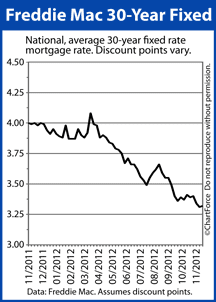

Low mortgage rates are pumping up home affordability. Average 30-year fixed-rate mortgage rates made a new all-time low in November, continuing this year Refinance Boom and giving fuel to the budding housing market recovery. At month-end, Freddie Mac’s survey of 125 banks nationwide put the benchmark product’s rate at 3.32% for borrowers willing to pay 0.8 discount points. This is just 0.01 percentage point above the record-low rate establishing prior to Thanksgiving. The 15-year fixed mortgage is similarly low, posting 2.64 percent nationwide, on average. This, too, is only slightly higher the all-time low set the week prior. Falling mortgage rates have helped to offset rising home prices in many U.S. cities. Steady job creation and rising consumer confidence has swelled the pool of home buyers nationwide, causing home inventories to shrink and home prices to rise. The improving economy has also led to rising rents and now, within many housing markets, it’s less costly to buy and own a home than to rent a comparable one. A $1,000 mortgage payment affords a $225,000 mortgage payment in Richmond. Last week, the economy was shown to be improving.

- The Commerce Department showed that the Gross Domestic Product increased at a 2.7% annual rate in Q3 2012

- The Labor Department showed first-time unemployment filings dropping by 23,000 claims

- The Pending Home Sales Index jumped to its highest point since April 2010

- The Existing Home Sales report showed home sales up 2.1%

- The Case-Shiller Index showed home values making annual gains

In addition, Federal Reserve Ben Bernanke said that the central bank will take action to speed economic growth, should the U.S. economy start to side-step. The Fiscal Cliff that dominates about every thought will continue to do so this week. However, there are key data points this week; it is employment week with Nov employment data out on Friday. In the meantime Monday has the Nov ISM manufacturing index, Wednesday the ISM services sector index. Mix in a number of other reports and the data this week will get plenty of attention. The Fiscal Cliff though is the central issue with apparent no progress so far, and a lot of posturing frm both political parties. Markets continue to swing back on forth on each comment, sending the key stock indexes into over-reactions. It is very unlikely there will be any deal until late Dec; both parties want to demonstrate to their core bases that they fought the good fight; an early settlement would be criticized from both the left and right bases that they didn’t hold their ground. The bond and mortgage markets are idling for the past three weeks; the 10 yr note is being rebuffed every time its yield falls to the 1.60% level as it did last week, on the upside there is good support when the note rate climbs to 1.65%. 30 yr MBSs also in tight ranges with little c\change in rates for the past few weeks. This week we expect the same action, narrow ranges with not much change. In Europe the Greek debt crisis is presently cooling. Europe’s stock markets improving a little. The early estimate for the Nov employment data on Friday is non-farm jobs +80K after October’s increase of 171K, the unemployment rate at 8.0% up frm 7.9%. Mortgage interest rates remain historically low and are subject to change on a daily basis. The sentiment data has the potential to move the markets.

Low mortgage rates are pumping up home affordability. Average 30-year fixed-rate mortgage rates made a new all-time low in November, continuing this year Refinance Boom and giving fuel to the budding housing market recovery. At month-end, Freddie Mac’s survey of 125 banks nationwide put the benchmark product’s rate at 3.32% for borrowers willing to pay 0.8 discount points. This is just 0.01 percentage point above the record-low rate establishing prior to Thanksgiving. The 15-year fixed mortgage is similarly low, posting 2.64 percent nationwide, on average. This, too, is only slightly higher the all-time low set the week prior. Falling mortgage rates have helped to offset rising home prices in many U.S. cities. Steady job creation and rising consumer confidence has swelled the pool of home buyers nationwide, causing home inventories to shrink and home prices to rise. The improving economy has also led to rising rents and now, within many housing markets, it’s less costly to buy and own a home than to rent a comparable one. A $1,000 mortgage payment affords a $225,000 mortgage payment in Richmond. Last week, the economy was shown to be improving.

Low mortgage rates are pumping up home affordability. Average 30-year fixed-rate mortgage rates made a new all-time low in November, continuing this year Refinance Boom and giving fuel to the budding housing market recovery. At month-end, Freddie Mac’s survey of 125 banks nationwide put the benchmark product’s rate at 3.32% for borrowers willing to pay 0.8 discount points. This is just 0.01 percentage point above the record-low rate establishing prior to Thanksgiving. The 15-year fixed mortgage is similarly low, posting 2.64 percent nationwide, on average. This, too, is only slightly higher the all-time low set the week prior. Falling mortgage rates have helped to offset rising home prices in many U.S. cities. Steady job creation and rising consumer confidence has swelled the pool of home buyers nationwide, causing home inventories to shrink and home prices to rise. The improving economy has also led to rising rents and now, within many housing markets, it’s less costly to buy and own a home than to rent a comparable one. A $1,000 mortgage payment affords a $225,000 mortgage payment in Richmond. Last week, the economy was shown to be improving.