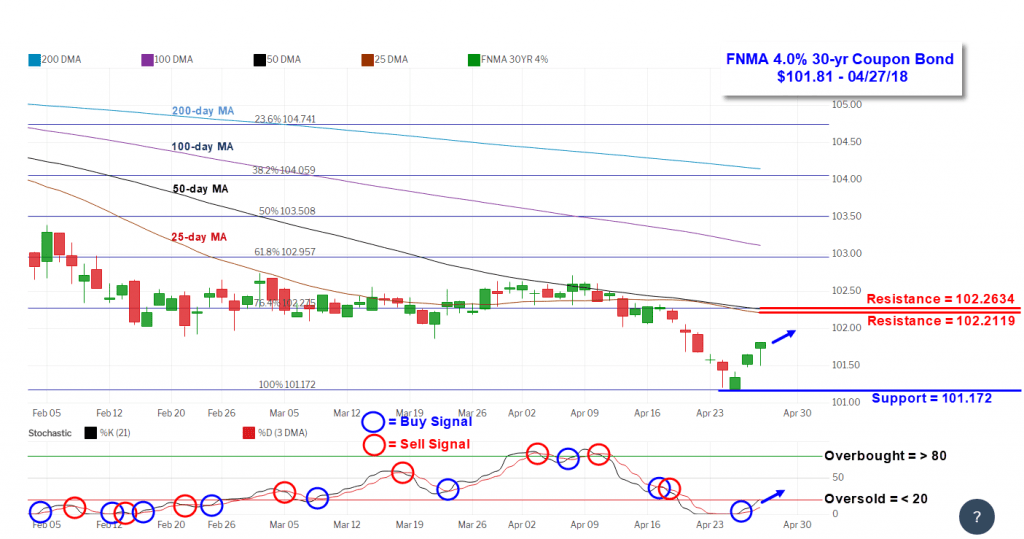

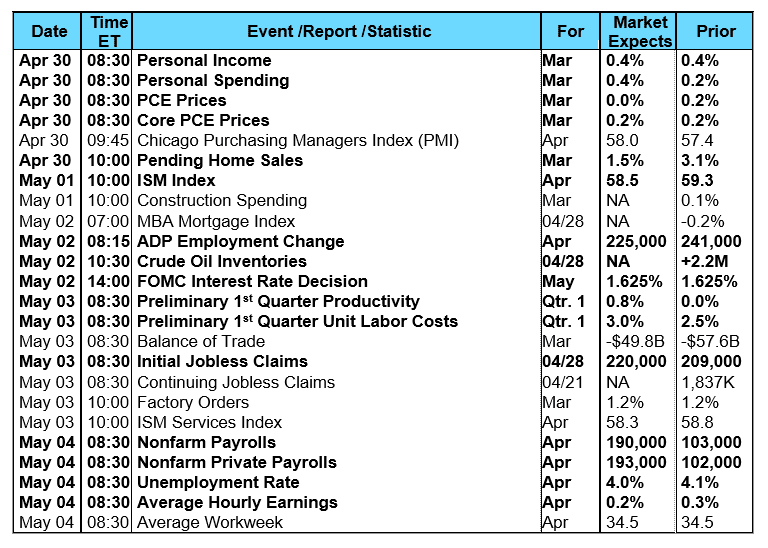

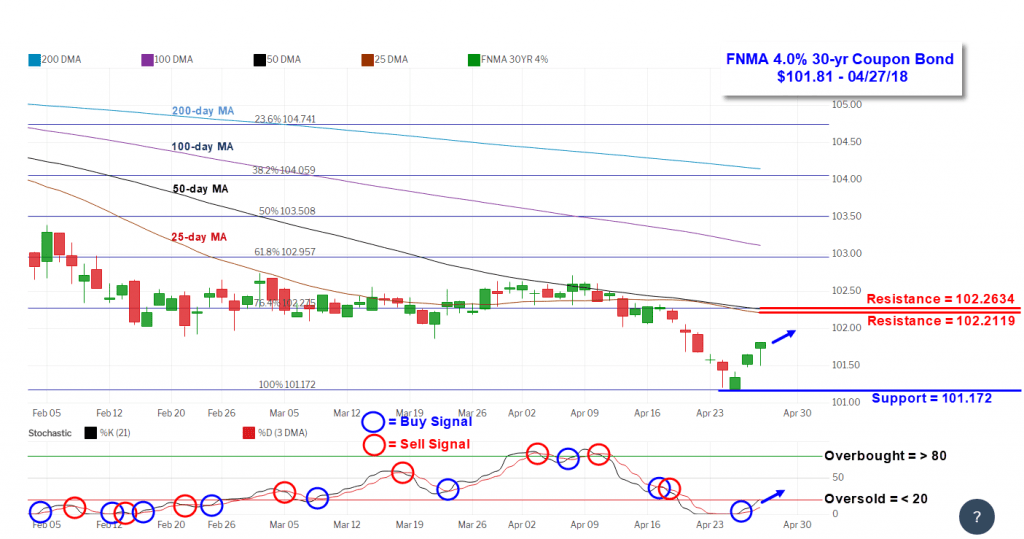

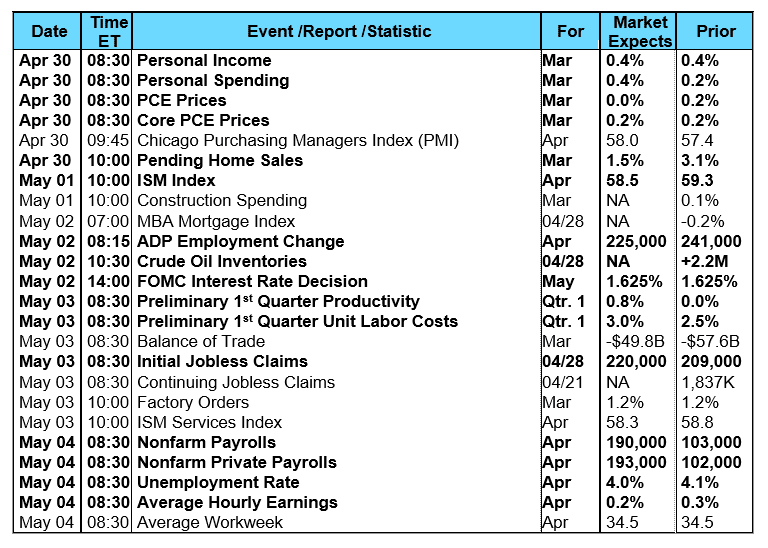

Market action in stocks and bonds was driven by a combination of 1 st Quarter earnings reports, economic news, and geopolitical news of a historic meeting between the leaders of North and South Korea, who agreed on Friday to work to remove all nuclear weapons from the Korean Peninsula and, within the year, pursue talks with the United States to declare an official end to the Korean War. This week past week more than a third of S&P 500 companies reported their earnings results and they were mostly better than expected. However, several companies including Caterpillar provided forward guidance that was worse than anticipated, helping to send stock prices lower for the week while at least temporarily boosting bond prices on Thursday and Friday. Caterpillar helped to take the Dow lower after saying in its post-earnings conference call that margins in the first quarter will be the "high water mark" for the year. Other than earnings reports, investors closely monitored Treasury yields, which reached new multi-year highs on Wednesday before retreating on Thursday and Friday. The benchmark 10-year Treasury yield crossed above the psychologically important 3.0% mark for the first time in over four years, reaching 3.03% before closing the week at 2.96%. In economic news, 1 st quarter Gross Domestic Product (GDP) showed the US economy grew by 2.3%, which was higher than expectations of 2.0%, but lower than the fourth quarter’s growth rate of 2.9%. Weaker consumer spending in the first quarter was largely responsible with only a 1.1% increase following an increase of 4.0% in the fourth quarter. In housing, the National Association of Realtors reported Existing Home Sales increased 1.1% month-over-month in March to a seasonally adjusted annual rate of 5.60 million, slightly above the consensus forecast of 5.57 million. The median existing home price for all housing types increased 5.8% to $250,400, while the median existing single-family home price increased 5.9% from a year ago to $252,100. Home inventory for sale at the end of March increased 5.7% to 1.67 million, but this is 7.2% lower than the same period a year ago. Unsold inventory is at a 3.6-month supply at the current rate of sales. The low inventory of existing homes for sale coupled with high prices and rising mortgage rates continues to hinder overall sales. Further, the Census Bureau and the Department of Housing and Urban Development reported New Home Sales in March at a seasonally adjusted annual rate of 694,000 versus expectations for 631,000. This was a 4.0% month-over-month increase above an upwardly revised February rate of 667,000. The median sales price of new houses sold in March was $337,200, a year-over-year increase of 4.8%. The average sales price dipped 3.8% to $369,900. Based on the current rate of sales, the inventory of new homes for sale fell to a 5.2-months' supply, versus 5.4 months in February and 5.0 months in the year-ago period. From the mortgage industry, the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey showed a drop in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) decreased 0.2% during the week ended April 20, 2018. The seasonally adjusted Purchase Index was unchanged from the week prior while the Refinance Index decreased by 0.3%. Overall, the refinance portion of mortgage activity fell to 37.2% from 37.6% of total applications from the prior week, its lowest level since September 2008. The adjustable-rate mortgage share of activity increased to 6.5% from 6.6% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.73% from 4.66%, its highest level since September 2013. Points increased to 0.49 from 0.46. For the week, the FNMA 4.0% coupon bond gained 12.5 basis points to close at $101.813 while the 10-year Treasury yield decreased 0.15 of one basis point to end at 2.9587%. The major stock indexes moved modestly lower during the week. The Dow Jones Industrial Average dropped 151.75 points to close at 24,311.19. The NASDAQ Composite Index fell 26.33 points to close at 7,119.80. The S&P 500 Index lost 0.23 points to close at 2,669.91. Year to date on a total return basis, the Dow Jones Industrial Average has fallen 1.65%, the NASDAQ Composite Index has gained 3.13%, and the S&P 500 Index has lost 0.14%. This past week, the national average 30-year mortgage rate increased to 4.61% from 4.58%; the 15-year mortgage rate rose to 3.99% from 3.95%; the 5/1 ARM mortgage rate remained unchanged at 3.77% while the FHA 30-year rate moved from 4.37% to 4.43%. Jumbo 30-year rates rose to 4.65% from 4.59%. Economic Calendar - for the Week of April 30, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.  Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($101.813, +12.5 bp) traded within a wider 64.1 basis point range between a weekly intraday low of $101.172 on Wednesday and a weekly intraday high of $101.813 on Friday before closing the week at $101.813 on Friday. As anticipated in last week’s newsletter, mortgage bond prices first fell for a test technical support before managing to bounce higher during the latter half of the week. The rebound on Thursday resulted in a positive stochastic crossover buy signal from a deeply oversold position. There was also positive follow through on Friday with the bond closing at its high for the day. From a purely technical basis, the bond should move higher for a test of resistance, and this would result in a slight improvement in rates. However, there is a potential market-moving personal consumption expenditures (PCE) report looming on Monday. This report is one of the Federal Reserve’s favorite measures of inflation, and if the data shows hotter than expected inflation we could see bond prices retreat back toward support resulting in slightly worse rates. Furthermore, a Preliminary 1 st Quarter Unit Labor Cost report on Thursday could show a rise in wage inflation that would be negative for bond prices. The week’s economic reports will also be highlighted by the April Jobs Report that could also be a market mover impacting mortgage rates. While the technical picture currently looks favorable, significant economic news often “trumps” technical signals.

Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($101.813, +12.5 bp) traded within a wider 64.1 basis point range between a weekly intraday low of $101.172 on Wednesday and a weekly intraday high of $101.813 on Friday before closing the week at $101.813 on Friday. As anticipated in last week’s newsletter, mortgage bond prices first fell for a test technical support before managing to bounce higher during the latter half of the week. The rebound on Thursday resulted in a positive stochastic crossover buy signal from a deeply oversold position. There was also positive follow through on Friday with the bond closing at its high for the day. From a purely technical basis, the bond should move higher for a test of resistance, and this would result in a slight improvement in rates. However, there is a potential market-moving personal consumption expenditures (PCE) report looming on Monday. This report is one of the Federal Reserve’s favorite measures of inflation, and if the data shows hotter than expected inflation we could see bond prices retreat back toward support resulting in slightly worse rates. Furthermore, a Preliminary 1 st Quarter Unit Labor Cost report on Thursday could show a rise in wage inflation that would be negative for bond prices. The week’s economic reports will also be highlighted by the April Jobs Report that could also be a market mover impacting mortgage rates. While the technical picture currently looks favorable, significant economic news often “trumps” technical signals.

Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($101.813, +12.5 bp) traded within a wider 64.1 basis point range between a weekly intraday low of $101.172 on Wednesday and a weekly intraday high of $101.813 on Friday before closing the week at $101.813 on Friday. As anticipated in last week’s newsletter, mortgage bond prices first fell for a test technical support before managing to bounce higher during the latter half of the week. The rebound on Thursday resulted in a positive stochastic crossover buy signal from a deeply oversold position. There was also positive follow through on Friday with the bond closing at its high for the day. From a purely technical basis, the bond should move higher for a test of resistance, and this would result in a slight improvement in rates. However, there is a potential market-moving personal consumption expenditures (PCE) report looming on Monday. This report is one of the Federal Reserve’s favorite measures of inflation, and if the data shows hotter than expected inflation we could see bond prices retreat back toward support resulting in slightly worse rates. Furthermore, a Preliminary 1 st Quarter Unit Labor Cost report on Thursday could show a rise in wage inflation that would be negative for bond prices. The week’s economic reports will also be highlighted by the April Jobs Report that could also be a market mover impacting mortgage rates. While the technical picture currently looks favorable, significant economic news often “trumps” technical signals.

Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($101.813, +12.5 bp) traded within a wider 64.1 basis point range between a weekly intraday low of $101.172 on Wednesday and a weekly intraday high of $101.813 on Friday before closing the week at $101.813 on Friday. As anticipated in last week’s newsletter, mortgage bond prices first fell for a test technical support before managing to bounce higher during the latter half of the week. The rebound on Thursday resulted in a positive stochastic crossover buy signal from a deeply oversold position. There was also positive follow through on Friday with the bond closing at its high for the day. From a purely technical basis, the bond should move higher for a test of resistance, and this would result in a slight improvement in rates. However, there is a potential market-moving personal consumption expenditures (PCE) report looming on Monday. This report is one of the Federal Reserve’s favorite measures of inflation, and if the data shows hotter than expected inflation we could see bond prices retreat back toward support resulting in slightly worse rates. Furthermore, a Preliminary 1 st Quarter Unit Labor Cost report on Thursday could show a rise in wage inflation that would be negative for bond prices. The week’s economic reports will also be highlighted by the April Jobs Report that could also be a market mover impacting mortgage rates. While the technical picture currently looks favorable, significant economic news often “trumps” technical signals.