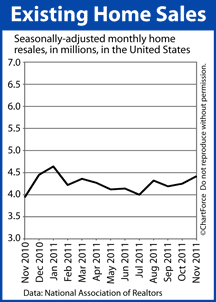

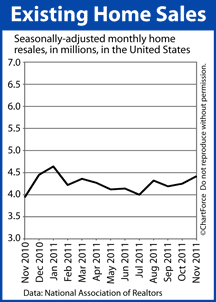

Mortgage markets worsened last week on renewed optimism from the Eurozone, additional evidence of a U.S. economic recovery, and ongoing strength in housing. The action sparked a stock market rally at the expense of mortgage bonds, sending conforming and FHA mortgage rates meaningfully higher for the first time in more than 2 months. Markets closed early Friday and remained closed Monday. When they re-open today, conforming mortgage rates will already have bounced off last week's new, all-time lows. As reported by

Freddie Mac's weekly mortgage rate survey, the average 30-year fixed rate mortgage fell to 3.91 percent nationwide, with an accompanying 0.7 discount points plus closing costs. 1 discount point is equal to 1 percent of your loan size such that 1 discount point on a $100,000 loan is equal to $1,000. It's not just the conventional 30-year fixed that made new lows last week, either. All of Freddie Mac's reported rates fell to new, all-time lows.

- 30-year fixed : 3.91% with 0.7 discount points

- 15-year fixed : 3.21% with 0.8 discount points

- 5-year ARM : 2.85% with 0.6 discount points

These rates are no longer valid, however. FHA mortgage rates rose slightly last week, too. This week, mortgage rates will be more volatile than usual. There isn't much economic data on which to trade, and it's a holiday-shortened week (again). Look for geopolitics and momentum to nudge markets forward, therefore -- a potentially bad combination for today's rate shoppers. There is very little room for mortgage rates to fall, but lots of room for them to rise.

| Date | Time (ET) | Statistic | For | Market Expects | Prior |

| 12/27/11 | 10:00:00 AM | Consumer Confidence | Dec | 58 | 56 |

| 12/29/11 | 08:30:00 AM | Initial Claims | 12/24/11 | 368K | 364K |

| 12/29/11 | 08:30:00 AM | Continuing Claims | 12/17/11 | 3600K | 3546K |

| 12/29/11 | 10:00:00 AM | Pending Home Sales | Nov | 0.60% | 10.40% |

If the stock market rallies to close 2011, mortgage rates will rise right on with it. For now, rates remain historically low. If you've been shopping for a mortgage -- waiting for rates to fall -- this last week of the year may be your last chance at sub-4 percent, fixed-rate mortgage rates. Don't wait too long or you might miss it. It's a good time to execute on a rate lock.

Mortgage markets worsened last week on renewed optimism from the Eurozone, additional evidence of a U.S. economic recovery, and ongoing strength in housing. The action sparked a stock market rally at the expense of mortgage bonds, sending conforming and FHA mortgage rates meaningfully higher for the first time in more than 2 months. Markets closed early Friday and remained closed Monday. When they re-open today, conforming mortgage rates will already have bounced off last week's new, all-time lows. As reported by Freddie Mac's weekly mortgage rate survey, the average 30-year fixed rate mortgage fell to 3.91 percent nationwide, with an accompanying 0.7 discount points plus closing costs. 1 discount point is equal to 1 percent of your loan size such that 1 discount point on a $100,000 loan is equal to $1,000. It's not just the conventional 30-year fixed that made new lows last week, either. All of Freddie Mac's reported rates fell to new, all-time lows.

Mortgage markets worsened last week on renewed optimism from the Eurozone, additional evidence of a U.S. economic recovery, and ongoing strength in housing. The action sparked a stock market rally at the expense of mortgage bonds, sending conforming and FHA mortgage rates meaningfully higher for the first time in more than 2 months. Markets closed early Friday and remained closed Monday. When they re-open today, conforming mortgage rates will already have bounced off last week's new, all-time lows. As reported by Freddie Mac's weekly mortgage rate survey, the average 30-year fixed rate mortgage fell to 3.91 percent nationwide, with an accompanying 0.7 discount points plus closing costs. 1 discount point is equal to 1 percent of your loan size such that 1 discount point on a $100,000 loan is equal to $1,000. It's not just the conventional 30-year fixed that made new lows last week, either. All of Freddie Mac's reported rates fell to new, all-time lows.