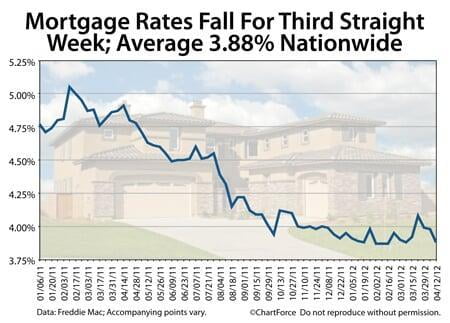

It's a money-saving time to be a Midlothian home buyer. Historically, mortgage rates of all types -- conventional, FHA, VA and USDA -- have never been lower and low mortgage rates make for low monthly payments. According to Freddie Mac's weekly mortgage rate survey, the average 30-year fixed rate m...

It's a money-saving time to be a Midlothian home buyer. Historically, mortgage rates of all types -- conventional, FHA, VA and USDA -- have never been lower and low mortgage rates make for low monthly payments. According to Freddie Mac's weekly mortgage rate survey, the average 30-year fixed rate m...

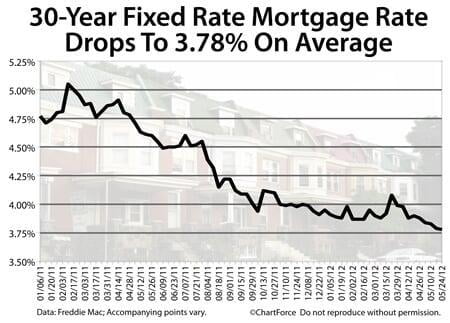

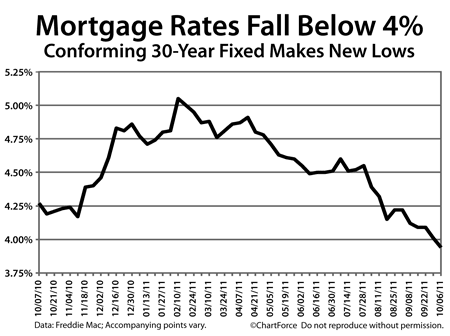

For the fifth consecutive week, conforming 30-year fixed rate mortgage rates have dropped to new all-time lows.

According to this week's Primary Mortgage Market Survey from Freddie Mac, "prime" mortgage applicants willing to pay 0.8 discount points plus closing costs can secure a mortgage r...

Conforming mortgage rates continue to drop.

For the second straight week, the 30-year fixed rate mortgage fell to a new, all-time low nationwide. According to Freddie Mac's weekly mortgage rate survey, the average 30-year fixed rate mortgage rate dropped 1 basis point to 3.83% this week for borrowers...

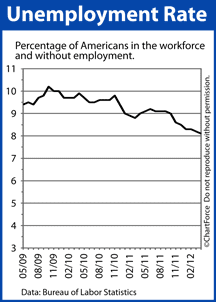

After two weeks of no change, mortgage markets improved last week, pushing mortgage rates lower throughout Virginia. The majority of the improvements occurred Friday after the April jobs report failed to impress Wall Street, and after it became clear that the Eurozone's struggles with sovereign debt...

After two weeks of no change, mortgage markets improved last week, pushing mortgage rates lower throughout Virginia. The majority of the improvements occurred Friday after the April jobs report failed to impress Wall Street, and after it became clear that the Eurozone's struggles with sovereign debt... Mortgage markets improved last week as a global flight-to-quality continued. With Spain facing questions on its sovereign debt, investors continued to pare exposure to risky assets, sparking demand for the relative safety of U.S. government-backed mortgage-backed bonds.

Mortgage markets improved last week as a global flight-to-quality continued. With Spain facing questions on its sovereign debt, investors continued to pare exposure to risky assets, sparking demand for the relative safety of U.S. government-backed mortgage-backed bonds.

As a result, conforming and FH...

