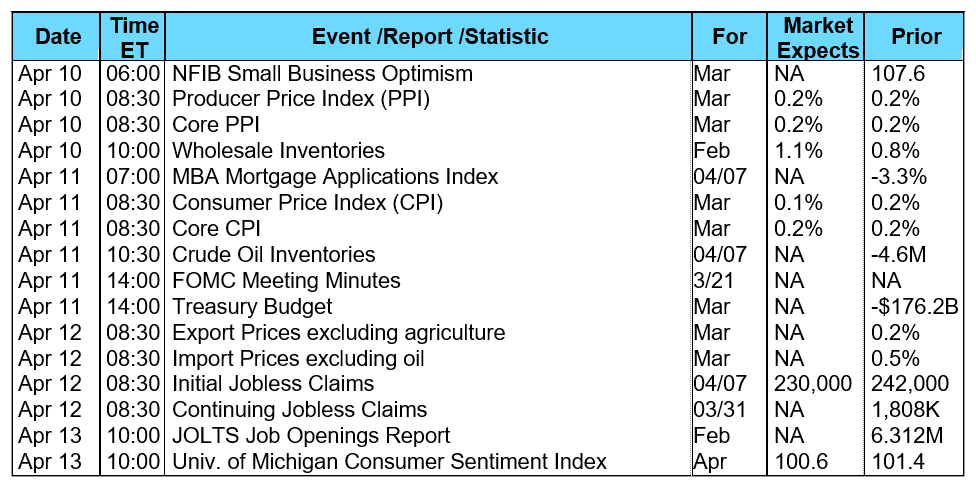

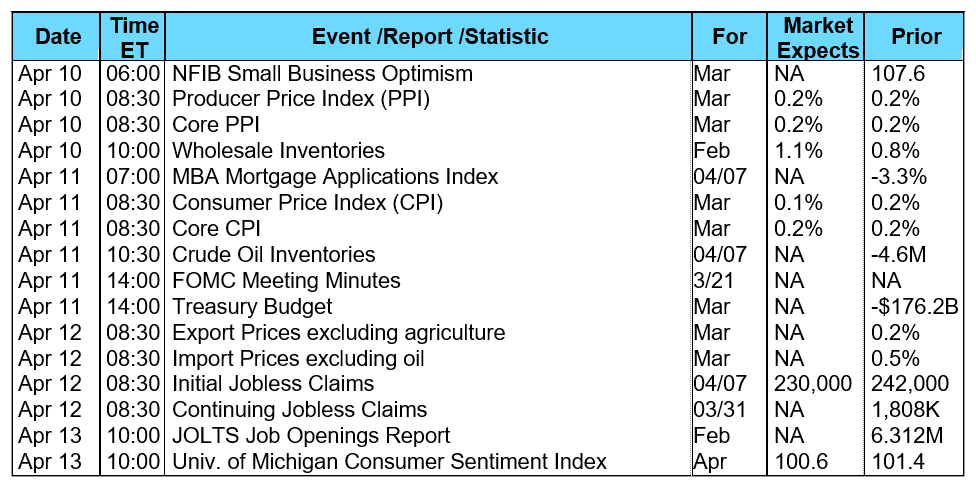

Fears of an escalating trade war between the U.S. and China along with the prospects for rising interest rates weighed on investor sentiment resulting in significant stock market volatility during the week. Trade officials in the U.S. and China went back and forth proposing new tariffs on each other’s imported goods. Last Monday, China announced it would retaliate against U.S. aluminum and steel tariffs with $3 billion in new tariffs of its own targeting mostly U.S. agricultural exports. On Tuesday, the U.S. countered with a new list of $50 billion in proposed tariffs on 1,300 Chinese products, and China promptly responded on Wednesday with its own $50 billion list of tariffs on U.S. aircraft, automobiles, and soybeans. President Trump responded by asking U.S. trade officials to consider tariffs on another $100 billion worth of Chinese imports. The recent volatility in the financial markets may be a sign investors are overreacting to the sentiment portrayed in the media about trade wars. The President’s new economic advisor, Larry Kudlow, and Commerce Secretary Wilbur Ross downplayed the economic impact of the proposed tariffs by suggesting further negotiations with China will soon occur. Also, there was a report by Bloomberg that President Trump may announce a possible agreement on a renegotiated North American Free Trade Agreement (NAFTA) at the Summit of the Americas meetings in mid-April. Another factor moving the markets was the Labor Department’s Employment Situation Summary (Jobs Report) for March that showed a far smaller increase in new job creation than expected. March saw the formation of 103,000 jobs versus a consensus estimate of 175,000. This lower number might be the result of the enormous increase of 326,000 jobs in February. Also, fears of future inflation were furthered by a solid 0.3% increase in Average Hourly Earnings for the month with an unemployment rate remaining at 4.1%. This will not deter the Federal Reserve from its plan to continue bumping interest rates higher. In fact, Fed Chairman Jerome Powell stated in a speech to the Economic Club of Chicago on Friday that he sees further gradual rate hikes on expectations that inflation will pick up this spring. In the mortgage industry, the number of mortgage applications decreased according to