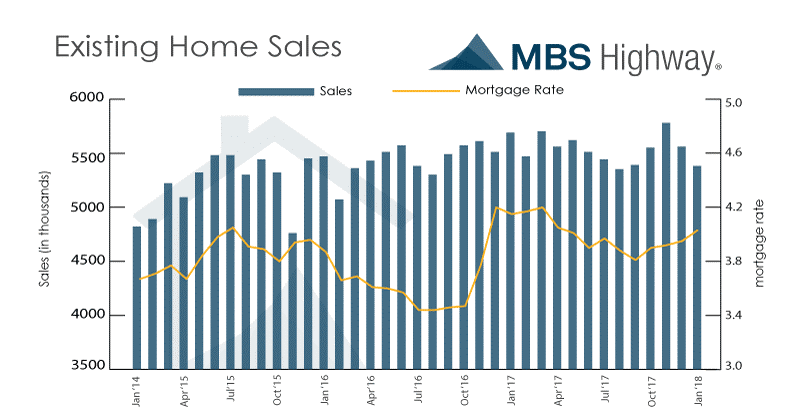

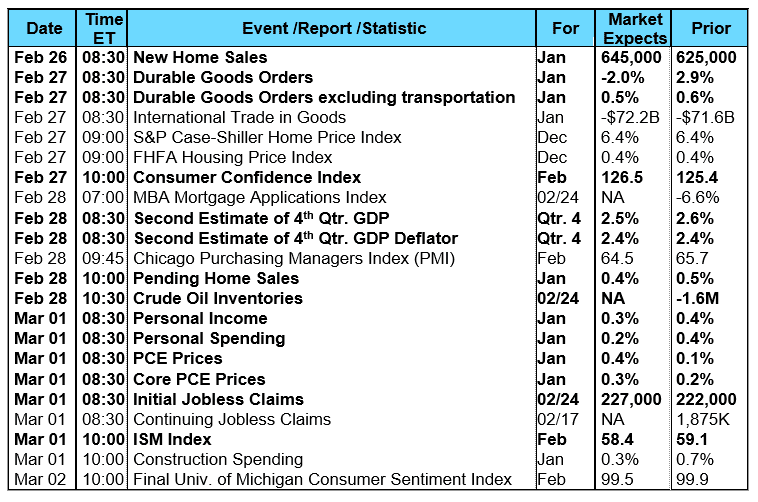

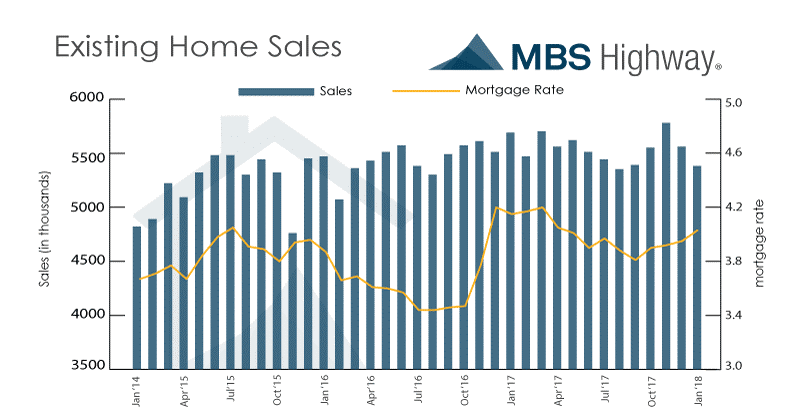

The major stock market indexes were able to register a modest move higher this past week due to a late rally on Friday that erased losses recorded on Tuesday and Wednesday when the indexes displayed increased intra-day volatility. Mid-week, investors were worried over recent market volatility, rising interest rates, and the S&P 500 Index breaking below its 50-day moving average of 2,726. The economic calendar was relatively quiet with the notable exception of Wednesday’s release of the minutes from the Federal Reserve’s January FOMC meeting. The minutes showed a majority of FOMC members expect inflation to increase in 2018 with most members believing in stronger economic growth that will raise the "likelihood that further gradual policy firming would be appropriate." The stock and bond markets reacted negatively to the release with the yield on the benchmark 10-year Treasury note moving up to a four-year high on Wednesday to 2.94% before pulling back to 2.866% by Friday's close to finish flat for the week. However, stocks seemed to get a boost late Friday after the Fed released its semiannual Monetary Policy Report to Congress, indicating the Fed expects inflation to remain below their 2% target in 2018. New Fed Chair Jerome Powell will be testifying about monetary policy before Congress this week. Elsewhere, the National Association of Realtors reported Existing Home Sales fell 3.2% month-over-month during January to a seasonally adjusted annual rate of 5.38 million compared to December’s rate. On a year-over-year basis, the decline in sales was an even worse 4.8%, the largest annual decline since August of 2014. Although the inventory of homes for sale at the end of January increased 4.1% to 1.52 million units, it is 9.5% lower than the same period a year ago and remains a headwind for future Existing Home Sales. Unsold inventory is at a 3.4-month supply