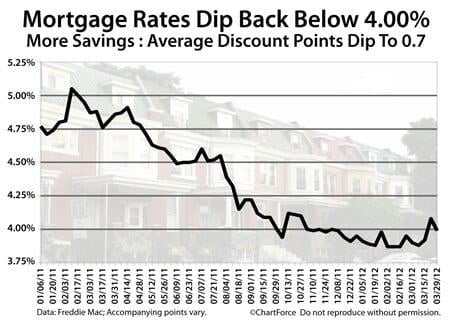

After a brief surge north of 4 percent last month, mortgage rates have settled down, near their lowest levels of all-time.

According to Freddie Mac's weekly Primary Mortgage Market Survey, for applicants willing to pay 0.7 discount points plus a complete set of closing costs, the average 30-ye...

After a brief run-up two weeks ago, mortgage rates are back below 4 percent. It's good news for home buyers and mortgage rate shoppers of Richmond because with lower mortgage rates come lower mortgage payments. According to Freddie Mac's weekly Primary Mortgage Market Survey, the national, average ...

After a brief run-up two weeks ago, mortgage rates are back below 4 percent. It's good news for home buyers and mortgage rate shoppers of Richmond because with lower mortgage rates come lower mortgage payments. According to Freddie Mac's weekly Primary Mortgage Market Survey, the national, average ... Mortgage markets carved out a wide range last week, eventually closing slightly worse. Mortgage-backed bonds sold off early in the week on rising investor sentiment. Then, they reversed higher on prepared remarks from Federal Reserve Chairman Ben Bernanke, which tempered Wall Street optimism. When b...

Mortgage markets carved out a wide range last week, eventually closing slightly worse. Mortgage-backed bonds sold off early in the week on rising investor sentiment. Then, they reversed higher on prepared remarks from Federal Reserve Chairman Ben Bernanke, which tempered Wall Street optimism. When b... Mortgage markets worsened last week as the Eurozone moved closer to a bailout agreement with Greece, and the U.S. economy displayed more signs of growth. In response, mortgage rates climbed last week. Rate shoppers should not be surprised that rates ticked north. Since mid-2011, weakness in Greece h...

Mortgage markets worsened last week as the Eurozone moved closer to a bailout agreement with Greece, and the U.S. economy displayed more signs of growth. In response, mortgage rates climbed last week. Rate shoppers should not be surprised that rates ticked north. Since mid-2011, weakness in Greece h...

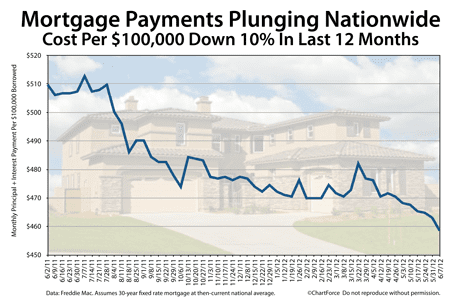

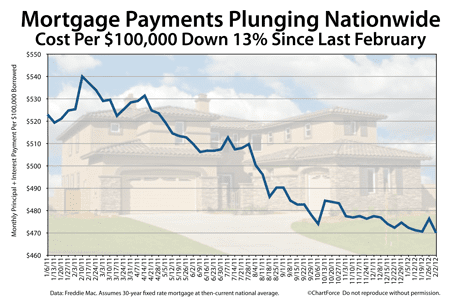

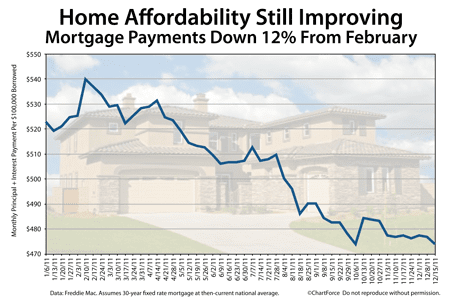

Falling mortgage rates make owning a home more affordable. Mortgage rates are directly tied to monthly mortgage payment so as mortgage rates drop, so does the cost of home-ownership.

