Last week was jam-packed with economic news; here are some highlights with emphasis on housing and mortgage related news: Monday: Retail sales for April increased to -0.1 percent from the March reading of -0.5 percent and also surpassed Wall Street's downward forecast of -0.6 percent. Retail sales a...

Last week was jam-packed with economic news; here are some highlights with emphasis on housing and mortgage related news: Monday: Retail sales for April increased to -0.1 percent from the March reading of -0.5 percent and also surpassed Wall Street's downward forecast of -0.6 percent. Retail sales a... The Federal Open Market Committee (FOMC) released minutes from its January meeting last Wednesday, as it generally does three weeks following the most recent meeting.

The Federal Open Market Committee (FOMC) released minutes from its January meeting last Wednesday, as it generally does three weeks following the most recent meeting.

The FOMC is a committee within the Federal Reserve System tasked with overseeing the purchase and sale of US Treasury securitie...

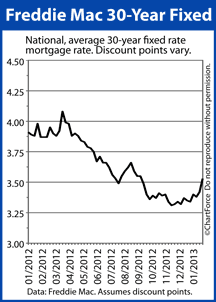

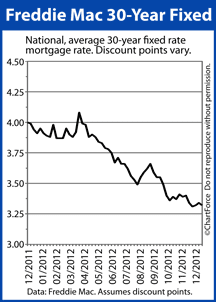

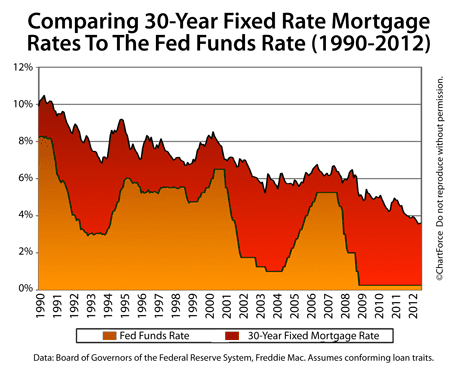

Mortgage rates worsened last week amid evidence of an improving economy. Conforming mortgage rates climbed in Virginia and nationwide, rising to a 4-month high. Freddie Mac has the average 30-year fixed rate mortgage rate at 3.53% for borrowers willing to pay 0.7 discount points plus a full set of c...

Mortgage rates worsened last week amid evidence of an improving economy. Conforming mortgage rates climbed in Virginia and nationwide, rising to a 4-month high. Freddie Mac has the average 30-year fixed rate mortgage rate at 3.53% for borrowers willing to pay 0.7 discount points plus a full set of c... The Federal Reserve's Federal Open Market Committee (FOMC) voted to maintain the Federal Funds Rate within its current range of zero to 0.25 percent, and to continue its current stimulus program of purchasing $85 billion monthly in Treasury bonds and mortgage-backed securities (MBS).

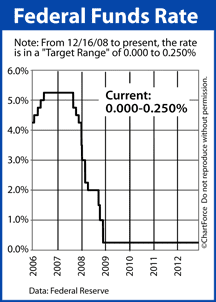

The Federal Reserve's Federal Open Market Committee (FOMC) voted to maintain the Federal Funds Rate within its current range of zero to 0.25 percent, and to continue its current stimulus program of purchasing $85 billion monthly in Treasury bonds and mortgage-backed securities (MBS).

Citing weather-r...

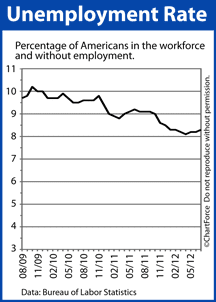

Mortgage rates rose last week as investors gained confidence in the global economy. China and Europe posted better-than-expected manufacturing rates, U.S. Jobless Claims fell for the second straight week, and the worst of the European debt crisis appears to have passed. Last week's economic news pro...

Mortgage rates rose last week as investors gained confidence in the global economy. China and Europe posted better-than-expected manufacturing rates, U.S. Jobless Claims fell for the second straight week, and the worst of the European debt crisis appears to have passed. Last week's economic news pro... Mortgage rates in Richmond rose during the first week of 2013. The fiscal cliff crisis was resolved prior to the market's opening Wednesday, when legislators voted to approve a deal. While many tax cuts were extended for taxpayers earning less than $450,000 annually, other facets of the fiscal cliff...

Mortgage rates in Richmond rose during the first week of 2013. The fiscal cliff crisis was resolved prior to the market's opening Wednesday, when legislators voted to approve a deal. While many tax cuts were extended for taxpayers earning less than $450,000 annually, other facets of the fiscal cliff... Mortgage bonds worsened last week, moving mortgage rates higher. Economic news was mostly positive and the Federal Open Market Committee (FOMC) changed some of Wall Street expectations for future monetary policy. Freddie Mac reported the average 30-year fixed rate mortgage rate at 3.32 percent natio...

Mortgage bonds worsened last week, moving mortgage rates higher. Economic news was mostly positive and the Federal Open Market Committee (FOMC) changed some of Wall Street expectations for future monetary policy. Freddie Mac reported the average 30-year fixed rate mortgage rate at 3.32 percent natio... The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Wednesday.

