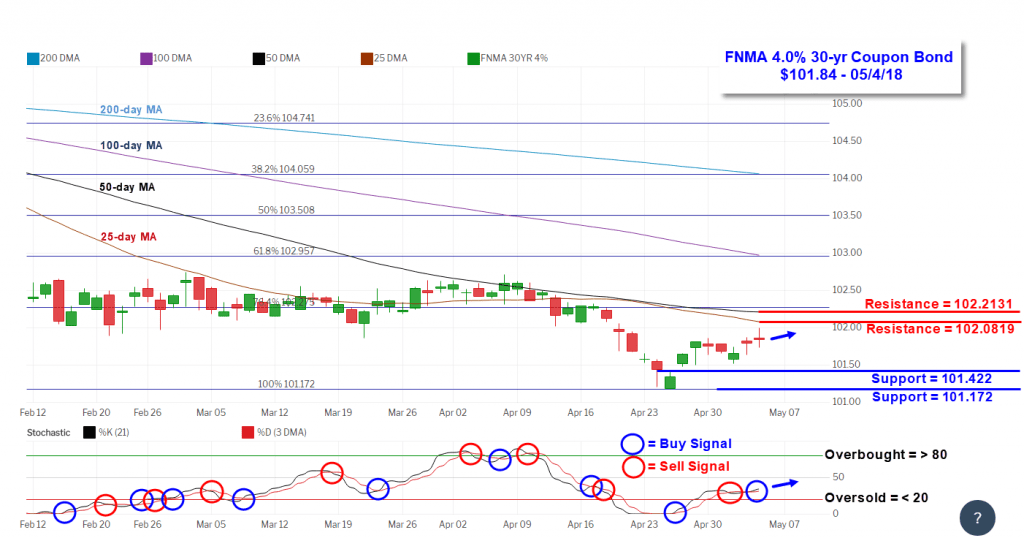

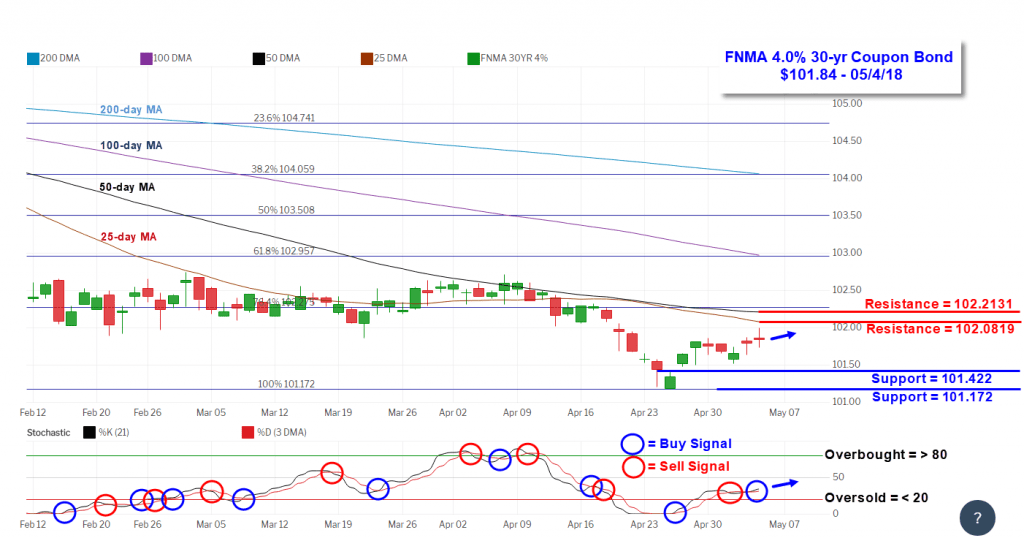

From the mortgage industry, the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey showed a decline in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) decreased 2.5% during the week ended April 27, 2018. The seasonally adjusted Purchase Index fell 2.0% from the week prior while the Refinance Index decreased by 4.0%. Overall, the refinance portion of mortgage activity fell to 36.5% from 37.2% of total applications from the prior week, its lowest level since September 2008. The adjustable-rate mortgage share of activity increased to 6.7% from 6.5% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.80% from 4.73%, its highest level since September 2013. Points increased to 0.53 from 0.49. For the week, the FNMA 4.0% coupon bond gained 3.1 basis points to close at $101.844 while the 10-year Treasury yield decreased 0.72 of one basis point to end at 2.9515%. The major stock indexes ended “mixed” for the week. The Dow Jones Industrial Average fell 48.68 points to close at 24,262.51. The NASDAQ Composite Index gained 89.82 points to close at 7,209.62. The S&P 500 Index lost 6.49 points to close at 2,663.42. Year to date on a total return basis, the Dow Jones Industrial Average has fallen 1.85%, the NASDAQ Composite Index has gained 4.44%, and the S&P 500 Index has dropped 0.38%. This past week, the national average 30-year mortgage rate decreased to 4.62% from 4.64%; the 15-year mortgage rate fell to 4.00% from 4.02%; the 5/1 ARM mortgage rate remained unchanged at 3.78% while the FHA 30-year rate stayed unchanged at 4.45%. Jumbo 30-year rates were also unchanged at 4.68%. Economic Calendar - for the Week of May 7, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.  Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($101.844, +3.1 bp) traded within a narrower 48.4 basis point range between a weekly intraday low of $101.516 on Wednesday and a weekly intraday high of $102.00 on Friday before closing the week at $101.844 on Friday. The bond looks like it will be range-bound this coming week, trading between dual bands of support and resistance. This should result in relatively stable mortgage rates this week.

Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($101.844, +3.1 bp) traded within a narrower 48.4 basis point range between a weekly intraday low of $101.516 on Wednesday and a weekly intraday high of $102.00 on Friday before closing the week at $101.844 on Friday. The bond looks like it will be range-bound this coming week, trading between dual bands of support and resistance. This should result in relatively stable mortgage rates this week.

From the mortgage industry, the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey showed a decline in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) decreased 2.5% during the week ended April 27, 2018. The seasonally adjusted Purchase Index fell 2.0% from the week prior while the Refinance Index decreased by 4.0%. Overall, the refinance portion of mortgage activity fell to 36.5% from 37.2% of total applications from the prior week, its lowest level since September 2008. The adjustable-rate mortgage share of activity increased to 6.7% from 6.5% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.80% from 4.73%, its highest level since September 2013. Points increased to 0.53 from 0.49. For the week, the FNMA 4.0% coupon bond gained 3.1 basis points to close at $101.844 while the 10-year Treasury yield decreased 0.72 of one basis point to end at 2.9515%. The major stock indexes ended “mixed” for the week. The Dow Jones Industrial Average fell 48.68 points to close at 24,262.51. The NASDAQ Composite Index gained 89.82 points to close at 7,209.62. The S&P 500 Index lost 6.49 points to close at 2,663.42. Year to date on a total return basis, the Dow Jones Industrial Average has fallen 1.85%, the NASDAQ Composite Index has gained 4.44%, and the S&P 500 Index has dropped 0.38%. This past week, the national average 30-year mortgage rate decreased to 4.62% from 4.64%; the 15-year mortgage rate fell to 4.00% from 4.02%; the 5/1 ARM mortgage rate remained unchanged at 3.78% while the FHA 30-year rate stayed unchanged at 4.45%. Jumbo 30-year rates were also unchanged at 4.68%. Economic Calendar - for the Week of May 7, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

From the mortgage industry, the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey showed a decline in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) decreased 2.5% during the week ended April 27, 2018. The seasonally adjusted Purchase Index fell 2.0% from the week prior while the Refinance Index decreased by 4.0%. Overall, the refinance portion of mortgage activity fell to 36.5% from 37.2% of total applications from the prior week, its lowest level since September 2008. The adjustable-rate mortgage share of activity increased to 6.7% from 6.5% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.80% from 4.73%, its highest level since September 2013. Points increased to 0.53 from 0.49. For the week, the FNMA 4.0% coupon bond gained 3.1 basis points to close at $101.844 while the 10-year Treasury yield decreased 0.72 of one basis point to end at 2.9515%. The major stock indexes ended “mixed” for the week. The Dow Jones Industrial Average fell 48.68 points to close at 24,262.51. The NASDAQ Composite Index gained 89.82 points to close at 7,209.62. The S&P 500 Index lost 6.49 points to close at 2,663.42. Year to date on a total return basis, the Dow Jones Industrial Average has fallen 1.85%, the NASDAQ Composite Index has gained 4.44%, and the S&P 500 Index has dropped 0.38%. This past week, the national average 30-year mortgage rate decreased to 4.62% from 4.64%; the 15-year mortgage rate fell to 4.00% from 4.02%; the 5/1 ARM mortgage rate remained unchanged at 3.78% while the FHA 30-year rate stayed unchanged at 4.45%. Jumbo 30-year rates were also unchanged at 4.68%. Economic Calendar - for the Week of May 7, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.  Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($101.844, +3.1 bp) traded within a narrower 48.4 basis point range between a weekly intraday low of $101.516 on Wednesday and a weekly intraday high of $102.00 on Friday before closing the week at $101.844 on Friday. The bond looks like it will be range-bound this coming week, trading between dual bands of support and resistance. This should result in relatively stable mortgage rates this week.

Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($101.844, +3.1 bp) traded within a narrower 48.4 basis point range between a weekly intraday low of $101.516 on Wednesday and a weekly intraday high of $102.00 on Friday before closing the week at $101.844 on Friday. The bond looks like it will be range-bound this coming week, trading between dual bands of support and resistance. This should result in relatively stable mortgage rates this week.