It's a money-saving time to buy a home in Richmond -- or to refinance one. Mortgage rates have never been this ...

Mortgage markets gained last week, picking up momentum into the weekend. Global demand for mortgage-backed bonds helped push mortgage rates to new lows, and closing costs eased somewhat, too. According to Freddie Mac's weekly mortgage rate survey, the average 30-year fixed rate mortgage rate fell to...

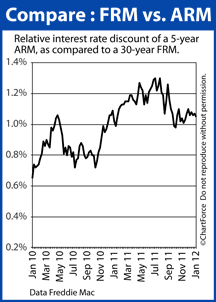

Mortgage markets gained last week, picking up momentum into the weekend. Global demand for mortgage-backed bonds helped push mortgage rates to new lows, and closing costs eased somewhat, too. According to Freddie Mac's weekly mortgage rate survey, the average 30-year fixed rate mortgage rate fell to... For buyers and refinancing households throughout Virginia , adjustable-rate mortgages are a relative bargain as compared to fixed-ones.

For buyers and refinancing households throughout Virginia , adjustable-rate mortgages are a relative bargain as compared to fixed-ones.

According to Freddie Mac's weekly survey of more than 125 banks nationwide, Midlothian mortgage applicants electing for a conventional ARM over a conventional f...

Mortgage markets improved last week during a holiday-shortened trading week. The mortgage bond markets were closed Monday for Christmas, and closed early Friday afternoon. Trading volume was light all week long, which contributed to a year-end rally. Mortgage bonds made their largest one-week gain i...

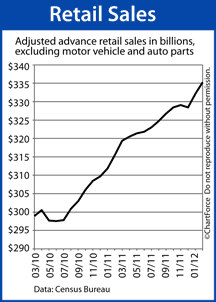

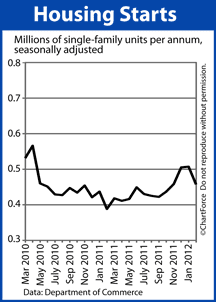

Mortgage markets improved last week during a holiday-shortened trading week. The mortgage bond markets were closed Monday for Christmas, and closed early Friday afternoon. Trading volume was light all week long, which contributed to a year-end rally. Mortgage bonds made their largest one-week gain i... Mortgage markets worsened last week on renewed optimism from the Eurozone, additional evidence of a U.S. economic recovery, and ongoing strength in housing. The action sparked a stock market rally at the expense of mortgage bonds, sending conforming and FHA mortgage rates meaningfully higher for the...

Mortgage markets worsened last week on renewed optimism from the Eurozone, additional evidence of a U.S. economic recovery, and ongoing strength in housing. The action sparked a stock market rally at the expense of mortgage bonds, sending conforming and FHA mortgage rates meaningfully higher for the... As mortgage rates drop, so do housing payments. It's a good time to consider refinancing your home, or making an offer on a new one. Mortgage payment affordability has never been so high in history. According to Freddie Mac, the average 30-year fixed rate mortgage rate is now 3.94 percent -- ...

As mortgage rates drop, so do housing payments. It's a good time to consider refinancing your home, or making an offer on a new one. Mortgage payment affordability has never been so high in history. According to Freddie Mac, the average 30-year fixed rate mortgage rate is now 3.94 percent -- ...

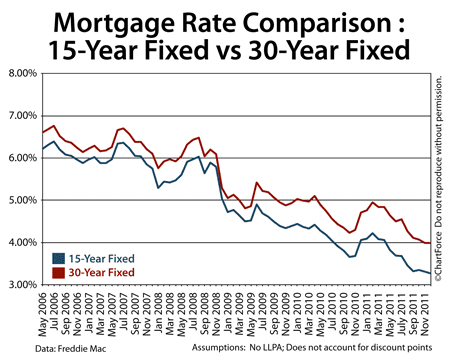

For as low as 30-year fixed rate mortgage rates are in Virginia today, 15-year fixed rate mortgage rates are even lower.

