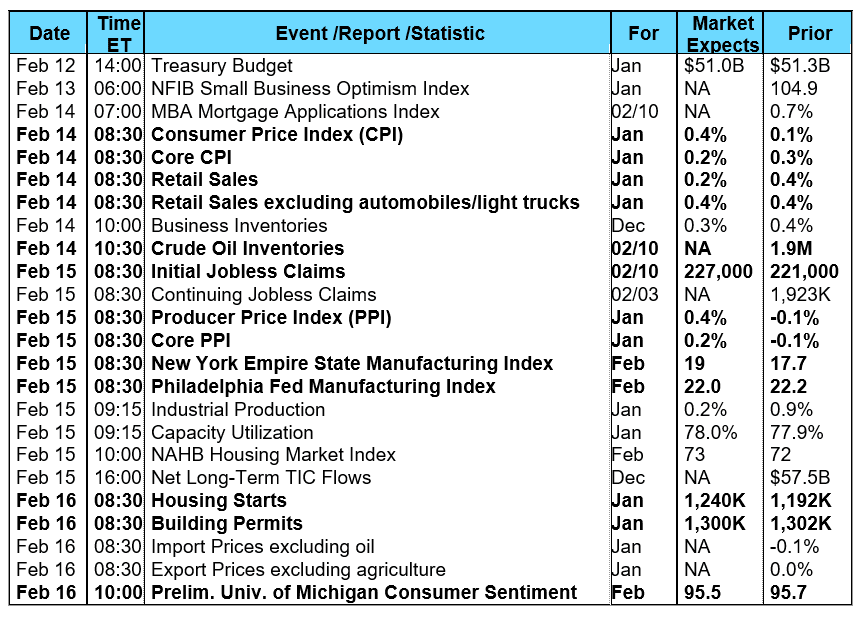

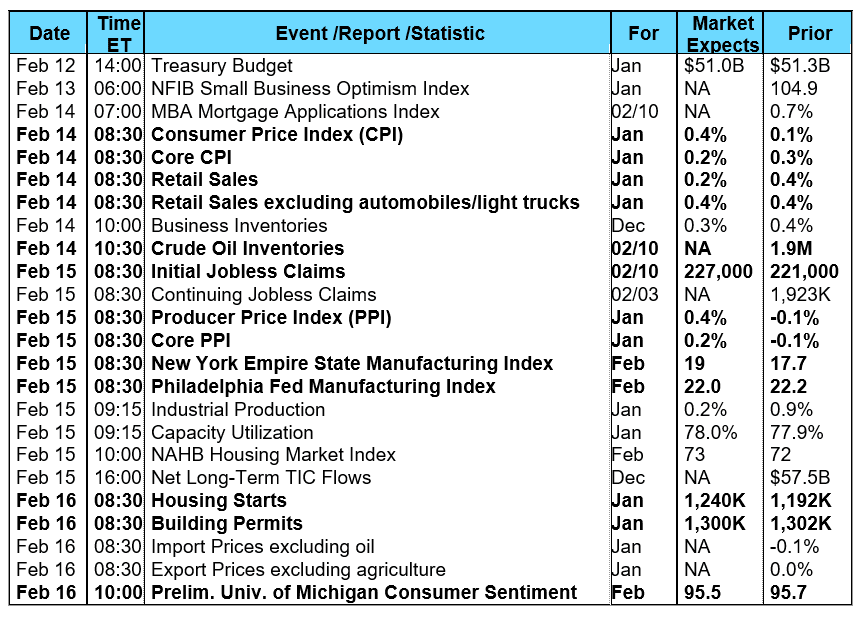

The major stock market indexes experienced a rapid decline with each losing about 5% in volatile trading. Surprisingly, the bond market also lost ground as investors failed to seek the “safe haven” bonds usually provide when the stock market sells off in such dramatic fashion. This past week’s selloff was again associated with fears about rising interest rates. Congress didn’t help matters much by passing a two-year budget deal that will increase spending by approximately $390 billion over the next two years while extending the debt ceiling until 2019. The growth in spending will force the government to borrow over $1 trillion in the coming fiscal year and the likelihood of increased Treasury borrowing also fueled fears of higher bond yields and interest rates. Investors were already expecting a rise in Treasury debt issuance due to the recent changes in the U.S. tax code and the lack of fiscal discipline shown by Congress intensifies concerns about rising yields and interest rates. The Fed Funds Futures market still expects the next rate hike will occur at the March FOMC meeting as Fed officials downplayed this week's sell off by continuing to underline a course of gradual rate increases. The probability of a March rate hike currently stands at 71.9%, down slightly from last week's 76.1%. In housing, the number of mortgage applications showed an increase according to the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) increased by 0.7% during the week ended February 2, 2018. The seasonally adjusted Purchase Index remained unchanged from the week prior while the Refinance Index increased 1.0%. Overall, the refinance portion of mortgage activity decreased to 46.4% of total applications from 47.8% in the prior week. The adjustable-rate mortgage share of activity increased to 6.1% of total applications from 5.7%. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.50% from 4.41%, with points increasing to 0.57 from 0.56. For the week, the FNMA 3.5% coupon bond lost 29.6 basis points to close at $99.938 while the 10-year Treasury yield increased 1.55 basis points to end at 2.8566%. The major stock indexes continued to crater during the week. The Dow Jones Industrial Average fell 1330.06 points to close at 24,190.90. The NASDAQ Composite Index dropped 366.46 points to close