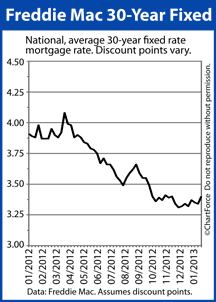

Mortgage rates dropped last week despite positive employment reports, which typically causes mortgage rates to rise. As of Thursday, Freddie Mac reports that the average mortgage rate for a 30-year fixed rate mortgage was 3.63 percent with borrowers paying their closing costs and 0.8 percent in disc...

Mortgage rates dropped last week despite positive employment reports, which typically causes mortgage rates to rise. As of Thursday, Freddie Mac reports that the average mortgage rate for a 30-year fixed rate mortgage was 3.63 percent with borrowers paying their closing costs and 0.8 percent in disc... Last week was quite for economic news. Mortgage rates and remained relatively stable, with slight variation through the week. Even the release of the FOMC meeting minutes from 1/30/13 on Wednesday didn't cause much of a stir. There were no surprised to cause rates to move eit...

Last week was quite for economic news. Mortgage rates and remained relatively stable, with slight variation through the week. Even the release of the FOMC meeting minutes from 1/30/13 on Wednesday didn't cause much of a stir. There were no surprised to cause rates to move eit... Mortgage rates improved slightly last week during a week of sparse economic news. Thursday's weekly jobless claims report showed 371,000 new claims, which was 1,000 fewer jobless claims than for the prior week. Wall Street expectations of 365,000 new jobless claims turned out to be too optimistic. T...

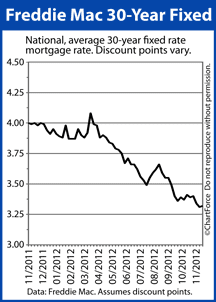

Mortgage rates improved slightly last week during a week of sparse economic news. Thursday's weekly jobless claims report showed 371,000 new claims, which was 1,000 fewer jobless claims than for the prior week. Wall Street expectations of 365,000 new jobless claims turned out to be too optimistic. T... Mortgage bonds worsened last week as Fiscal Cliff talks moved closer to resolution and as the U.S. economy showed continued signs of growth. Conforming mortgage rates in Virginia rose slightly, edging off the all-time lows late in November. According to Freddie Mac's weekly mortgage rate survey, the...

Mortgage bonds worsened last week as Fiscal Cliff talks moved closer to resolution and as the U.S. economy showed continued signs of growth. Conforming mortgage rates in Virginia rose slightly, edging off the all-time lows late in November. According to Freddie Mac's weekly mortgage rate survey, the... Low mortgage rates are pumping up home affordability. Average 30-year fixed-rate mortgage rates made a new all-time low in November, continuing this year Refinance Boom and giving fuel to the budding housing market recovery. At month-end, Freddie Mac’s survey of 125 banks nationwide put...

Low mortgage rates are pumping up home affordability. Average 30-year fixed-rate mortgage rates made a new all-time low in November, continuing this year Refinance Boom and giving fuel to the budding housing market recovery. At month-end, Freddie Mac’s survey of 125 banks nationwide put... Mortgage markets worsened last week as hope for a European economic rebound and stronger-than-expected U.S. economic data moved investors out of mortgage-backed bonds. Mortgage rates all of types -- conventional, FHA and VA -- lost ground last week, harming home affordability in Midlothian and reduc...

Mortgage markets worsened last week as hope for a European economic rebound and stronger-than-expected U.S. economic data moved investors out of mortgage-backed bonds. Mortgage rates all of types -- conventional, FHA and VA -- lost ground last week, harming home affordability in Midlothian and reduc...

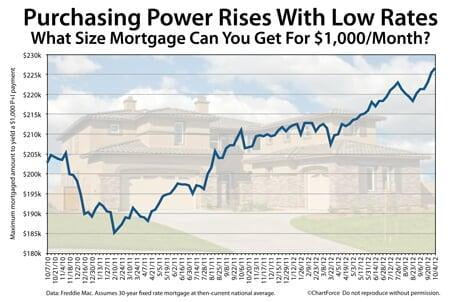

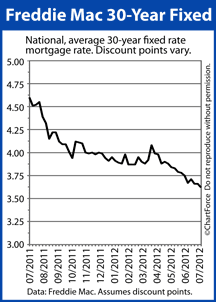

Mortgage rates in Virginia continue to troll near all-time lows, boosting the purchasing power of home buyers statewide.

According to Freddie Mac's most recent Primary Mortgage Market survey, the average 30-year fixed rate mortgage is now 3.39 percent nationwide, just three ticks off an all-time low....

