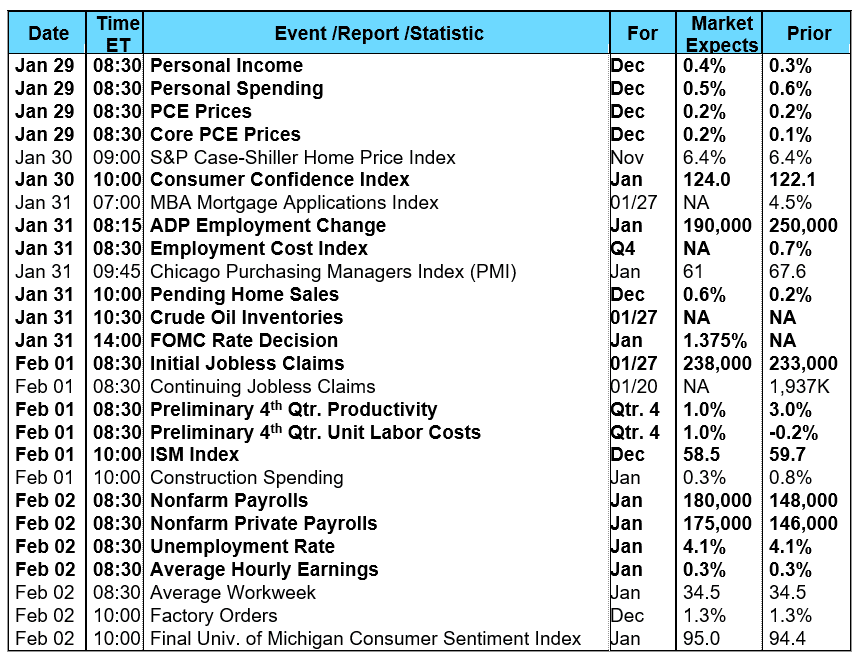

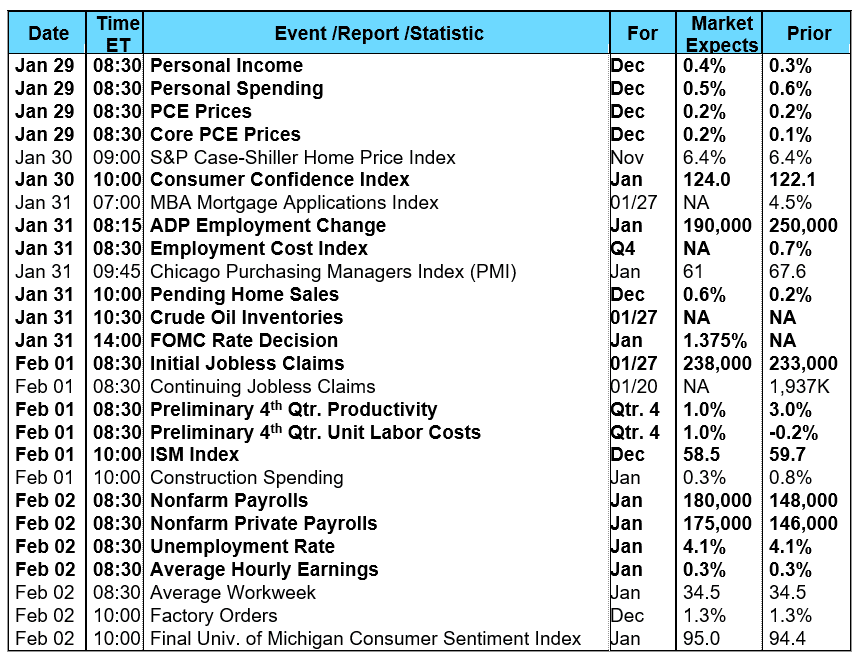

The three major stock market indexes finished higher for the fourth consecutive week and ended Friday with a set of new all-time highs while bond prices finished the week very close to where they ended the prior week. However, the stock and bond markets were briefly rattled mid-week when Treasury Secretary Steven Mnuchin spoke at a press conference at the World Economic Forum in Davos on Wednesday saying the U.S. is open for business and welcomed a weaker dollar, saying that it would benefit the country. Mnuchin stated “Obviously a weaker dollar is good for us as it relates to trade and opportunities,” and added the currency's short term value is "not a concern of ours at all." Mnuchin also said the government was committed to economic growth of 3% or higher and "Longer term, the strength of the dollar is a reflection of the strength of the U.S. economy and the fact that it is and will continue to be the primary currency in terms of the reserve currency.” Mnuchin’s statements may have been misinterpreted by the media and investors as the dollar temporarily fell to a three-year low while stocks and bonds both moved lower following his remarks. A weaker dollar makes investment in U.S. stocks and bonds less appealing to foreign investors. On Thursday, Mnuchin clarified his remarks along with President Trump who stated “Our country is becoming so economically strong again and strong in other ways, too, by the way, that the dollar is going to get stronger and stronger, and ultimately, I want to see a strong dollar.” Following these comments, the markets began to rebound and move higher. In housing news, Existing Home Sales fell more than forecast in December after rising to its highest level in November since February 2007. The National Association of Realtors (NAR) reported Existing Home Sales declined 3.6% month-over-month in December to a seasonally adjusted annual rate of 5.57 million versus a consensus forecast of 5.70 million. This was also lower than November’s downwardly revised 5.78 million annual sales pace. The median existing home price for all housing types increased 5.8% to $246,800 – the 70th straight month of year-over-year gains. The median existing single-family home price advanced 5.8% from a year ago to $248,100. The inventory of 1.48 million homes for sale at the end of December dropped 11.4% and is 10.3% lower than the same period a year ago. The inventory of existing homes for sale has fallen year-over-year for 31 consecutive months currently resulting in an unsold inventory at a 3.2-month supply, the lowest on record.  Also, the latest data from the Census Bureau and the Department of Housing and Urban Development showed a disappointing 9.3% decline in New Home Sales in December to a seasonally adjusted annual rate of 625,000. The consensus forecast had called for an annual rate of was 679,000. This was in addition to a large downward revision to November from an originally reported 733,000 to 689,000 in annual New Home Sales. The median sales price increased 2.6% year-over-year to $335,400 while the average sales price increased 4.3% to $398,900. Based on the current sales pace, the inventory of new homes for sale increased to a 5.7-months' supply versus 4.9 months in November and 5.6 months in the year-ago period. The number of mortgage applications showed an increase according to