at the current sales rate compared to 3.6 months a year ago. Low inventory is also leading to higher home prices. The median price for all categories of homes in January was $240,500, 5.8% higher than the same time a year ago and the 71st straight month of year-over-year gains in home prices. The median price for existing single-family homes increased 5.7% from a year ago to $241,700.  The number of mortgage applications showed a decrease according to the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) fell by 6.6% during the week ended February 16, 2018. The seasonally adjusted Purchase Index decreased by 6.0% from the week prior while the Refinance Index decreased 7.0%. Overall, the refinance portion of mortgage activity increased to 44.4% of total applications from 46.5% in the prior week. The adjustable-rate mortgage share of activity increased to 6.4% of total applications from 6.3%. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.64% from 4.57% to its highest level since January 2014, with points increasing to 0.61 from 0.59. For the week, the FNMA 4.0% coupon bond was unchanged to close at $102.469 while the 10-year Treasury yield decreased 0.71 basis points to end at 2.866%. The major stock indexes moved modestly higher on the week. The Dow Jones Industrial Average moved 90.61 points higher to close at 25,309.99. The NASDAQ Composite Index added 97.93 points to close at 7,337.39 and the S&P 500 Index gained 15.08 points to close at 2,747.30. Year to date on a total return basis, the Dow Jones Industrial Average has risen 2.39%, the NASDAQ Composite Index has gained 6.29%, and the S&P 500 Index has advanced 2.76%. This past week, the national average 30-year mortgage rate was unchanged at 4.53%; the 15-year mortgage rate increased to 3.90% from 3.89%; the 5/1 ARM mortgage rate increased to 3.54% from 3.49% and the FHA 30-year rate was unchanged at 4.33%. Jumbo 30-year rates increased to 4.55% from 4.53%. Economic Calendar - for the Week of February 26, 2018