According to Freddie Mac's weekly mortgage rate survey, the average 15-year fixed rate mortgage rate is now 3.27% nationwide with an accompanying 0.8 discount points. 1 discount po...

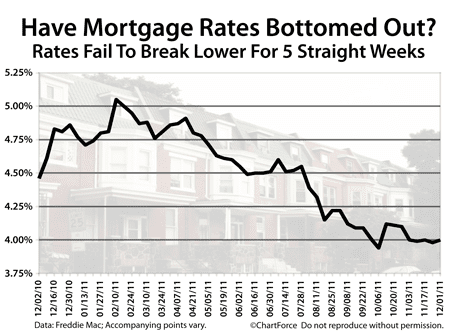

Mortgage rates have troughed. Or, so it seems. According to Freddie Mac's weekly Primary Mortgage Market Survey, the average 30-year fixed rate mortgage is 4.00 percent nationwide -- roughly the same rate as it's been for 5 weeks. During that times, rates have ranged between 3.97 and 4.02 percent w...

Mortgage rates have troughed. Or, so it seems. According to Freddie Mac's weekly Primary Mortgage Market Survey, the average 30-year fixed rate mortgage is 4.00 percent nationwide -- roughly the same rate as it's been for 5 weeks. During that times, rates have ranged between 3.97 and 4.02 percent w...

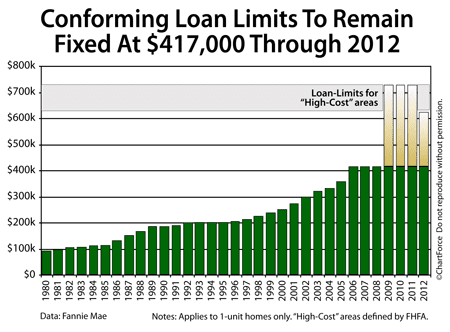

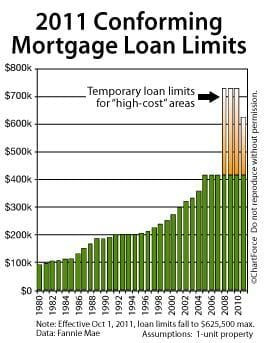

A conforming mortgage is one that, literally, conforms to the mortgage guidelines as set forth by Fannie Mae and Freddie Mac.

Conforming mortgage guidelines are Fannie's and Freddie's eligibility standards; an underwriter's series of check-boxes to determine whether a given loan should be ...

Mortgage rates have dropped past 4 percent.

For the first time in more than 40 years, data from Freddie Mac's weekly Primary Mortgage Market Survey shows the average 30-year fixed rate mortgage falling below 4 percent, dropping to 3.94 percent nationwide. It's the lowest average 30-year fixed reading...

For homeowners in high-cost areas nationwide, conforming and FHA loan limits have dropped by as much as 14 percent. The following are FHA and Conforming (enhanced) mortgage loan limits for purchase and refinance transactions in VIrginia: - Richmond Area: $535,900 - DC Metro (N Va including Frederic...

For homeowners in high-cost areas nationwide, conforming and FHA loan limits have dropped by as much as 14 percent. The following are FHA and Conforming (enhanced) mortgage loan limits for purchase and refinance transactions in VIrginia: - Richmond Area: $535,900 - DC Metro (N Va including Frederic...(1)

(3)

(8)

(1)

(5)

(9)

(3)

(227)

(2)

(1)

(3)

(1)

(50)

(185)

(5)

(1)

(57)

(1)

(7)

(13)

(29)

(373)

(4)

(14)

(20)

(8)

(22)

(53)

(3)

(7)

(37)