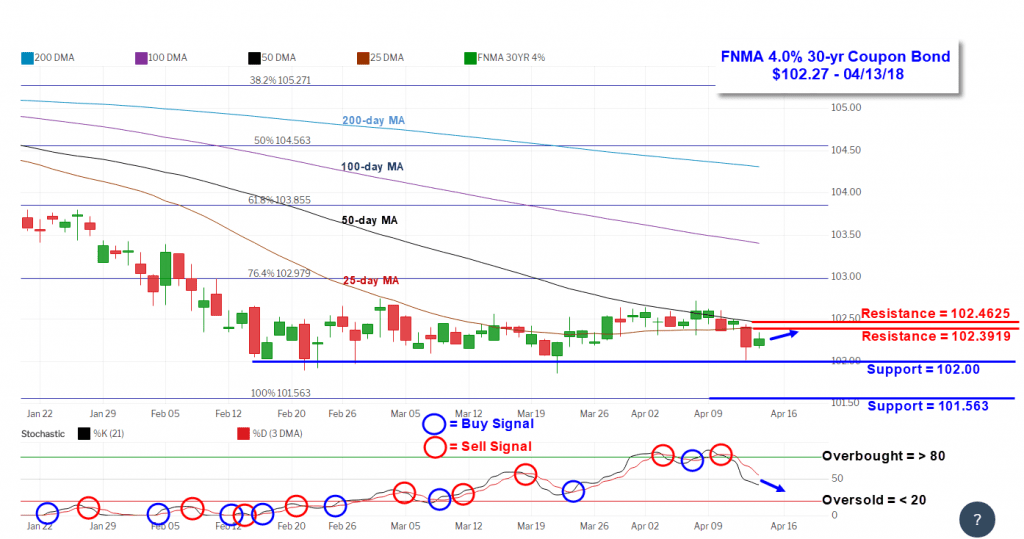

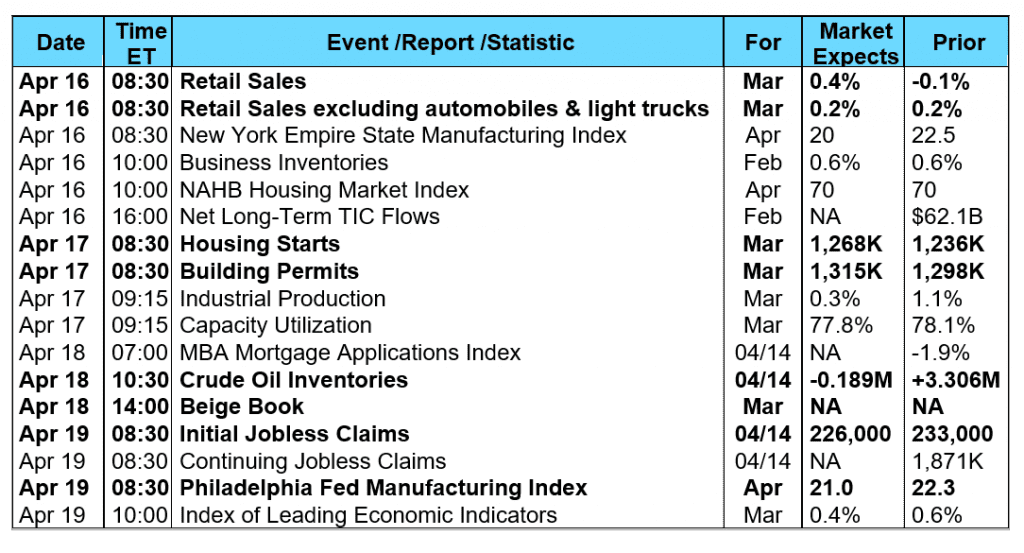

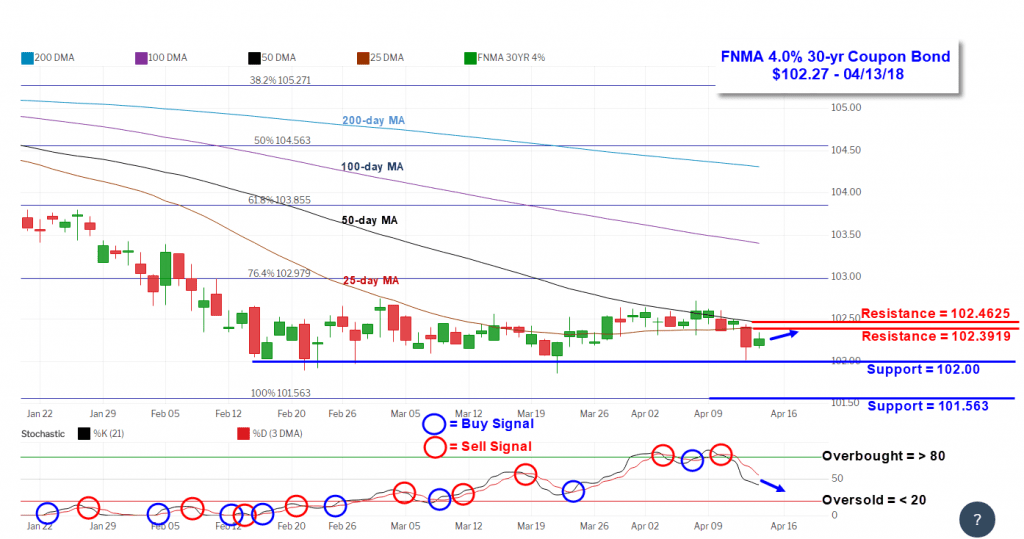

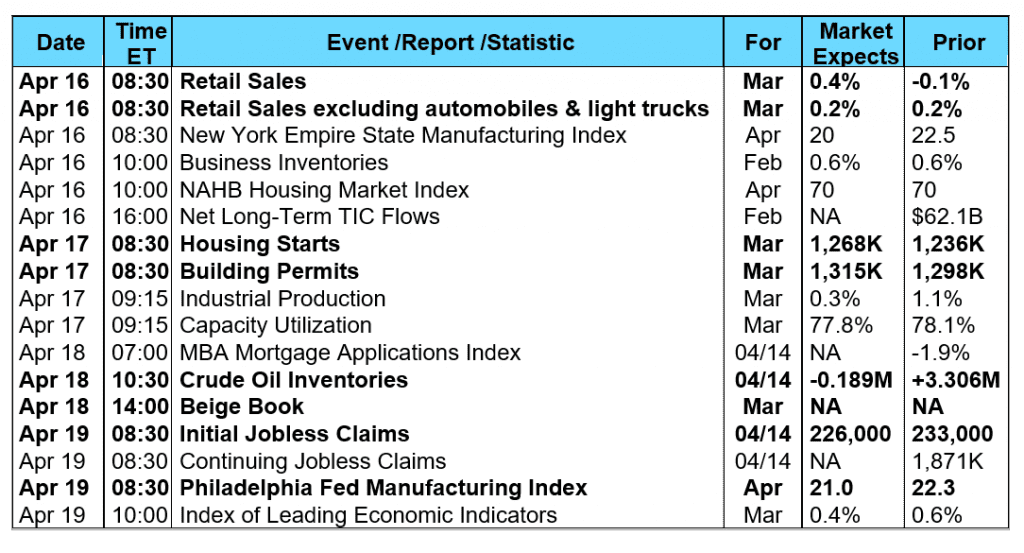

The stock market bounced back this past week as concerns about a possible trade war with China faded after several U.S. officials, including Treasury Secretary Steven Mnuchin, and Chinese President Xi Jinping downplayed talk of a retaliatory trade war. In fact, Xi Jinping stated in a speech at the Boao Forum on Tuesday that he “plans to significantly cut tariffs on imported automobiles, reduce duties on other imported goods, and improve the intellectual property rights of foreign firms.” Fears of a trade war with China were then replaced with rising geopolitical tension between the U.S. and Russia. A suspected chemical attack from the Russian-supported Syrian government on the rebel-held town of Douma, Syria on April 7 th brought strong condemnation and threats of a retaliatory strike against Syria from the U.S., Great Britain, and France. Russia replied last Wednesday that it would shoot down any missiles fired at Syria prompting President Trump to state "get ready Russia, because they will be coming." And come they did late Friday evening when a military coalition from the U.S., Great Britain, and France struck several chemical weapons sites in Syria. As a result, we will likely see a sharp increase in volatility this week in the financial markets with the rising tensions between Russia and coalition forces and the uncertainty that comes from military action in Syria. The week’s economic reports took a backseat to geopolitical news, receiving a muted response from investors. Minutes from the Fed’s March FOMC meeting were released containing no surprises. The latest round of inflation data from the March Producer Price Index (PPI) and Consumer Price Index (CPI) reports revealed a stiffening inflation trend with the PPI rising +0.3% while the core CPI advanced 0.2% for the month. This will keep the Fed on plan to raise rates at least two more times this year with the next 25 basis point hike likely to occur at the June FOMC meeting with a probability of 95.0%. According to the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey, there was a decline in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) decreased by 1.9% during the week ended April 6, 2018. The seasonally adjusted Purchase Index decreased by 2.0% from the week prior while the Refinance Index also decreased by 2.0%. Overall, the refinance portion of mortgage activity fell to 38.4% from 38.5% of total applications from