Mortgage markets were basically unchanged last week. With a dearth of new U.S. economic data due for release, investors turned their collective attention to the Europe, China, and the Middle East. The combination of civil protests, economic slowdowns, and growing political tensions caused investors ...

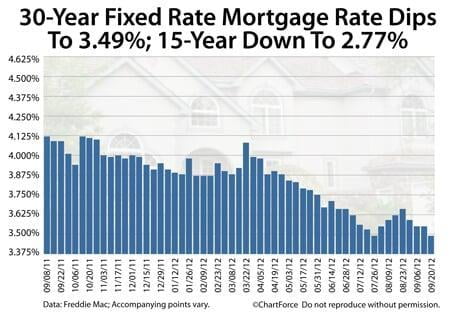

Mortgage markets were basically unchanged last week. With a dearth of new U.S. economic data due for release, investors turned their collective attention to the Europe, China, and the Middle East. The combination of civil protests, economic slowdowns, and growing political tensions caused investors ... For the first time in 9 weeks, mortgage rates have made new lows. According to Freddie Mac's weekly Primary Mortgage Market Survey, the average 30-year fixed rate mortgage rate fell 6 basis points to 3.49% this week, tying the all-time low set in late-July. The 15-year fixed rate mortgage also drop...

For the first time in 9 weeks, mortgage rates have made new lows. According to Freddie Mac's weekly Primary Mortgage Market Survey, the average 30-year fixed rate mortgage rate fell 6 basis points to 3.49% this week, tying the all-time low set in late-July. The 15-year fixed rate mortgage also drop... Mortgage markets worsened slightly in last week's holiday-shortened week. As expected, Wall Street took its cues from Europe and from the U.S. jobs market, and mortgage rates moved across a wide range. Home buyers in Henrico and would-be refinancing households were greeted with wildly varying mortga...

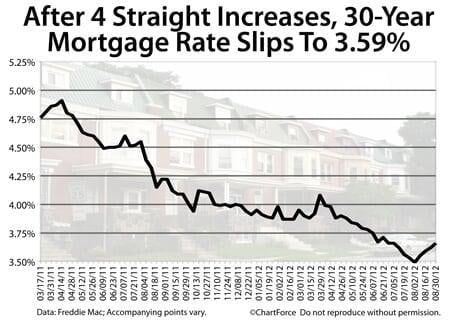

Mortgage markets worsened slightly in last week's holiday-shortened week. As expected, Wall Street took its cues from Europe and from the U.S. jobs market, and mortgage rates moved across a wide range. Home buyers in Henrico and would-be refinancing households were greeted with wildly varying mortga... After 4 weeks of rising costs, Henrico mortgage rates finally recede. According to Freddie Mac's weekly Primary Mortgage Market Survey, the average 30-year fixed rate mortgage rate dropped 7 basis points to 3.59% this week. Depending on where you live, however, you may find that your offered m...

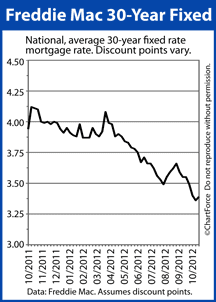

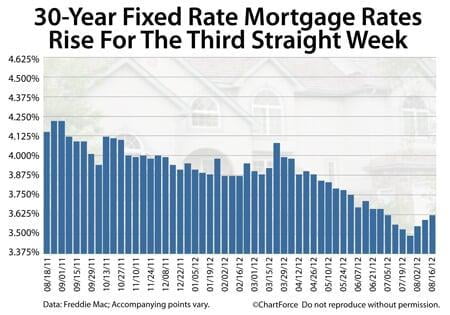

After 4 weeks of rising costs, Henrico mortgage rates finally recede. According to Freddie Mac's weekly Primary Mortgage Market Survey, the average 30-year fixed rate mortgage rate dropped 7 basis points to 3.59% this week. Depending on where you live, however, you may find that your offered m... Mortgage markets worsened for the third straight week last week as the U.S. economy showed new signs of expansion, and as little new news came from Europe. August has been a rough month for rate shoppers. Since the start of the month, mortgage rates in Henrico have climbed steadily and are now ...

Mortgage markets worsened for the third straight week last week as the U.S. economy showed new signs of expansion, and as little new news came from Europe. August has been a rough month for rate shoppers. Since the start of the month, mortgage rates in Henrico have climbed steadily and are now ...

Mortgage rates in Richmond keep on rising.

According to Freddie Mac's weekly Primary Mortgage Market Survey, for the third straight week, the 30-year fixed rate mortgage rate rose, this time tacking on 3 basis points on a week-over-week basis to 3.62%, on average, nationwide. The 3.62% mortgage rate ...