The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Wednesday.

For the tenth consecutive meeting, the FOMC vote was nearly unanimous. Richmond Federal Reserve President Jeffrey Lacker was the lone dissenter in the 9-1 vo...

The Federal Open Market Committee (FOMC) begins a 2-day meeting today, its last of 8 scheduled meetings this year.

The Federal Open Market Committee (FOMC) begins a 2-day meeting today, its last of 8 scheduled meetings this year.

The Federal Open Market Committee is a 12-person subcommittee within the Federal Reserve. It's the group which votes upon U.S. monetary policy.

The monetary policy action for w...

Mortgage bonds worsened last week as Fiscal Cliff talks moved closer to resolution and as the U.S. economy showed continued signs of growth. Conforming mortgage rates in Virginia rose slightly, edging off the all-time lows late in November. According to Freddie Mac's weekly mortgage rate survey, the...

Mortgage bonds worsened last week as Fiscal Cliff talks moved closer to resolution and as the U.S. economy showed continued signs of growth. Conforming mortgage rates in Virginia rose slightly, edging off the all-time lows late in November. According to Freddie Mac's weekly mortgage rate survey, the... The Federal Reserve released its October Federal Open Market Committee (FOMC) meeting minutes last week, revealing a Fed in disagreement about the future of the U.S. economy and about what, if any, stimulus may be warranted in the next 12 months.

The Federal Reserve released its October Federal Open Market Committee (FOMC) meeting minutes last week, revealing a Fed in disagreement about the future of the U.S. economy and about what, if any, stimulus may be warranted in the next 12 months.

The "Fed Minutes" recaps the conversations a...

The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Wednesday.

The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Wednesday.

For the ninth consecutive meeting, the vote was nearly unanimous. And, also for the ninth consecutive meeting, Richmond Federal Reserve President Jeffre...

Mortgage markets worsened last week as hope for a European economic rebound and stronger-than-expected U.S. economic data moved investors out of mortgage-backed bonds. Mortgage rates all of types -- conventional, FHA and VA -- lost ground last week, harming home affordability in Midlothian and reduc...

Mortgage markets worsened last week as hope for a European economic rebound and stronger-than-expected U.S. economic data moved investors out of mortgage-backed bonds. Mortgage rates all of types -- conventional, FHA and VA -- lost ground last week, harming home affordability in Midlothian and reduc... The minutes from the Federal Reserve's September Federal Open Market Committee meeting were released Thursday.

The minutes from the Federal Reserve's September Federal Open Market Committee meeting were released Thursday.

The Fed Minutes detail the discussions and debates which shaped the central banker's launch of its third round of qualitative easing since 2008. The minutes also give Wall Street insight int...

The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Thursday. For the eighth consecutive meeting, the vote was nearly unanimous.

The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Thursday. For the eighth consecutive meeting, the vote was nearly unanimous.

Just one FOMC member, Richmond Federal Reserve President Jeffrey Lacker, dissented in the 9...

The Federal Open Market Committee ends a 2-day meeting today, the group's sixth of 8 scheduled meetings this year. As a Henrico home buyer or would-be refinancer, be ready for mortgage rates to change.

The Federal Open Market Committee is a 12-person sub-committee of the Federal Reserve. Led by Fed C...

Mortgage markets worsened slightly in last week's holiday-shortened week. As expected, Wall Street took its cues from Europe and from the U.S. jobs market, and mortgage rates moved across a wide range. Home buyers in Henrico and would-be refinancing households were greeted with wildly varying mortga...

Mortgage markets worsened slightly in last week's holiday-shortened week. As expected, Wall Street took its cues from Europe and from the U.S. jobs market, and mortgage rates moved across a wide range. Home buyers in Henrico and would-be refinancing households were greeted with wildly varying mortga... Eariler this week, the Federal Reserve released the minutes from its 2-day meeting which ended August 1, 2012. Since the release, mortgage rates have dropped.

Eariler this week, the Federal Reserve released the minutes from its 2-day meeting which ended August 1, 2012. Since the release, mortgage rates have dropped.

The Fed Minutes are released on a schedule, three weeks after the FOMC adjourns from one of its 8 scheduled meetings of the year.

The Fed ...

Mortgage bonds worsened last week in a news- and event-heavy week. A series of non-action from the world's central banks -- including the Federal Reserve -- plus a better-than-expected jobs report pushed mortgage rates to their highest levels in more than a month. Conforming mortgage rates rose...

Mortgage bonds worsened last week in a news- and event-heavy week. A series of non-action from the world's central banks -- including the Federal Reserve -- plus a better-than-expected jobs report pushed mortgage rates to their highest levels in more than a month. Conforming mortgage rates rose...(1)

(3)

(8)

(1)

(5)

(9)

(3)

(227)

(2)

(1)

(3)

(1)

(50)

(185)

(5)

(1)

(57)

(1)

(7)

(13)

(29)

(373)

(4)

(14)

(20)

(8)

(22)

(53)

(3)

(7)

(37)