the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) decreased by 3.3% during the week ended March 30, 2018. The seasonally adjusted Purchase Index decreased by 2.0% from the week prior while the Refinance Index decreased 5.0%. Overall, the refinance portion of mortgage activity fell to 38.5% from 39.4% of total applications from the prior week. The adjustable-rate mortgage share of activity fell to 6.5% from 7.0% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance remained at 4.69% with points remaining unchanged at 0.43. For the week, the FNMA 4.0% coupon bond lost 1.5 basis points to close at $102.594 while the 10-year Treasury yield increased 3.46 basis points to end at 2.7753%. The major stock indexes moved lower during the week. The Dow Jones Industrial Average declined 170.35 points to close at 23,932.76. The NASDAQ Composite Index fell148.33 points to close at 6,915.11. The S&P 500 Index lost 36.40 points to close at 2,604.47. Year to date on a total return basis, the Dow Jones Industrial Average has fallen 3.18%, the NASDAQ Composite Index has gained 0.17%, and the S&P 500 Index has lost 2.59%. This past week, the national average 30-year mortgage rate decreased to 4.48% from 4.51%; the 15-year mortgage rate declined to 3.86% from 3.89%; the 5/1 ARM mortgage rate increased to 3.65% from 3.64% and the FHA 30-year rate decreased to 4.25% from 4.30%. Jumbo 30-year rates fell to 4.50% from 4.54%. Economic Calendar - for the Week of April 9, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.  Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($102.59, -1.5 bp) traded within a narrower 40.6 basis point range between a weekly intraday low of $102.313 on Tuesday and Friday and a weekly intraday high of $102.719 on Friday before closing the week at $102.594 on Friday. Mortgage bonds traded in a sideways direction within a narrow range between the 25-day and 50-day moving averages. These two moving averages serve as nearest technical support and resistance levels respectively. The chart shows the bond is just below the “overbought” level while showing a new buy signal from a positive stochastic crossover. This suggests there is some room for price improvement with the prospects the bond will stay above its 50-day moving average. If the bond can manage to stay above the 50-day moving average, mortgage rates should remain stable at current levels or may improve very slightly.