at 6,874.49 and the S&P 500 Index lost 142.58 points to close at 2,619.55. Year to date on a total return basis, the Dow Jones Industrial Average has retreated 2.14%, the NASDAQ Composite Index declined 0.42%, and the S&P 500 Index has dropped 2.02%. This past week, the national average 30-year mortgage rate rose to 4.50% from 4.45%; the 15-year mortgage rate increased to 3.86% from 3.79%; the 5/1 ARM mortgage rate increased to 3.45% from 3.42% and the FHA 30-year rate climbed to 4.30% from 4.25%. Jumbo 30-year rates increased to 4.55% from 4.50%. Economic Calendar - for the Week of February 12, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold. Mortgage Rate Forecast with Chart - FNMA 30-Year 3.5% Coupon Bond The FNMA 30-year 3.5% coupon bond ($99.94, -29.6 bp) traded within a 117.20 basis point range between a weekly intraday high of $100.969 on Monday and a weekly intraday low of $99.797 on Thursday before closing the week at $99.938 on Friday. The bond made a nice reversal by opening and trading higher last Monday before running into what proved to be stiff resistance at the 61.8% Fibonacci retracement level at 100.929. The bond subsequently pulled back and traded lower for the rest of the week even though the stock market was undergoing a sharp correction, the magnitude of which has not been seen for a couple of years. The bond remains oversold while seeking a bottom and if support levels can hold we should see rates remain relatively stable this coming week. On Friday, the S&P 500 index moved down to test its 200-day moving average, which appeared to be a technical “line in the sand” that triggered automated buying programs to kick in resulting in sharp rebound off of session lows. It will be interesting to see if Friday’s rebound off of the key 200-day moving average will have staying power and signal a turn higher in the stock market. A number of momentum indicators flashed buy signals from oversold positions as a result of Friday’s trading action so we could see stocks attempt a rally off of Friday’s bounce. The economic calendar picks up some strength this coming week and investors will be closely watching a couple of inflation reports – the consumer price and producer price indexes. The markets have recently become fearful of the prospects of inflation so these two reports could trigger strong market reactions in both stocks and bonds.

