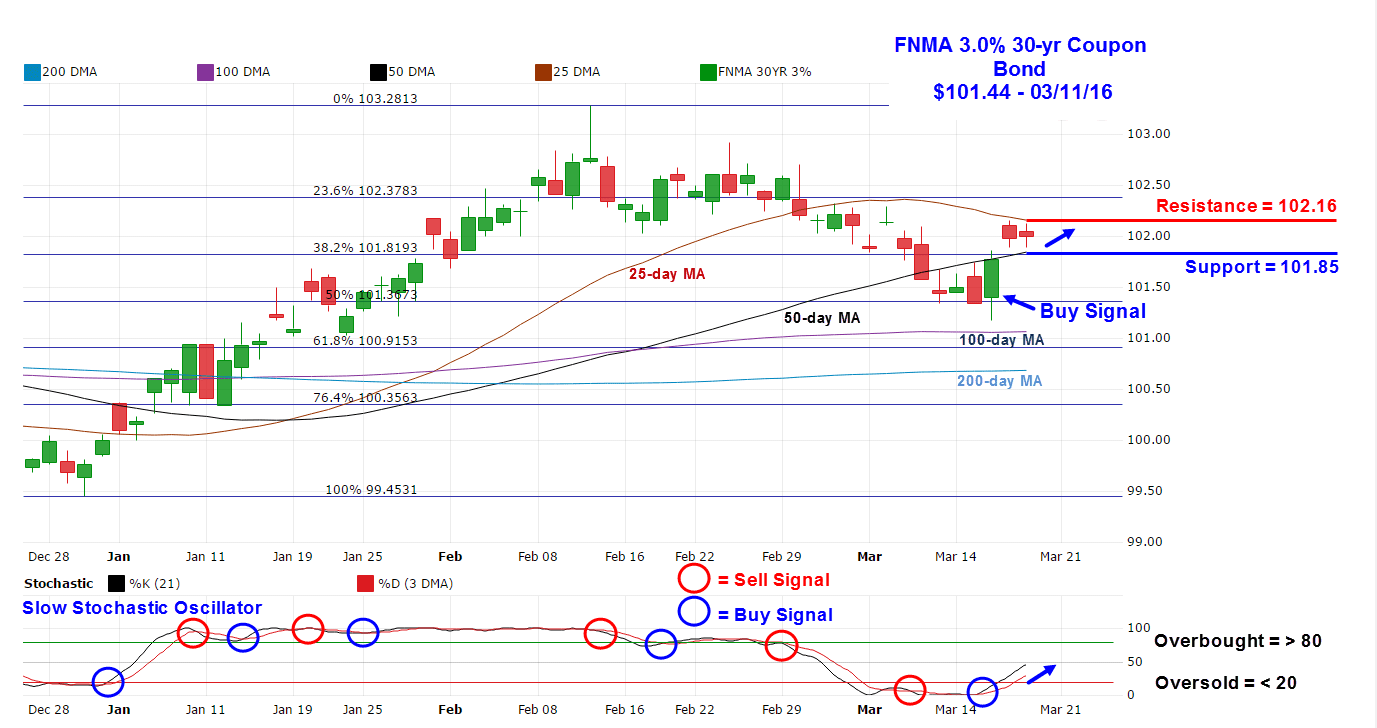

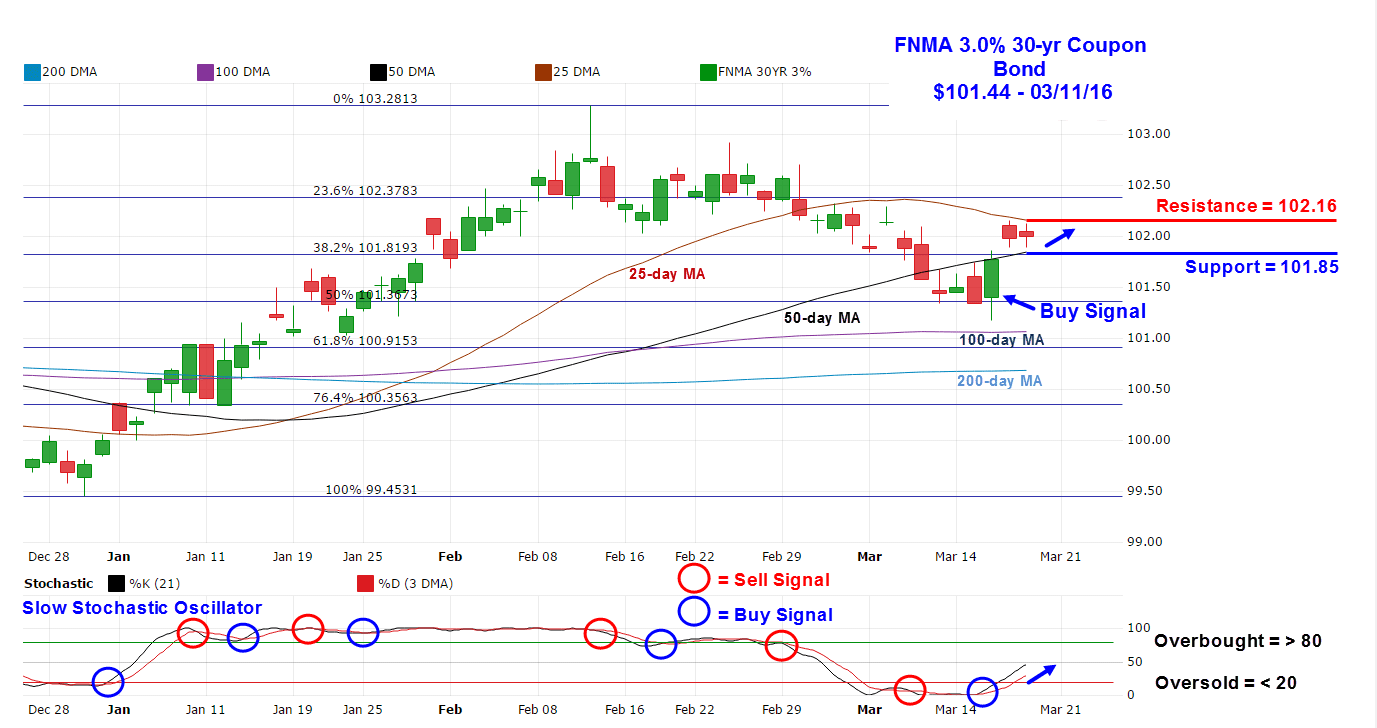

The stock market logged its fifth consecutive weekly advance while the bond market also scored noteworthy gains. Crude oil continued to rally helping to boost stocks when news surfaced of a meeting between 15 OPEC and non-OPEC producers planned for April 17 when serious plans to limit oil production are likely to be discussed. These 15 producers account for about 73% of global output. The advance in the stock market also resulted in the Dow Jones Industrial Average and the S&P 500 Index closing in positive territory for the first time this year. However, the primary catalyst for the constructive gains in both the stock and bonds markets was the Federal Reserve’s Federal Open Market Committee (FOMC) decision to not raise interest rates at the conclusion of its two-day monetary policy meeting on Wednesday. Moreover, the FOMC released a rather “dovish” policy statement reducing its forecast of the number of interest rate increases in 2016 from as many as four to only two hikes in 2016. The FOMC is also forecasting PCE inflation (their favorite inflation measurement) to decline to 1.2% from 1.6% and 2016 GDP growth to fall to 2.2% from 2.4%. Elsewhere, investment bank Morgan Stanley put out a note saying they believe bond markets will see a price surge this year as a result of disappointing economic growth in most major economies. They believe the 10-year Treasury yield could decline to 1.45% by the end of the third quarter this year. If Morgan Stanley is correct in their view, we will see mortgage rates improve later this year. In housing, the National Association of Homebuilders (NAHB) reported their Housing Market Index came in at 58 versus a consensus estimate of 59. The index of current sales was unchanged at 65 while the gauge of sales expectations in the next six months dropped three points to 61. NAHB chief economist David Crowe remarked “solid job growth, low mortgage rates and improving mortgage availability will help keep the housing market on a gradual upward trajectory in the coming months.” As for mortgages, the Mortgage Bankers Association released their latest Mortgage Application Data for the week ending March 11 showing the overall seasonally adjusted Market Composite Index decreased 3.3%. The seasonally adjusted Purchase Index decreased 0.3% from the prior reporting period while the Refinance Index decreased 6.0%. Overall, the refinance portion of mortgage activity decreased to 55% of total applications from 56.7%. The adjustable-rate mortgage segment of activity decreased to 4.9% of total applications from 5.2%. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balance increased from 3.89% to 3.94%. For the week, the FNMA 3.0% coupon bond gained 56.2 basis points to end at $102.00 while the 10-year Treasury yield fell 10.4 basis points to end at 1.8767%. Stocks ended the week with the Dow Jones Industrial Average increasing 388.99 points to end at 17,602.30. The NASDAQ Composite Index added 47.18 points to close at 4,795.65, and the S&P 500 Index gained 27.39 points to close at 2,049.58. Year to date, and exclusive of any dividends, the Dow Jones Industrial Average has gained 1.01%, the NASDAQ Composite Index has lost 4.42%, and the S&P 500 Index has gained 0.28%. This past week, the national average 30-year mortgage rate decreased to 3.75% from 3.83% while the 15-year mortgage rate fell to 3.02% from 3.09%. The 5/1 ARM mortgage rate decreased to 3.02% from 3.06%. FHA 30-year rates dropped to 3.30% from 3.35% and Jumbo 30-year rates decreased to 3.60% from 3.65%. Mortgage Rate Forecast with Chart For the week, the FNMA 30-year 3.0% coupon bond ($102.00, +56.2 bp) traded within a wider 99 basis point range between a weekly intraday low of $101.17 and a weekly intraday high of 102.16 before closing at $102.00 on Friday. The bond was whipsawed between a weak sell signal on Tuesday and a stronger buy signal on Wednesday that followed the FOMC’s interest rate decision and dovish policy statement. Wednesday’s new buy signal was generated from a positive stochastic crossover and occurred well below the “overbought” level. This suggests the bond could make a move higher to challenge resistance, especially if the stock market cools off. The Dow Jones Industrial Average and the S&P 500 Index have both crossed above their respective 200-day moving averages, a sign of technical strength. However, both indexes are extremely “overbought” and appear ready to take a pause or pull-back. If stocks consolidate some of their recent gains next week, bond prices should advance with mortgage rates improving slightly. Chart: FNMA 30-Year 3.0% Coupon Bond