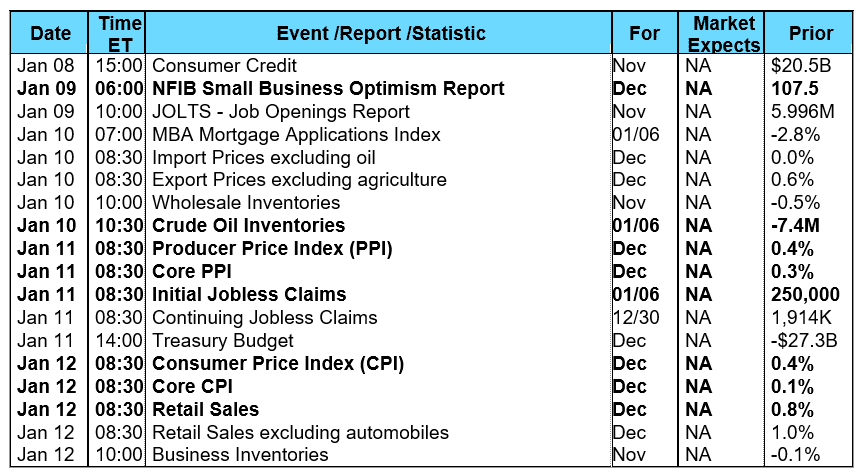

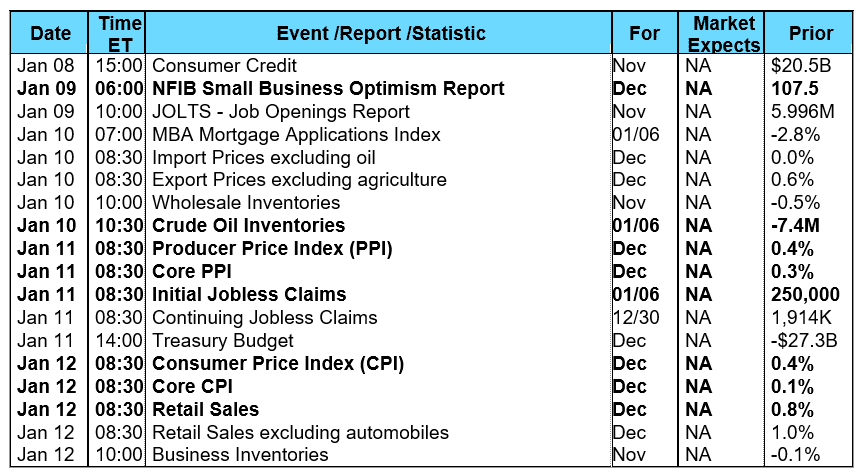

The stock market began the New Year with a bang, with all of the major stock indexes reaching new all-time highs. Although the Dow Jones Industrial Average is narrowly focused, containing just 30 large-cap stocks, it attracted considerable investor attention as it passed above the 25,000 mark on Thursday, less than a year after breaking above 20,000 for the first time. The euphoria generated in the stock market resulted in some selling pressure in the bond market on Thursday and Friday. However, this was not before bonds underwent a small rally on Wednesday following the release of minutes from the Federal Reserve’s December 12-13 policy meeting. The minutes revealed some dissenting views from the vote to raise rates with two members concerned the December rate hike could slow economic growth and further inhibit inflation growth. The minutes also showed the Fed remains committed to its objectives of maximum employment and a sustained return to two percent inflation. Nevertheless, the probability for the next 25 basis point rate hike at the Fed’s policy meeting scheduled for March 21 is currently 68.1%, up from 51.7% last week. The week’s most significant economic news was the December employment report. Nonfarm payroll growth for December was reported well below the consensus forecast of 188,000, coming in at 148,000 while the two prior months were downwardly revised by 9,000. The unemployment rate held steady at 4.1% while the labor participation rate remained at 62.7%. Hours worked were unchanged at 34.5. Average hourly earnings gained .3% month-over-month, after increasing a downwardly revised 0.1% (from 0.2%) in November. Over the last 12 months, average hourly earnings have gained 2.5% to match the 2.5% for the 12 months ending in November. For a two week period ending December 29, 2017, the Mortgage Bankers Association (MBA) reported their overall seasonally adjusted Market Composite Index (application volume) fell by 2.8%. The seasonally adjusted Purchase Index decreased 1.0% from two weeks prior while the Refinance Index declined 7.0%. Overall, the refinance portion of mortgage activity increased to 52.0% of total applications from 51.8% in the prior week. The adjustable-rate mortgage share of activity decreased to 5.3% from 5.6% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance was unchanged at 4.25% with points increasing to 0.36 from 0.35. For the week, the FNMA 3.5% coupon bond lost 23.5 basis points to close at $102.484. The 10-year Treasury yield increased 6.53 basis points to end at 2.4763%. The major stock indexes continued to trend higher during the week. The Dow Jones Industrial Average soared 576.65 points to close at 25,295.87. The NASDAQ Composite Index jumped 233.17 points to close at 7,136.56 and the S&P 500 Index gained 69.54 points to close at 2,743.15. Year to date on a total return basis, the Dow Jones Industrial Average has gained 2.33%, the NASDAQ Composite Index has advanced 3.38%, and the S&P 500 Index has added 2.60%. This past week, the national average 30-year mortgage rate rose from 4.04% to 4.06%; the 15-year mortgage rate increased to 3.41% from 3.37%; the 5/1 ARM mortgage rate increased to 3.21% from 3.20% and the FHA 30-year rate was unchanged at 3.75%. Jumbo 30-year rates increased to 4.21% from 4.19%. Economic Calendar - for the Week of January 8, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold. Mortgage Rate Forecast with Chart - FNMA 30-Year 3.5% Coupon Bond The FNMA 30-year 3.5% coupon bond ($102.484, -23.5 bp) traded within a 28.1 basis point range between a weekly intraday high of $102.734 on Wednesday and a weekly intraday low of $102.453 on Tuesday and Friday before closing the week at $102.484 on Friday. In another holiday-shortened week, bonds opened Tuesday below the 25-day and 50-day moving averages from a closing position above these levels on Friday, December 29. The bond then popped back above these moving averages on Wednesday before moving back below them on Thursday and Friday as stocks surged higher. The 25 and 50-day moving averages have not held up very well as support levels since the end of last September, and once again they serve as short-term resistance levels. The bond is currently neither “overbought” nor “oversold” and remains trading from a sell signal generated last Thursday, so we could easily see a continuation lower for a test of support at 102.42. A decline through the 102.42 level could result in a further decline toward the next support level at 102.17. Should this scenario take place it would result in a slight rise in mortgage rates.