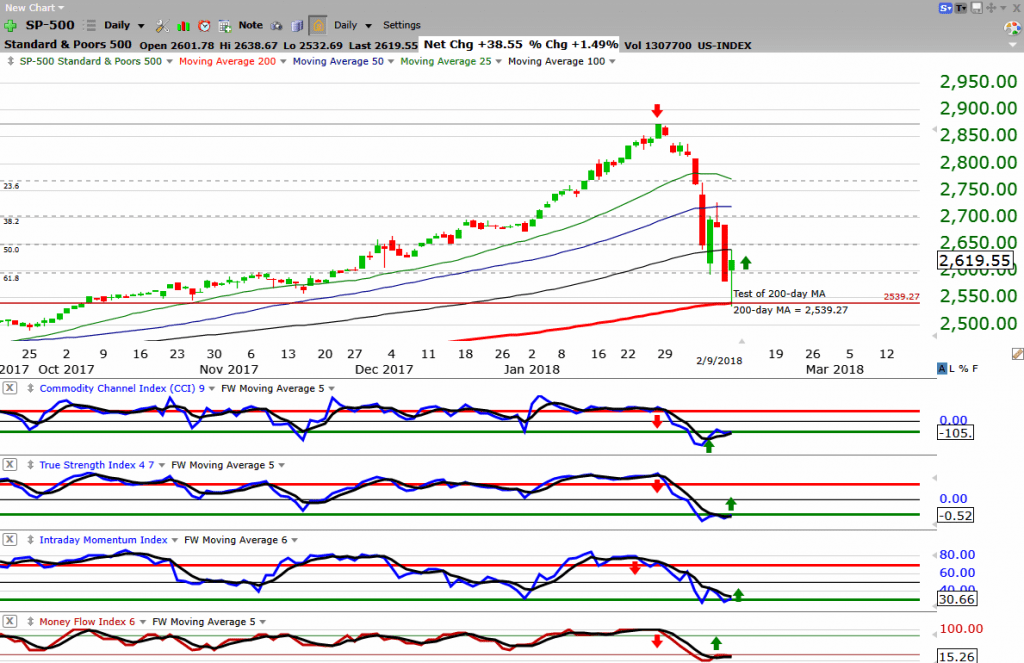

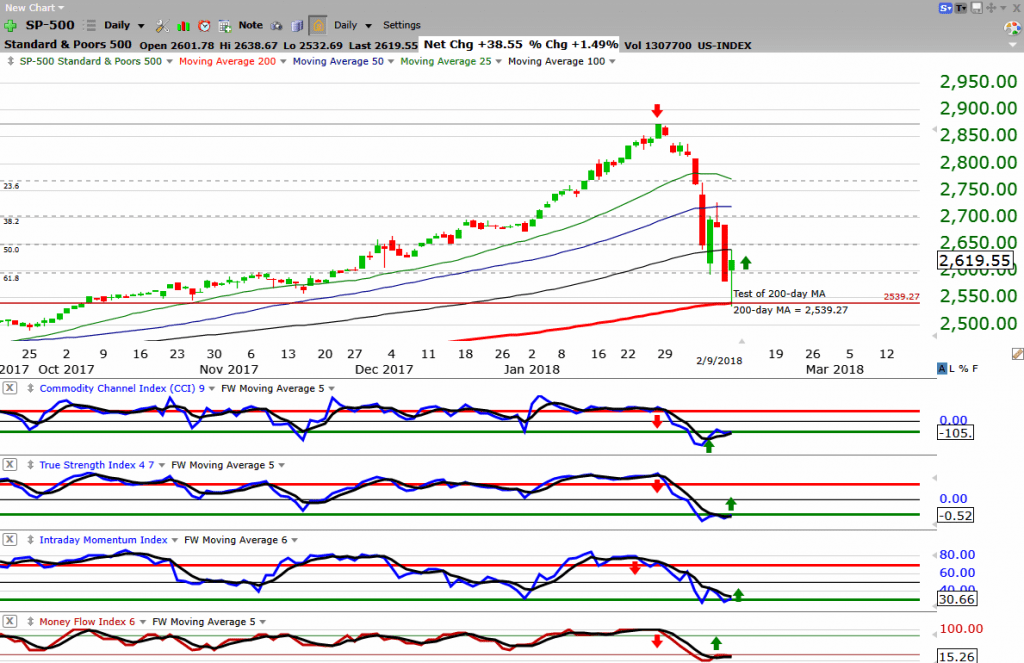

Economic reports having the greatest potential impact on the financial markets are highlighted in bold. Mortgage Rate Forecast with Chart - FNMA 30-Year 3.5% Coupon Bond The FNMA 30-year 3.5% coupon bond ($99.94, -29.6 bp) traded within a 117.20 basis point range between a weekly intraday high of $100.969 on Monday and a weekly intraday low of $99.797 on Thursday before closing the week at $99.938 on Friday. The bond made a nice reversal by opening and trading higher last Monday before running into what proved to be stiff resistance at the 61.8% Fibonacci retracement level at 100.929. The bond subsequently pulled back and traded lower for the rest of the week even though the stock market was undergoing a sharp correction, the magnitude of which has not been seen for a couple of years. The bond remains oversold while seeking a bottom and if support levels can hold we should see rates remain relatively stable this coming week. On Friday, the S&P 500 index moved down to test its 200-day moving average, which appeared to be a technical “line in the sand” that triggered automated buying programs to kick in resulting in sharp rebound off of session lows. It will be interesting to see if Friday’s rebound off of the key 200-day moving average will have staying power and signal a turn higher in the stock market. A number of momentum indicators flashed buy signals from oversold positions as a result of Friday’s trading action so we could see stocks attempt a rally off of Friday’s bounce. The economic calendar picks up some strength this coming week and investors will be closely watching a couple of inflation reports – the consumer price and producer price indexes. The markets have recently become fearful of the prospects of inflation so these two reports could trigger strong market reactions in both stocks and bonds.

Economic reports having the greatest potential impact on the financial markets are highlighted in bold. Mortgage Rate Forecast with Chart - FNMA 30-Year 3.5% Coupon Bond The FNMA 30-year 3.5% coupon bond ($99.94, -29.6 bp) traded within a 117.20 basis point range between a weekly intraday high of $100.969 on Monday and a weekly intraday low of $99.797 on Thursday before closing the week at $99.938 on Friday. The bond made a nice reversal by opening and trading higher last Monday before running into what proved to be stiff resistance at the 61.8% Fibonacci retracement level at 100.929. The bond subsequently pulled back and traded lower for the rest of the week even though the stock market was undergoing a sharp correction, the magnitude of which has not been seen for a couple of years. The bond remains oversold while seeking a bottom and if support levels can hold