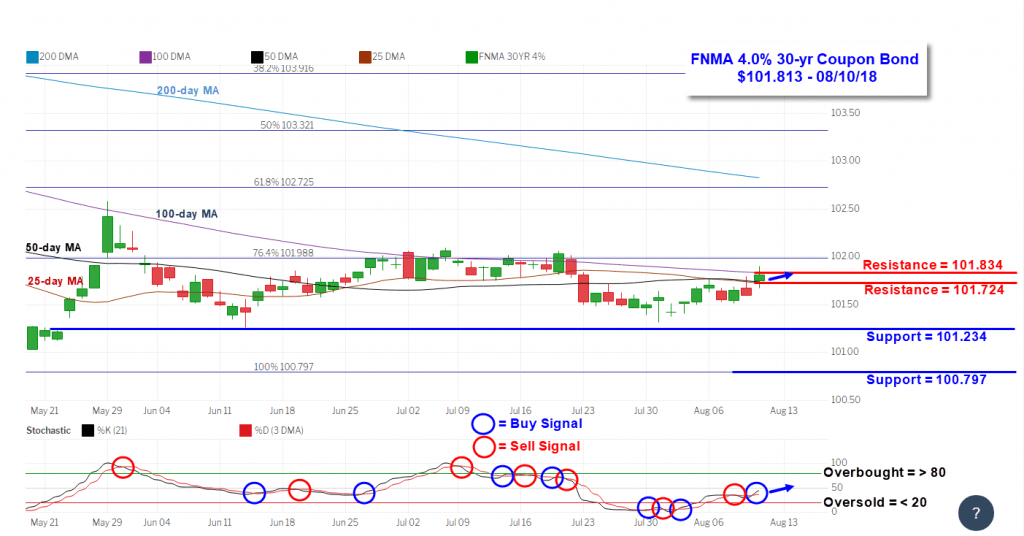

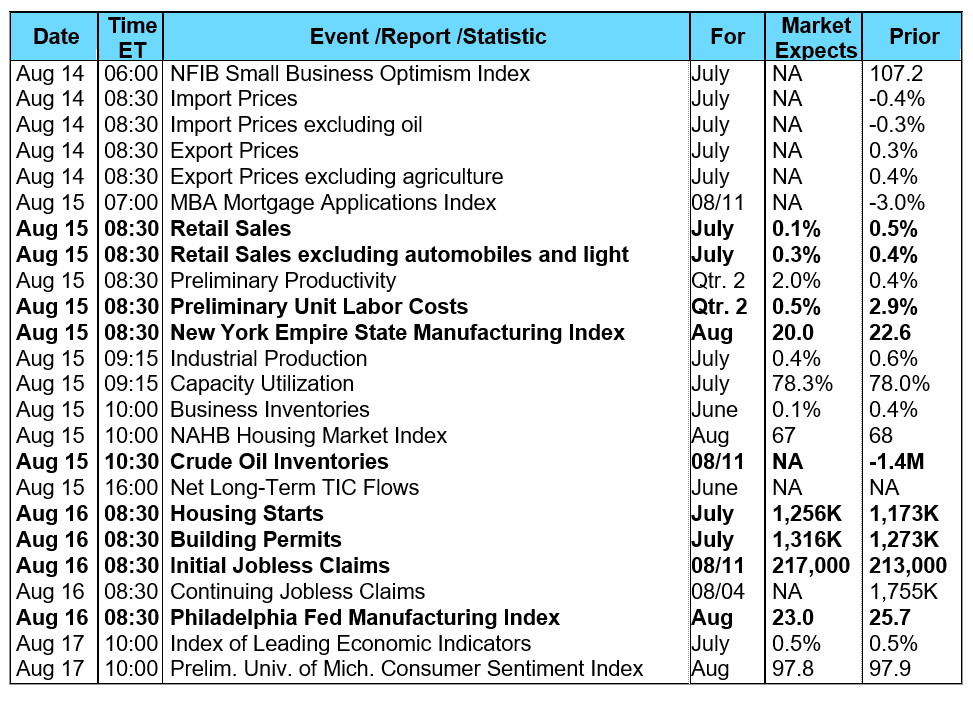

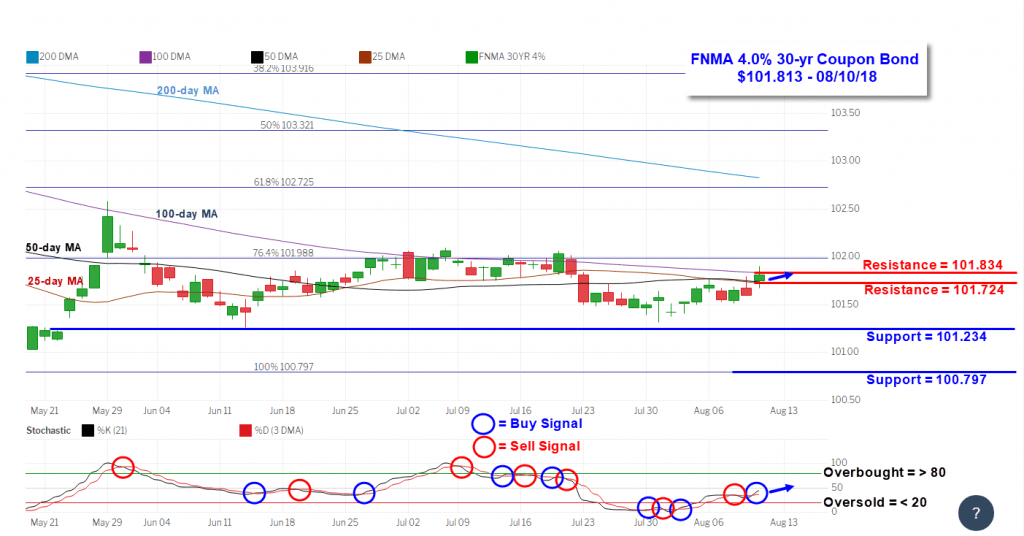

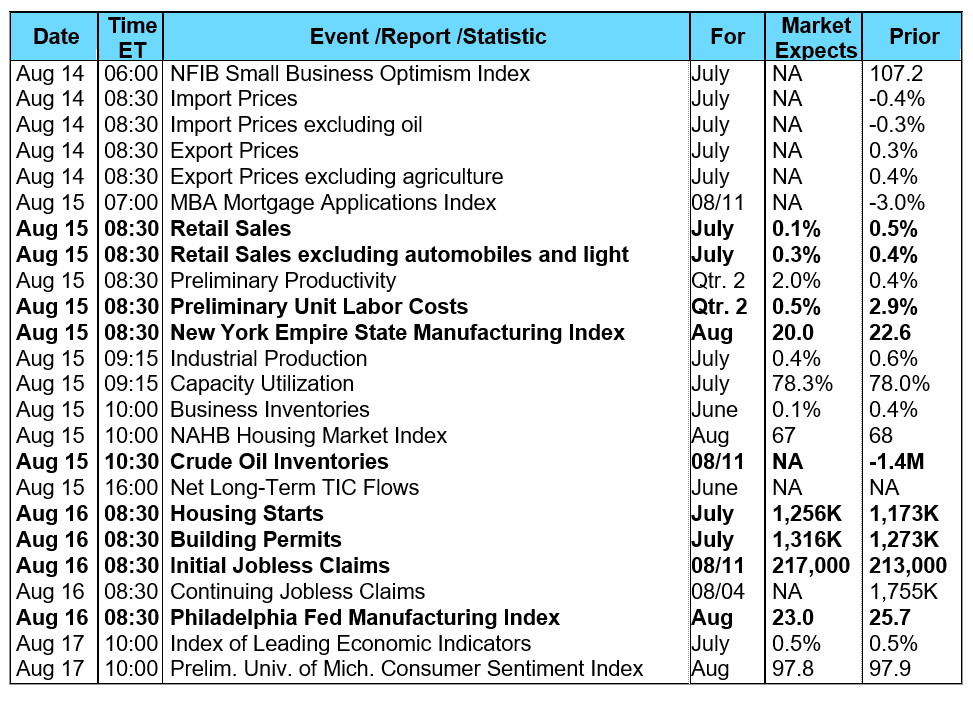

Another wave of trade disputes ignited by a somewhat unusual situation unsettled the stock and currency markets late in the week. In a dispute with Turkey over that country’s jailing of an American pastor, President Trump announced the U.S. would be doubling its tariffs on steel and aluminum imports from Turkey. This led to a significant currency decline in the Turkish lira which spilled over into other emerging market currencies. This in turn led to lower equity markets in the U.S. and elsewhere globally. Furthermore, the trade “war” between the U.S. and China continued to escalate with China announcing new tariffs on $16 billion worth of U.S. imported goods. These geopolitical trade events promoted a modest “flight to safety” in U.S. Treasuries on Friday to push the yield on the 10-year Treasury note down to its lowest level in almost a month. Meanwhile, second-quarter corporate earnings reports continue to be mostly better than expected among analysts. According to the latest data from FactSet Research Systems, a financial data and software company catering to investment professionals, earnings for S&P 500 Index companies have grown 24.6% over the same quarter a year ago while keeping pace with the first quarter’s results which were the best earnings growth in nearly eight years. In housing, the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey revealed last Wednesday showed a decrease in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) fell 3.0% during the week ended August 3, 2018. The seasonally adjusted Purchase Index decreased 2.0% from the week prior while the Refinance Index decreased by 5.0% from a week earlier to its lowest level since December 2000. Overall, the refinance portion of mortgage activity decreased to 36.6% from 37.1% of total applications from the prior week. The adjustable-rate mortgage share of activity decreased to 6.3% from 6.4% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance remained unchanged at 4.84% with points remaining unchanged at 0.45. For the week, the FNMA 4.0% coupon bond gained 14.1 basis points to close at $101.813 while the 10-year Treasury yield decreased 7.95 basis points to end at 2.873%. The Dow Jones Industrial Average lost 149.44 points to close at 25,313.14. The NASDAQ Composite Index added 27.09 points to close at 7,839.11. The S&P 500 Index fell 7.07 points to close at 2,833.28. Year to date on a total return basis, the Dow Jones Industrial Average has gained 2.40%, the NASDAQ Composite Index has advanced 13.55%, and the S&P 500 Index has added 5.97%. This past week, the national average 30-year mortgage rate declined to 4.64% from 4.72%; the 15-year mortgage rate fell to 4.13% from 4.18%; the 5/1 ARM mortgage rate dropped to 3.95% from 4.00% while the FHA 30-year rate fell to 4.37% from 4.42%. Jumbo 30-year rates eased to 4.40% from 4.48%. Economic Calendar - for the Week of August 13, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.  Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($101.813, +14.1 bp) traded within a narrow 39.0 basis point range between a weekly intraday low of 101.516 on Wednesday and a weekly intraday high of $101.906 on Friday before closing the week at $101.813 on Friday. Mortgage bond prices dipped slightly lower mid-week before turning higher toward resistance levels to end the week. While the bond is no longer “oversold,” there is room for prices to run higher before becoming “overbought.” So, we could likely see prices push higher this coming week to challenge resistance levels at the 25-day, 50-day and 100-day moving averages which are in close proximity to one another. Bottom line, the technical chart continues to suggest there will be stable to slightly improved mortgage rates this coming week.

Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($101.813, +14.1 bp) traded within a narrow 39.0 basis point range between a weekly intraday low of 101.516 on Wednesday and a weekly intraday high of $101.906 on Friday before closing the week at $101.813 on Friday. Mortgage bond prices dipped slightly lower mid-week before turning higher toward resistance levels to end the week. While the bond is no longer “oversold,” there is room for prices to run higher before becoming “overbought.” So, we could likely see prices push higher this coming week to challenge resistance levels at the 25-day, 50-day and 100-day moving averages which are in close proximity to one another. Bottom line, the technical chart continues to suggest there will be stable to slightly improved mortgage rates this coming week.

Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($101.813, +14.1 bp) traded within a narrow 39.0 basis point range between a weekly intraday low of 101.516 on Wednesday and a weekly intraday high of $101.906 on Friday before closing the week at $101.813 on Friday. Mortgage bond prices dipped slightly lower mid-week before turning higher toward resistance levels to end the week. While the bond is no longer “oversold,” there is room for prices to run higher before becoming “overbought.” So, we could likely see prices push higher this coming week to challenge resistance levels at the 25-day, 50-day and 100-day moving averages which are in close proximity to one another. Bottom line, the technical chart continues to suggest there will be stable to slightly improved mortgage rates this coming week.

Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($101.813, +14.1 bp) traded within a narrow 39.0 basis point range between a weekly intraday low of 101.516 on Wednesday and a weekly intraday high of $101.906 on Friday before closing the week at $101.813 on Friday. Mortgage bond prices dipped slightly lower mid-week before turning higher toward resistance levels to end the week. While the bond is no longer “oversold,” there is room for prices to run higher before becoming “overbought.” So, we could likely see prices push higher this coming week to challenge resistance levels at the 25-day, 50-day and 100-day moving averages which are in close proximity to one another. Bottom line, the technical chart continues to suggest there will be stable to slightly improved mortgage rates this coming week.