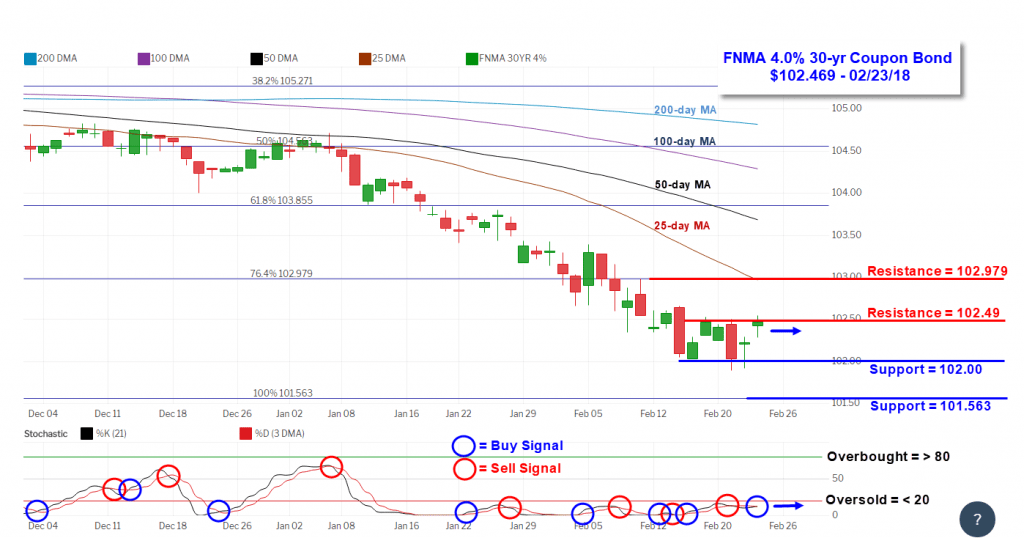

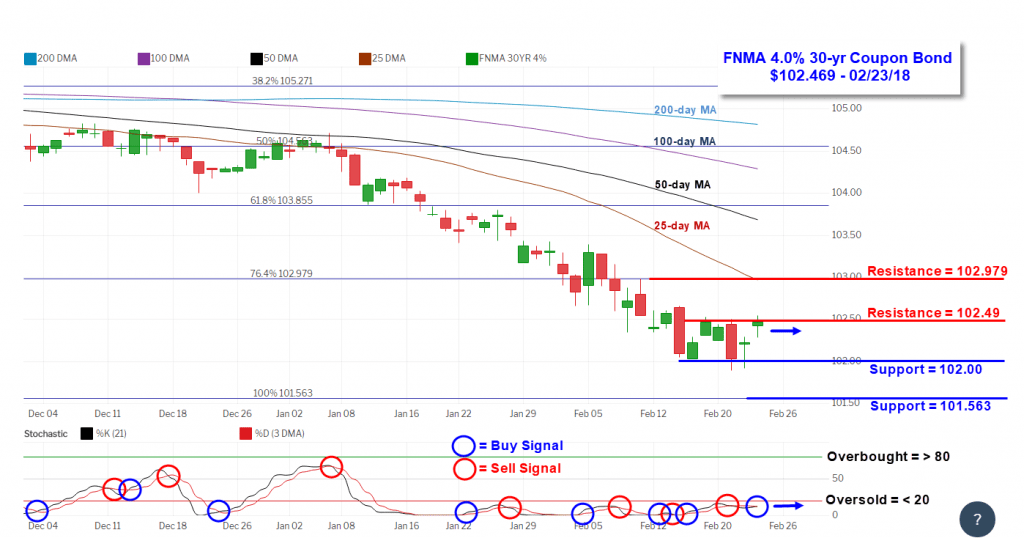

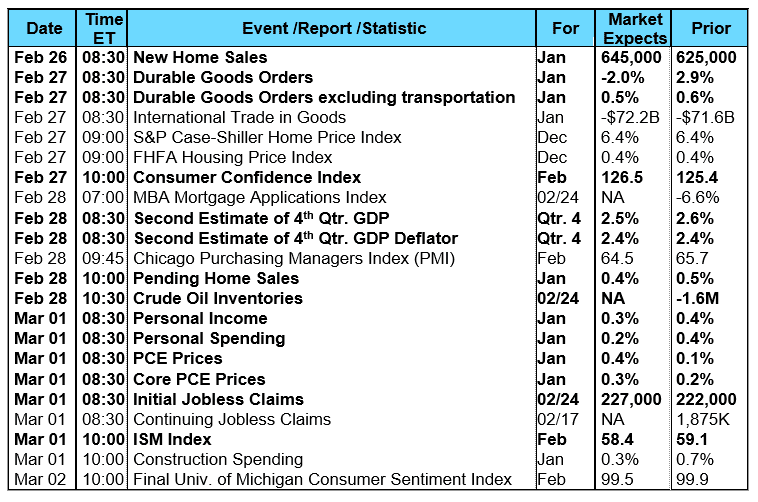

The number of mortgage applications showed a decrease according to the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) fell by 6.6% during the week ended February 16, 2018. The seasonally adjusted Purchase Index decreased by 6.0% from the week prior while the Refinance Index decreased 7.0%. Overall, the refinance portion of mortgage activity increased to 44.4% of total applications from 46.5% in the prior week. The adjustable-rate mortgage share of activity increased to 6.4% of total applications from 6.3%. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.64% from 4.57% to its highest level since January 2014, with points increasing to 0.61 from 0.59. For the week, the FNMA 4.0% coupon bond was unchanged to close at $102.469 while the 10-year Treasury yield decreased 0.71 basis points to end at 2.866%. The major stock indexes moved modestly higher on the week. The Dow Jones Industrial Average moved 90.61 points higher to close at 25,309.99. The NASDAQ Composite Index added 97.93 points to close at 7,337.39 and the S&P 500 Index gained 15.08 points to close at 2,747.30. Year to date on a total return basis, the Dow Jones Industrial Average has risen 2.39%, the NASDAQ Composite Index has gained 6.29%, and the S&P 500 Index has advanced 2.76%. This past week, the national average 30-year mortgage rate was unchanged at 4.53%; the 15-year mortgage rate increased to 3.90% from 3.89%; the 5/1 ARM mortgage rate increased to 3.54% from 3.49% and the FHA 30-year rate was unchanged at 4.33%. Jumbo 30-year rates increased to 4.55% from 4.53%. Economic Calendar - for the Week of February 26, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold. Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($102.469, unchanged) traded within a 65.6 basis point range between a weekly intraday high of $102.547 on Friday and a weekly intraday low of $101.891 on Wednesday before closing the week at $102.469 on Friday. The bond traded in a “V” pattern during the holiday-shortened (Presidents’ Day) week. After selling off hard on Wednesday following the release of the January FOMC meeting minutes, the bond rebounded off of support at the $102 level to erase Wednesday’s loss. The bond ended the week unchanged and just below overhead resistance found at $102.49. The economic calendar heats up this week with Wednesday, March 1 being a significant news day. Personal Income, Personal Spending, and key inflation data from PCE and Core PCE Prices will be reported and could trigger a sizeable market reaction. In all likelihood, bond prices will be driven more by economic news this week than by technical factors. There was a weak buy signal on Friday and even though bonds are “oversold” they are bumping up against resistance, so it will take tame inflation numbers on Wednesday for bonds to have a chance to move higher. If PCE and Core PCE Prices jump higher, bonds will sell off and move back toward support resulting in slightly higher mortgage rates.