we should see rates remain relatively stable this coming week. On Friday, the S&P 500 index moved down to test its 200-day moving average, which appeared to be a technical “line in the sand” that triggered automated buying programs to kick in resulting in sharp rebound off of session lows. It will be interesting to see if Friday’s rebound off of the key 200-day moving average will have staying power and signal a turn higher in the stock market. A number of momentum indicators flashed buy signals from oversold positions as a result of Friday’s trading action so we could see stocks attempt a rally off of Friday’s bounce. The economic calendar picks up some strength this coming week and investors will be closely watching a couple of inflation reports – the consumer price and producer price indexes. The markets have recently become fearful of the prospects of inflation so these two reports could trigger strong market reactions in both stocks and bonds.

Economic reports having the greatest potential impact on the financial markets are highlighted in bold. Mortgage Rate Forecast with Chart - FNMA 30-Year 3.5% Coupon Bond The FNMA 30-year 3.5% coupon bond ($99.94, -29.6 bp) traded within a 117.20 basis point range between a weekly intraday high of $100.969 on Monday and a weekly intraday low of $99.797 on Thursday before closing the week at $99.938 on Friday. The bond made a nice reversal by opening and trading higher last Monday before running into what proved to be stiff resistance at the 61.8% Fibonacci retracement level at 100.929. The bond subsequently pulled back and traded lower for the rest of the week even though the stock market was undergoing a sharp correction, the magnitude of which has not been seen for a couple of years. The bond remains oversold while seeking a bottom and if support levels can hold we should see rates remain relatively stable this coming week. On Friday, the S&P 500 index moved down to test its 200-day moving average, which appeared to be a technical “line in the sand” that triggered automated buying programs to kick in resulting in sharp rebound off of session lows. It will be interesting to see if Friday’s rebound off of the key 200-day moving average will have staying power and signal a turn higher in the stock market. A number of momentum indicators flashed buy signals from oversold positions as a result of Friday’s trading action so we could see stocks attempt a rally off of Friday’s bounce. The economic calendar picks up some strength this coming week and investors will be closely watching a couple of inflation reports – the consumer price and producer price indexes. The markets have recently become fearful of the prospects of inflation so these two reports could trigger strong market reactions in both stocks and bonds.