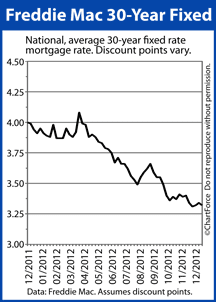

Mortgage bonds worsened last week, moving mortgage rates higher. Economic news was mostly positive and the Federal Open Market Committee (FOMC) changed some of Wall Street expectations for future monetary policy. Freddie Mac reported the average 30-year fixed rate mortgage rate at 3.32 percent nationwide for borrowers willing to pay an accompanying 0.7 discount points plus closing costs. The average 15-year fixed rate mortgage rate was listed at 2.66 percent nationwide with an accompanying 0.6 discount points plus closing costs. Both mortgage rates had climbed by week's end, however. Mortgage rates made their best levels Monday afternoon. Between Tuesday and Friday, mortgage rates in Richmond climbed. Also last week, the National Association of Homebuilders/First American Improving Markets Index (IMI) reported 201 improving metropolitan economies nationwide. This index uses data including local employment statistics and home values to determine whether an area's economy is "improving". 76 new areas were added to the IMI list in December as compared to November. The geographic diversity the newly-added markets suggests an overall improvement in the national economy. Last week's major event, however, was the 2-day Federal Reserve meeting, which adjourned Wednesday. The post-meeting press release after included the Fed's commitment to hold the Fed Funds Rate near zero percent where it's been since December 2008. However, the Fed announced a change to in its plans to raise the Fed Funds Rate from near-zero at a future date. Previously, the Fed had said it would raise the Fed Funds Rate beginning in mid-2015. Now, the Fed says it will start to raise rates when the national unemployment rate reaches 6.5 percent. This week, mortgage rates have a lot to move on including Housing Starts (Wednesday) and Existing Home Sales (Thursday) from the housing sector; Jobless Claims (Thursday) from the Labor Department; and a key inflation reading from the Department of Commerce. Each has the capability to move mortgage rates. The question this week is whether or not Congress and the Administration can come to an agreement to avoid going over the Cliff. If no progress is made politicians will have only a few days next week to get something accomplished. Treasury will auction $99B of notes beginning Monday through Wednesday (2 yr, 5 yr and 7 yr notes) on sale. Technically the near term outlook remains slightly bearish for the bond and MBS markets. The bond market held captive to the Cliff talks as are the global stock markets. Remember rates are historically very favorable and financial conditions can change quickly.

Mortgage bonds worsened last week, moving mortgage rates higher. Economic news was mostly positive and the Federal Open Market Committee (FOMC) changed some of Wall Street expectations for future monetary policy. Freddie Mac reported the average 30-year fixed rate mortgage rate at 3.32 percent nationwide for borrowers willing to pay an accompanying 0.7 discount points plus closing costs. The average 15-year fixed rate mortgage rate was listed at 2.66 percent nationwide with an accompanying 0.6 discount points plus closing costs. Both mortgage rates had climbed by week's end, however. Mortgage rates made their best levels Monday afternoon. Between Tuesday and Friday, mortgage rates in Richmond climbed. Also last week, the National Association of Homebuilders/First American Improving Markets Index (IMI) reported 201 improving metropolitan economies nationwide. This index uses data including local employment statistics and home values to determine whether an area's economy is "improving". 76 new areas were added to the IMI list in December as compared to November. The geographic diversity the newly-added markets suggests an overall improvement in the national economy. Last week's major event, however, was the 2-day Federal Reserve meeting, which adjourned Wednesday. The post-meeting press release after included the Fed's commitment to hold the Fed Funds Rate near zero percent where it's been since December 2008. However, the Fed announced a change to in its plans to raise the Fed Funds Rate from near-zero at a future date. Previously, the Fed had said it would raise the Fed Funds Rate beginning in mid-2015. Now, the Fed says it will start to raise rates when the national unemployment rate reaches 6.5 percent. This week, mortgage rates have a lot to move on including Housing Starts (Wednesday) and Existing Home Sales (Thursday) from the housing sector; Jobless Claims (Thursday) from the Labor Department; and a key inflation reading from the Department of Commerce. Each has the capability to move mortgage rates. The question this week is whether or not Congress and the Administration can come to an agreement to avoid going over the Cliff. If no progress is made politicians will have only a few days next week to get something accomplished. Treasury will auction $99B of notes beginning Monday through Wednesday (2 yr, 5 yr and 7 yr notes) on sale. Technically the near term outlook remains slightly bearish for the bond and MBS markets. The bond market held captive to the Cliff talks as are the global stock markets. Remember rates are historically very favorable and financial conditions can change quickly.