the prior week, its lowest level since September 2008. The adjustable-rate mortgage share of activity fell to 6.3% from 6.5% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance fell to 4.66% from 4.69% with points increasing to 0.46 from 0.43. For the week, the FNMA 4.0% coupon bond fell 32.8 basis points to close at $102.266 while the 10-year Treasury yield increased 4.95 basis points to end at 2.8248%. The major stock indexes moved higher during the week. The Dow Jones Industrial Average gained 427.38 points to close at 24,360.14. The NASDAQ Composite Index advanced 191.54 points to close at 7,106.65. The S&P 500 Index added 51.83 points to close at 2,656.30. Year to date on a total return basis, the Dow Jones Industrial Average has fallen 3.18%, the NASDAQ Composite Index has gained 0.17%, and the S&P 500 Index has lost 2.59%. This past week, the national average 30-year mortgage rate increased to 4.50% from 4.48%; the 15-year mortgage rate rose to 3.89% from 3.86%; the 5/1 ARM mortgage rate increased to 3.68% from 3.65% while the FHA 30-year rate was unchanged at 4.25%. Jumbo 30-year rates rose to 4.51% from 4.50%. Economic Calendar - for the Week of April 16, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold  . Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($102.27, -32.8 bp) traded within a wider 60.9 basis point range between a weekly intraday high of $102.625 on Monday and a weekly intraday low of $102.016 on Thursday before closing the week at $102.266 on Friday. Mortgage bonds lost ground during the week as the stock market advanced and failed to remain above a declining 50-day moving average while also falling below the 25-day moving average. These two moving averages now form a tight band of overhead resistance. However, Friday’s trading resulted in a potentially bullish two-day Harami candlestick pattern signaling a possible change in market direction higher that will require confirmation on Monday with a positive candlestick with a higher closing price. With a coalition of U.S., Great Britain, and French military forces striking chemical weapons installations in Syria late Friday evening to significantly increase geopolitical tensions with Syrian ally Russia, we will likely see increased volatility in the stock and crude oil markets with investors moving money from stocks into bonds in a “flight to safety” trade. If this anticipated reaction is strong enough, it would be bullish for mortgage bonds and would perhaps send prices above both resistance levels resulting in a slight improvement in mortgage rates this coming week.

. Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($102.27, -32.8 bp) traded within a wider 60.9 basis point range between a weekly intraday high of $102.625 on Monday and a weekly intraday low of $102.016 on Thursday before closing the week at $102.266 on Friday. Mortgage bonds lost ground during the week as the stock market advanced and failed to remain above a declining 50-day moving average while also falling below the 25-day moving average. These two moving averages now form a tight band of overhead resistance. However, Friday’s trading resulted in a potentially bullish two-day Harami candlestick pattern signaling a possible change in market direction higher that will require confirmation on Monday with a positive candlestick with a higher closing price. With a coalition of U.S., Great Britain, and French military forces striking chemical weapons installations in Syria late Friday evening to significantly increase geopolitical tensions with Syrian ally Russia, we will likely see increased volatility in the stock and crude oil markets with investors moving money from stocks into bonds in a “flight to safety” trade. If this anticipated reaction is strong enough, it would be bullish for mortgage bonds and would perhaps send prices above both resistance levels resulting in a slight improvement in mortgage rates this coming week.

. Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($102.27, -32.8 bp) traded within a wider 60.9 basis point range between a weekly intraday high of $102.625 on Monday and a weekly intraday low of $102.016 on Thursday before closing the week at $102.266 on Friday. Mortgage bonds lost ground during the week as the stock market advanced and failed to remain above a declining 50-day moving average while also falling below the 25-day moving average. These two moving averages now form a tight band of overhead resistance. However, Friday’s trading resulted in a potentially bullish two-day Harami candlestick pattern signaling a possible change in market direction higher that will require confirmation on Monday with a positive candlestick with a higher closing price. With a coalition of U.S., Great Britain, and French military forces striking chemical weapons installations in Syria late Friday evening to significantly increase geopolitical tensions with Syrian ally Russia, we will likely see increased volatility in the stock and crude oil markets with investors moving money from stocks into bonds in a “flight to safety” trade. If this anticipated reaction is strong enough, it would be bullish for mortgage bonds and would perhaps send prices above both resistance levels resulting in a slight improvement in mortgage rates this coming week.

. Mortgage Rate Forecast with Chart - FNMA 30-Year 4.0% Coupon Bond The FNMA 30-year 4.0% coupon bond ($102.27, -32.8 bp) traded within a wider 60.9 basis point range between a weekly intraday high of $102.625 on Monday and a weekly intraday low of $102.016 on Thursday before closing the week at $102.266 on Friday. Mortgage bonds lost ground during the week as the stock market advanced and failed to remain above a declining 50-day moving average while also falling below the 25-day moving average. These two moving averages now form a tight band of overhead resistance. However, Friday’s trading resulted in a potentially bullish two-day Harami candlestick pattern signaling a possible change in market direction higher that will require confirmation on Monday with a positive candlestick with a higher closing price. With a coalition of U.S., Great Britain, and French military forces striking chemical weapons installations in Syria late Friday evening to significantly increase geopolitical tensions with Syrian ally Russia, we will likely see increased volatility in the stock and crude oil markets with investors moving money from stocks into bonds in a “flight to safety” trade. If this anticipated reaction is strong enough, it would be bullish for mortgage bonds and would perhaps send prices above both resistance levels resulting in a slight improvement in mortgage rates this coming week.