Economic reports having the greatest potential impact on the financial markets are highlighted in bold. Mortgage Rate Forecast with Chart - FNMA 30-Year 3.5% Coupon Bond The FNMA 30-year 3.5% coupon bond ($102.484, -23.5 bp) traded within a 28.1 basis point range between a weekly intraday high of $102.734 on Wednesday and a weekly intraday low of $102.453 on Tuesday and Friday before closing the week at $102.484 on Friday. In another holiday-shortened week, bonds opened Tuesday below the 25-day and 50-day moving averages from a closing position above these levels on Friday, December 29. The bond then popped back above these moving averages on Wednesday before moving back below them on Thursday and Friday as stocks surged higher. The 25 and 50-day moving averages have not held up very well as support levels since the end of last September, and once again they serve as short-term resistance levels. The bond is currently neither “overbought” nor “oversold” and remains trading from a sell signal generated last Thursday, so we could easily see a continuation lower for a test of support at 102.42. A decline through the 102.42 level could result in a further decline toward the next support level at 102.17. Should this scenario take place it would result in a slight rise in mortgage rates.

Economic reports having the greatest potential impact on the financial markets are highlighted in bold. Mortgage Rate Forecast with Chart - FNMA 30-Year 3.5% Coupon Bond The FNMA 30-year 3.5% coupon bond ($102.484, -23.5 bp) traded within a 28.1 basis point range between a weekly intraday high of $102.734 on Wednesday and a weekly intraday low of $102.453 on Tuesday and Friday before closing the week at $102.484 on Friday. In another holiday-shortened week, bonds opened Tuesday below the 25-day and 50-day moving averages from a closing position above these levels on Friday, December 29. The bond then popped back above these moving averages on Wednesday before moving back below them on Thursday and Friday as stocks surged higher. The 25 and 50-day moving averages have not held up very well as support levels since the end of last September, and once again they serve as short-term resistance levels. The bond is currently neither “overbought” nor “oversold” and remains trading from a sell signal generated last Thursday, so we could easily see a continuation lower for a test of support at 102.42. A decline through the 102.42 level could result in a further decline toward the next support level at 102.17. Should this scenario take place it would result in a slight rise in mortgage rates.

Economic reports having the greatest potential impact on the financial markets are highlighted in bold. Mortgage Rate Forecast with Chart - FNMA 30-Year 3.5% Coupon Bond The FNMA 30-year 3.5% coupon bond ($102.484, -23.5 bp) traded within a 28.1 basis point range between a weekly intraday high of $102.734 on Wednesday and a weekly intraday low of $102.453 on Tuesday and Friday before closing the week at $102.484 on Friday. In another holiday-shortened week, bonds opened Tuesday below the 25-day and 50-day moving averages from a closing position above these levels on Friday, December 29. The bond then popped back above these moving averages on Wednesday before moving back below them on Thursday and Friday as stocks surged higher. The 25 and 50-day moving averages have not held up very well as support levels since the end of last September, and once again they serve as short-term resistance levels. The bond is currently neither “overbought” nor “oversold” and remains trading from a sell signal generated last Thursday, so we could easily see a continuation lower for a test of support at 102.42. A decline through the 102.42 level could result in a further decline toward the next support level at 102.17. Should this scenario take place it would result in a slight rise in mortgage rates.