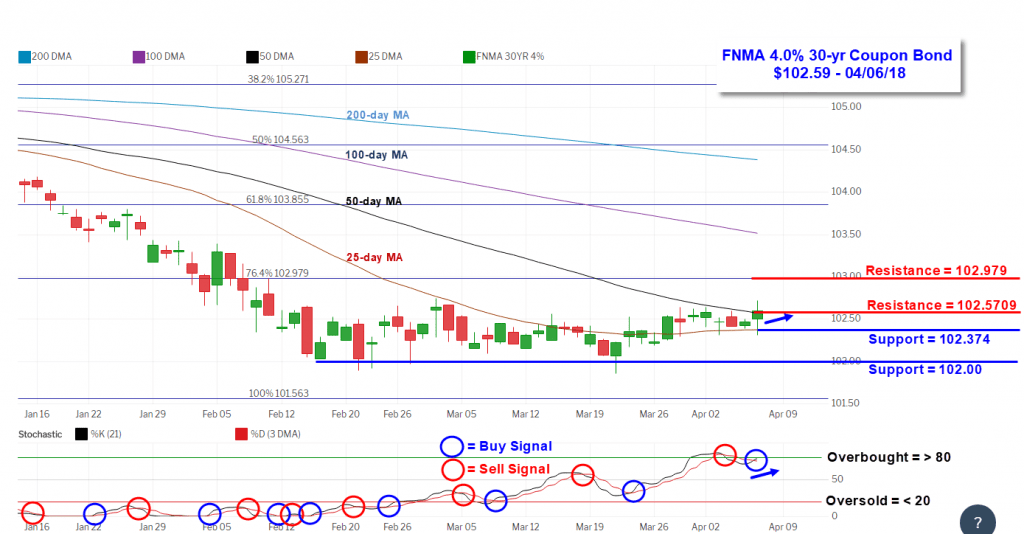

Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($102.59, -1.5 bp) traded within a narrower 40.6 basis point range between a weekly intraday low of $102.313 on Tuesday and Friday and a weekly intraday high of $102.719 on Friday before closing the week at $102.594 on Friday. Mortgage bonds traded in a sideways direction within a narrow range between the 25-day and 50-day moving averages. These two moving averages serve as nearest technical support and resistance levels respectively. The chart shows the bond is just below the “overbought” level while showing a new buy signal from a positive stochastic crossover. This suggests there is some room for price improvement with the prospects the bond will stay above its 50-day moving average. If the bond can manage to stay above the 50-day moving average, mortgage rates should remain stable at current levels or may improve very slightly.  \

\

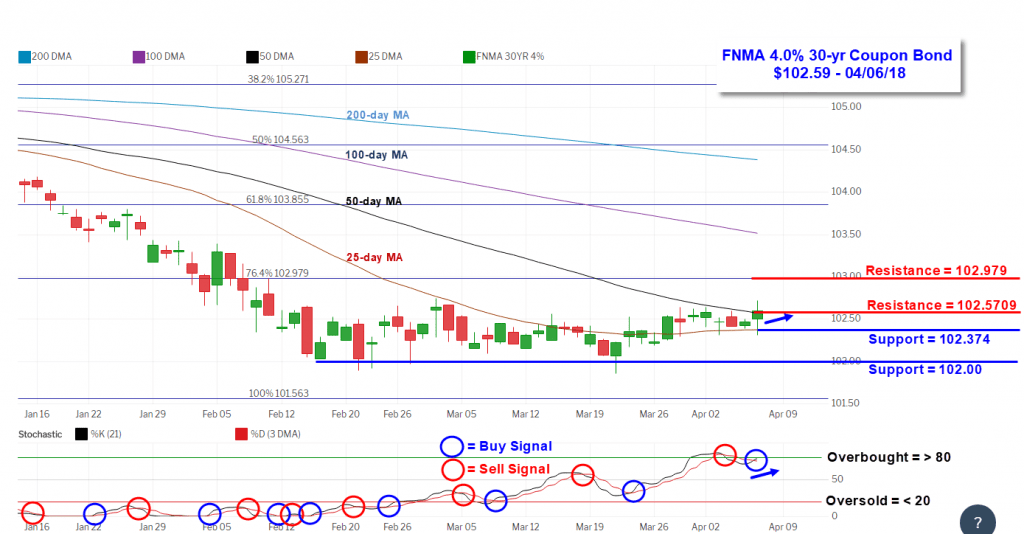

Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($102.59, -1.5 bp) traded within a narrower 40.6 basis point range between a weekly intraday low of $102.313 on Tuesday and Friday and a weekly intraday high of $102.719 on Friday before closing the week at $102.594 on Friday. Mortgage bonds traded in a sideways direction within a narrow range between the 25-day and 50-day moving averages. These two moving averages serve as nearest technical support and resistance levels respectively. The chart shows the bond is just below the “overbought” level while showing a new buy signal from a positive stochastic crossover. This suggests there is some room for price improvement with the prospects the bond will stay above its 50-day moving average. If the bond can manage to stay above the 50-day moving average, mortgage rates should remain stable at current levels or may improve very slightly.

Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($102.59, -1.5 bp) traded within a narrower 40.6 basis point range between a weekly intraday low of $102.313 on Tuesday and Friday and a weekly intraday high of $102.719 on Friday before closing the week at $102.594 on Friday. Mortgage bonds traded in a sideways direction within a narrow range between the 25-day and 50-day moving averages. These two moving averages serve as nearest technical support and resistance levels respectively. The chart shows the bond is just below the “overbought” level while showing a new buy signal from a positive stochastic crossover. This suggests there is some room for price improvement with the prospects the bond will stay above its 50-day moving average. If the bond can manage to stay above the 50-day moving average, mortgage rates should remain stable at current levels or may improve very slightly.  \

\