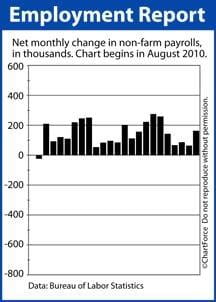

Mortgage bonds worsened last week in a news- and event-heavy week. A series of non-action from the world's central banks -- including the Federal Reserve -- plus a better-than-expected jobs report pushed mortgage rates to their highest levels in more than a month. Conforming mortgage rates rose...

Mortgage bonds worsened last week in a news- and event-heavy week. A series of non-action from the world's central banks -- including the Federal Reserve -- plus a better-than-expected jobs report pushed mortgage rates to their highest levels in more than a month. Conforming mortgage rates rose... Mortgage rates couldn't fall forever, it seems.

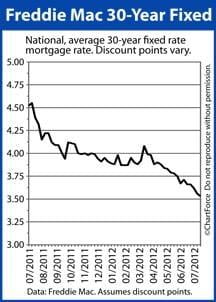

Mortgage rates couldn't fall forever, it seems.

This week, for the first time since mid-June, the 30-year fixed rate mortgage rate climbed on a week-over-week basis, moving 6 basis points to 3.55%, on average, nationwide.

According to Freddie Mac, 3.55 percent is the highest average rate at which the ...

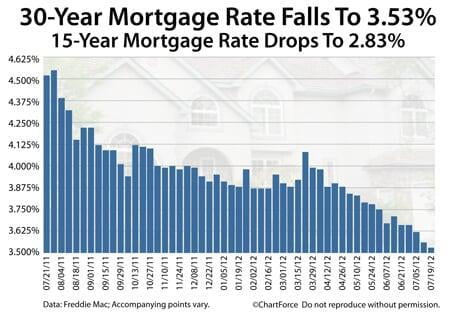

Another week, another new low for mortgage rates.

According to Freddie Mac's weekly Primary Mortgage Market Survey, the 30-year fixed rate mortgage rate fell 3 basis points to 3.53% last week nationwide. The 3.53% mortgage rate is available to mortgage applicants who are willing to pay 0.7 disc...

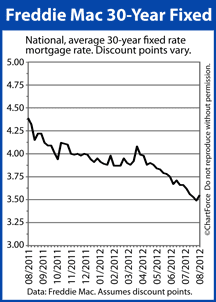

Mortgage markets improved last week on expectations for new Federal Reserve stimulus, plus ongoing concerns about the European Union's future. Mortgage-backed bonds climbed to new all-time highs, which helped conforming mortgage rates drop to new all-time lows. The average 30-year fixed-rate mortgag...

Mortgage markets improved last week on expectations for new Federal Reserve stimulus, plus ongoing concerns about the European Union's future. Mortgage-backed bonds climbed to new all-time highs, which helped conforming mortgage rates drop to new all-time lows. The average 30-year fixed-rate mortgag... When the calendar flips to a new year, analysts and economists like to make predictions for the year ahead.

When the calendar flips to a new year, analysts and economists like to make predictions for the year ahead.

So, today, with the year half-complete, it's an opportune time to check back to see how the experts' predictions are faring (so far).

If you'll remember, when 2011 closed, the housing market was...

30-year fixed rate mortgage rates made new, all-time lows once again this week.

30-year fixed rate mortgage rates made new, all-time lows once again this week.

According to Freddie Mac's weekly mortgage rate survey of more than 125 banks nationwide, the average 30-year fixed rate mortgage rate fell 4 basis point to 3.62% nationwide.

The rate is available to conforming, prime borr...

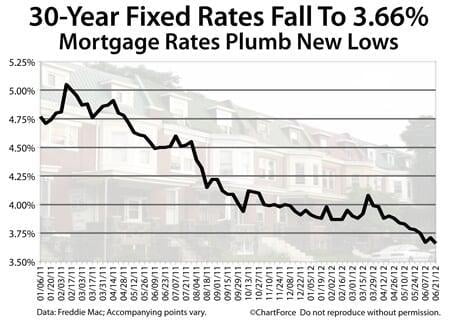

Mortgage rates have resumed their downward trend.

According to Freddie Mac's weekly Primary Mortgage Market Survey, the national average 30-year fixed rate mortgage rate fell 5 basis points to 3.66% this week. The rate is available to "prime" borrowers who are willing to pay, on average, 0....

(1)

(3)

(8)

(1)

(5)

(9)

(3)

(227)

(2)

(1)

(3)

(1)

(50)

(185)

(5)

(1)

(57)

(1)

(7)

(13)

(29)

(373)

(4)

(14)

(20)

(8)

(22)

(53)

(3)

(7)

(37)