The stock and bond markets both struggled this past week. Stocks fell for the second consecutive week as some encouraging domestic economic news was offset by a China Trade Balance report showing a 10% drop in exports and a 2% decline in imports during September. This report renewed investor worries of a possible slowdown in global growth. Also, the third quarter corporate earnings season got off to a disappointing start when Alcoa reported lower than expected revenue and profits in addition to softer earnings guidance. Favorable economic news included continued strength in the job market with Weekly Jobless Claims falling to 246,000, a decline of 9,000 below the consensus forecast of 255,000 claims. The underlying trend remains consistent with healthy labor market conditions as claims have now been below the 300,000 level for 84 consecutive weeks. The four-week moving average of claims fell by 3,500 to 249,250 claims last week. Furthermore, the Commerce Department reported Retail Sales were robust in September, rebounding from disappointing sales in August. Retail Sales increased 0.6% in September while Retail Sales excluding autos increased 0.5%. Both readings matched their respective consensus forecasts. The Retail Sales numbers eased investor concerns over the current status of discretionary spending and its potential impact on 3 rd quarter GDP. The Wednesday release of the minutes from the Federal Reserve’s September FOMC meeting triggered some bond market volatility with the yield of the benchmark 10-year Treasury note rising to 1.80%, its highest level in four months. The minutes showed “Several members judged that it would be appropriate to increase the target range for the federal funds rate relatively soon if economic developments unfolded about as the committee expected. It was noted that a reasonable argument could be made either for an increase at this meeting or for waiting for some additional information on the labor market and inflation.” Among the participants who supported awaiting further evidence of continued progress toward the committee’s objectives, several stated that the decision at this meeting was a “close call.” Based on the current prices of fed funds futures, the market is now pricing in a 64.3% chance of a rate increase by the Fed’s December 14 FOMC meeting. The bond market was also hit with some selling pressure on Friday when Fed Chair Janet Yellen remarked in a speech that she was comfortable with the Fed “overshooting” their inflation target. In housing, the Mortgage Bankers Association (MBA) released their latest Mortgage Application Data for the week ending October 7 th showing the overall seasonally adjusted Market Composite Index decreased 6.0%. The seasonally adjusted Purchase Index fell 3.0% from the prior week, while the Refinance Index decreased 8.0%. Overall, the refinance portion of mortgage activity decreased to 62.4% of total applications from 63.8% in the prior week. The adjustable-rate mortgage share of activity decreased to 4.1% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased from 3.62% to 3.68% with points increasing to 0.35 from 0.32. For the week, the FNMA 3.0% coupon bond lost 54.7 basis points to end at $102.98 while the 10-year Treasury yield increased 6.9 basis points to end at 1.8048%. Stocks ended the week lower with the Dow Jones Industrial Average falling 102.11 points to end at 18,138.38. The NASDAQ Composite Index dropped 78.25 points to close at 5,214.16, and the S&P 500 Index lost 20.76 points to close at 2,132.98. Year to date, and exclusive of any dividends, the Dow Jones Industrial Average has gained 3.93%, the NASDAQ Composite Index has added 3.97%, and the S&P 500 Index has advanced 4.17%. This past week, the national average 30-year mortgage rate increased to 3.58% from 3.53% while the 15-year mortgage rate increased to 2.89% from 2.85%. The 5/1 ARM mortgage rate rose to 2.91% from 2.90%. FHA 30-year rates increased to 3.40% from 3.35% and Jumbo 30-year rates increased to 3.73% from 3.68%. Economic Calendar - for the Week of October 17, 2016 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

