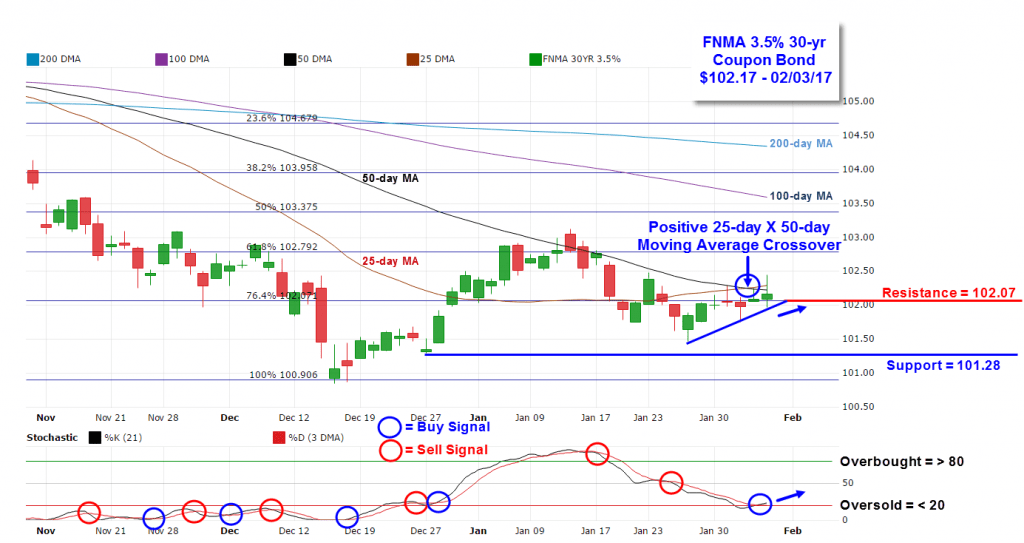

Weekly Review The major stock market indexes finished the week “mixed” with little overall change as did bond prices. The rather flat, lackluster performance in the financial markets may have been reflective of trader’s attention on the current political environment in Washington rather than on economic news and fourth-quarter corporate earnings reports. For example, there were a number of earnings reports during the week easily exceeding analyst expectations that were unable to trigger significant stock gains. A notable exception took place on Wednesday when Apple’s earnings surprise sparked a 6% rally in the shares. The economic calendar was robust but generated little market reaction as stock indexes remained close to record levels. The Federal Reserve’s Federal Open Market Committee (FOMC) maintained its current monetary policy on Wednesday while providing no solid clues when the next rate hike could be announced. However, FOMC voting member Chicago Fed President Charles Evans stated a “slow pace of hikes is needed to help the U.S. economy weather downside shocks” while San Francisco Fed President Williams (non-FOMC voter) came out on Friday saying three rate hikes is a "reasonable guess" for the Fed in 2017 and a “March rate hike is on the table.” Based on the latest CME Group 30-Day Fed Fund futures prices, the current probability for a March 15 rate hike of 25 basis points is only 13.3%. The probability for a May 3 rate hike is 35.5% and the probability for a June 14 rate hike is currently 68.2%. The most significant economic report for the week was Friday’s Employment Situation Summary for January showing greater than forecast job growth of 227,000 versus a consensus of 170,000. However, the potentially inflationary Average Hourly Earnings only increased 0.1% compared to a consensus forecast of 0.3% while December’s reading was downwardly revised to 0.2% from an initially reported 0.4%. This combination of substantial job growth and tepid wage growth should temper Fed officials from rushing toward their next rate hike. In housing, the National Association of Realtors (NAR) reported Pending Home Sales in December increased 1.6% from November versus a consensus estimate of 1.3%. The NAR stated "enough buyers fended off rising mortgage rates and alarmingly low inventory levels to sign a contract. The main storyline in the early months of 2017 will be if supply can meaningfully increase to keep price growth at a moderate enough level for households to absorb higher borrowing costs. Sales will struggle to build on last year's strong pace if inventory conditions don't improve." As for mortgages, mortgage application data for the week ending January 27 was released by the Mortgage Bankers Association (MBA) showing their overall seasonally adjusted Market Composite Index (application volume) fell by 3.2%. The seasonally adjusted Purchase Index fell 6.0% from the prior week, while the Refinance Index declined 1.0%. Overall, the refinance portion of mortgage activity decreased to 49.4% of total applications from 50.0% from the prior week. The adjustable-rate mortgage share of activity accounted for 6.4% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased from 4.35% to 4.39% with points increasing to 0.34 from 0.30. For the week, the FNMA 3.5% coupon bond advanced 14.1 basis points to close at $102.17 while the 10-year Treasury yield decreased 1.96 basis points to end at 2.4666%. Stocks ended the week “mixed” with the Dow Jones Industrial Average dropping 22.32 points to end at 20,071.46. The NASDAQ Composite Index rose 5.99 points to close at 5,666.77, and the S&P 500 Index advanced 2.73 points to close at 2,297.42. Year to date, and exclusive of any dividends, the Dow Jones Industrial Average has gained 1.54%, the NASDAQ Composite Index has advanced 5.01%, and the S&P 500 Index has gained 2.55%. This past week, the national average 30-year mortgage rate was unchanged at 4.24%; the 15-year mortgage rate was unchanged at 3.44%; the 5/1 ARM mortgage rate remained unchanged at 3.05%; and the FHA 30-year rate remained unchanged at 3.80%. Jumbo 30-year rates increased to 4.36% from 4.35%. Mortgage Rate Forecast with Chart - FNMA 30-Year 3.5% Coupon Bond The FNMA 30-year 3.5% coupon bond ($102.17, +14.1 bp) traded within a 70 basis point range between a weekly intraday high of $102.45 on Friday and a weekly intraday low of $101.75 on Wednesday before closing the week at $102.17. The chart shows the bond traded around the 76.4% Fibonacci retracement level ($102.071) during the past week and is poised to make a bounce higher off of this level on a technical basis. There was a bullish moving average crossover buy signal as the 25-day moving average crossed above the 50-day moving average. There was also a positive stochastic crossover buy signal from an oversold condition in the slow stochastic oscillator suggesting higher prices. Should this scenario play out this coming week, we should see a rise in bond prices (lower yields) leading to slightly lower mortgage rates.

| Date | TimeET | Event /Report /Statistic | For | Market Expects | Prior |

| Feb 07 | 08:30 | Balance of Trade | Dec | -$45.0B | -$45.2B |

| Feb 07 | 10:00 | JOLTS Job Openings Report | NA | 5.522M | |

| Feb 07 | 15:00 | Consumer Credit | Dec | $19.4B | $24.5B |

| Feb 08 | 07:00 | MBA Mortgage Applications Index | 02/04 | NA | -3.2% |

| Feb 08 | 10:30 | Crude Oil Inventories | 02/04 | NA | +6.500M |

| Feb 09 | 08:30 | Initial Jobless Claims | 02/04 | 250K | 246K |

| Feb 09 | 08:30 | Continuing Jobless Claims | 02/04 | NA | 2064K |

| Feb 09 | 10:00 | Wholesale Inventories | Dec | 1.0% | 1.0% |

| Feb 10 | 08:30 | Export Prices excluding agriculture | Jan | NA | 0.4% |

| Feb 10 | 08:30 | Import Prices excluding oil | Jan | NA | -0.2% |

| Feb 10 | 10:00 | Prelim. Univ. of Michigan Consumer Sentiment Index | Feb | 97.9 | 98.5 |

| Feb 10 | 14:00 | Treasury Budget | Jan | NA | $55.2B |