Economic reports having the greatest potential impact on the financial markets are highlighted in bold. Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($102.469, unchanged) traded within a 65.6 basis point range between a weekly intraday high of $102.547 on Friday and a weekly intraday low of $101.891 on Wednesday before closing the week at $102.469 on Friday. The bond traded in a “V” pattern during the holiday-shortened (Presidents’ Day) week. After selling off hard on Wednesday following the release of the January FOMC meeting minutes, the bond rebounded off of support at the $102 level to erase Wednesday’s loss. The bond ended the week unchanged and just below overhead resistance found at $102.49. The economic calendar heats up this week with Wednesday, March 1 being a significant news day. Personal Income, Personal Spending, and key inflation data from PCE and Core PCE Prices will be reported and could trigger a sizeable market reaction. In all likelihood, bond prices will be driven more by economic news this week than by technical factors. There was a weak buy signal on Friday and even though bonds are “oversold” they are bumping up against resistance, so it will take tame inflation numbers on Wednesday for bonds to have a chance to move higher. If PCE and Core PCE Prices jump higher, bonds will sell off and move back toward support resulting in slightly higher mortgage rates.

The number of mortgage applications showed a decrease according to the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) fell by 6.6% during the week ended February 16, 2018. The seasonally adjusted Purchase Index decreased by 6.0% from the week prior while the Refinance Index decreased 7.0%. Overall, the refinance portion of mortgage activity increased to 44.4% of total applications from 46.5% in the prior week. The adjustable-rate mortgage share of activity increased to 6.4% of total applications from 6.3%. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.64% from 4.57% to its highest level since January 2014, with points increasing to 0.61 from 0.59. For the week, the FNMA 4.0% coupon bond was unchanged to close at $102.469 while the 10-year Treasury yield decreased 0.71 basis points to end at 2.866%. The major stock indexes moved modestly higher on the week. The Dow Jones Industrial Average moved 90.61 points higher to close at 25,309.99. The NASDAQ Composite Index added 97.93 points to close at 7,337.39 and the S&P 500 Index gained 15.08 points to close at 2,747.30. Year to date on a total return basis, the Dow Jones Industrial Average has risen 2.39%, the NASDAQ Composite Index has gained 6.29%, and the S&P 500 Index has advanced 2.76%. This past week, the national average 30-year mortgage rate was unchanged at 4.53%; the 15-year mortgage rate increased to 3.90% from 3.89%; the 5/1 ARM mortgage rate increased to 3.54% from 3.49% and the FHA 30-year rate was unchanged at 4.33%. Jumbo 30-year rates increased to 4.55% from 4.53%. Economic Calendar - for the Week of February 26, 2018