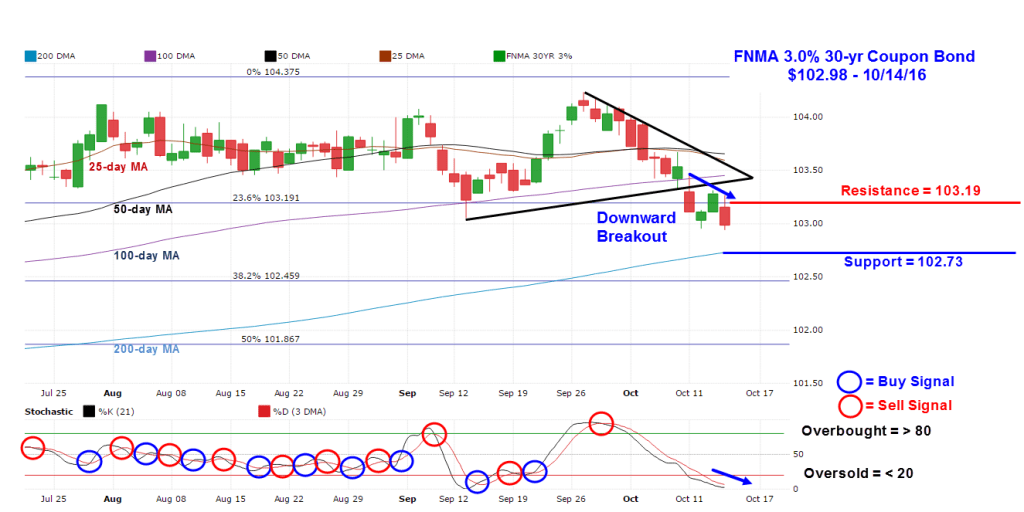

Mortgage Rate Forecast with Chart For the week, the FNMA 30-year 3.0% coupon bond ($102.98, -54.7 basis points) traded within a 53 basis point range between a weekly intraday high of $103.47 on Tuesday and a weekly intraday low of $102.94 on Friday before closing the week at $102.98. The potential breakout pointed out in last week’s newsletter took place this week, and unfortunately it was a downward rather than an upward breakout despite the stock market losing ground. The bond appears to be settling into a new trading range between technical resistance at its 23.6% Fibonacci retracement level and support at the 200-day moving average at $102.73. A continuing move toward support this coming week will result in slightly higher mortgage rates. Chart: FNMA 30-Year 3.0% Coupon Bond

| Date | TimeET | Event /Report /Statistic | For | Market Expects | Prior |

| Oct 17 | 08:30 | New York Empire State Manufacturing Index | Oct | 2.0 | -2.0 |

| Oct 17 | 09:15 | Industrial Production | Sept | 0.2% | -0.4% |

| Oct 17 | 09:15 | Capacity Utilization | Sept | 75.6% | 75.5% |

| Oct 18 | 04:00 | Net Long-Term TIC Flows | Aug | 0.3% | $103.9B |

| Oct 18 | 08:30 | Consumer Price Index (CPI) | Sept | 0.2% | 0.2% |

| Oct 18 | 08:30 | Core CPI | Sept | 59.0 | 0.3% |

| Oct 18 | 10:00 | NAHB Housing Market Index | Oct | NA | 65 |

| Oct 19 | 07:00 | MBA Mortgage Index | 10/15 | NA | NA |

| Oct 19 | 08:30 | Housing Starts | Sept | 1,168K | 1,142K |

| Oct 19 | 08:30 | Building Permits | Sept | 1,164K | 1,139K |

| Oct 19 | 10:30 | Crude Oil Inventories | 10/15 | NA | 4.900M |

| Oct 19 | 14:00 | Fed's Beige Book | Oct | NA | NA |

| Oct 20 | 08:30 | Initial Jobless Claims | 10/15 | 249,000 | 246,000 |

| Oct 20 | 08:30 | Continuing Jobless Claims | 10/08 | NA | 2,046K |

| Oct 20 | 08:30 | Philadelphia Fed Manufacturing Index | Oct | 5.5 | 12.8 |

| Oct 20 | 10:00 | Existing Home Sales | Sept | 5.30 | 5.33M |