The number of mortgage applications showed a decrease according to the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) fell by 6.6% during the week ended February 16, 2018. The seasonally adjusted Purchase Index decreased by 6.0% from the week prior while the Refinance Index decreased 7.0%. Overall, the refinance portion of mortgage activity increased to 44.4% of total applications from 46.5% in the prior week. The adjustable-rate mortgage share of activity increased to 6.4% of total applications from 6.3%. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.64% from 4.57% to its highest level since January 2014, with points increasing to 0.61 from 0.59. For the week, the FNMA 4.0% coupon bond was unchanged to close at $102.469 while the 10-year Treasury yield decreased 0.71 basis points to end at 2.866%. The major stock indexes moved modestly higher on the week. The Dow Jones Industrial Average moved 90.61 points higher to close at 25,309.99. The NASDAQ Composite Index added 97.93 points to close at 7,337.39 and the S&P 500 Index gained 15.08 points to close at 2,747.30. Year to date on a total return basis, the Dow Jones Industrial Average has risen 2.39%, the NASDAQ Composite Index has gained 6.29%, and the S&P 500 Index has advanced 2.76%. This past week, the national average 30-year mortgage rate was unchanged at 4.53%; the 15-year mortgage rate increased to 3.90% from 3.89%; the 5/1 ARM mortgage rate increased to 3.54% from 3.49% and the FHA 30-year rate was unchanged at 4.33%. Jumbo 30-year rates increased to 4.55% from 4.53%. Economic Calendar - for the Week of February 26, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold. Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($102.469, unchanged) traded within a 65.6 basis point range between a weekly intraday high of $102.547 on Friday and a weekly intraday low of $101.891 on Wednesday before closing the week at $102.469 on Friday. The bond traded in a “V” pattern during the holiday-shortened (Presidents’ Day) week. After selling off hard on Wednesday following the release of the January FOMC meeting minutes, the bond rebounded off of support at the $102 level to erase Wednesday’s loss. The bond ended the week unchanged and just below overhead resistance found at $102.49. The economic calendar heats up this week with Wednesday, March 1 being a significant news day. Personal Income, Personal Spending, and key inflation data from PCE and Core PCE Prices will be reported and could trigger a sizeable market reaction. In all likelihood, bond prices will be driven more by economic news this week than by technical factors. There was a weak buy signal on Friday and even though bonds are “oversold” they are bumping up against resistance, so it will take tame inflation numbers on Wednesday for bonds to have a chance to move higher. If PCE and Core PCE Prices jump higher, bonds will sell off and move back toward support resulting in slightly higher mortgage rates.

Economic reports having the greatest potential impact on the financial markets are highlighted in bold. Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($102.469, unchanged) traded within a 65.6 basis point range between a weekly intraday high of $102.547 on Friday and a weekly intraday low of $101.891 on Wednesday before closing the week at $102.469 on Friday. The bond traded in a “V” pattern during the holiday-shortened (Presidents’ Day) week. After selling off hard on Wednesday following the release of the January FOMC meeting minutes, the bond rebounded off of support at the $102 level to erase Wednesday’s loss. The bond ended the week unchanged and just below overhead resistance found at $102.49. The economic calendar heats up this week with Wednesday, March 1 being a significant news day. Personal Income, Personal Spending, and key inflation data from PCE and Core PCE Prices will be reported and could trigger a sizeable market reaction. In all likelihood, bond prices will be driven more by economic news this week than by technical factors. There was a weak buy signal on Friday and even though bonds are “oversold” they are bumping up against resistance, so it will take tame inflation numbers on Wednesday for bonds to have a chance to move higher. If PCE and Core PCE Prices jump higher, bonds will sell off and move back toward support resulting in slightly higher mortgage rates.