the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) increased by 4.5% during the week ended January 19, 2018. The seasonally adjusted Purchase Index increased 6.0% from a week prior while the Refinance Index advanced 1.0%. Overall, the refinance portion of mortgage activity decreased to 49.4% of total applications from 52.2% in the prior week. The adjustable-rate mortgage share of activity was unchanged at 5.2% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.36% from 4.33%, with points remaining unchanged at 0.54. For the week, the FNMA 3.5% coupon bond gained 1.5 basis points to close at $101.281 while the 10-year Treasury yield decreased 0.12 basis points to end at 2.6599%. The major stock indexes continued to move higher during the week. The Dow Jones Industrial Average climbed 544.99 points to close at 26,616.71. The NASDAQ Composite Index climbed 169.39 points to close at 7,505.77 and the S&P 500 Index gained 62.57 points to close at 2,872.87. Year to date on a total return basis, the Dow Jones Industrial Average has gained 7.68%, the NASDAQ Composite Index has advanced 8.73%, and the S&P 500 Index has added 7.45%. This past week, the national average 30-year mortgage rate rose to 4.28% from 4.23%; the 15-year mortgage rate increased to 3.65% from 3.59%; the 5/1 ARM mortgage rate increased to 3.34% from 3.29% and the FHA 30-year rate climbed to 4.05% from 4.00%. Jumbo 30-year rates increased to 4.41% from 4.36%. Economic Calendar - for the Week of January 29, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

Also, the latest data from the Census Bureau and the Department of Housing and Urban Development showed a disappointing 9.3% decline in New Home Sales in December to a seasonally adjusted annual rate of 625,000. The consensus forecast had called for an annual rate of was 679,000. This was in addition to a large downward revision to November from an originally reported 733,000 to 689,000 in annual New Home Sales. The median sales price increased 2.6% year-over-year to $335,400 while the average sales price increased 4.3% to $398,900. Based on the current sales pace, the inventory of new homes for sale increased to a 5.7-months' supply versus 4.9 months in November and 5.6 months in the year-ago period. The number of mortgage applications showed an increase according to the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) increased by 4.5% during the week ended January 19, 2018. The seasonally adjusted Purchase Index increased 6.0% from a week prior while the Refinance Index advanced 1.0%. Overall, the refinance portion of mortgage activity decreased to 49.4% of total applications from 52.2% in the prior week. The adjustable-rate mortgage share of activity was unchanged at 5.2% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.36% from 4.33%, with points remaining unchanged at 0.54. For the week, the FNMA 3.5% coupon bond gained 1.5 basis points to close at $101.281 while the 10-year Treasury yield decreased 0.12 basis points to end at 2.6599%. The major stock indexes continued to move higher during the week. The Dow Jones Industrial Average climbed 544.99 points to close at 26,616.71. The NASDAQ Composite Index climbed 169.39 points to close at 7,505.77 and the S&P 500 Index gained 62.57 points to close at 2,872.87. Year to date on a total return basis, the Dow Jones Industrial Average has gained 7.68%, the NASDAQ Composite Index has advanced 8.73%, and the S&P 500 Index has added 7.45%. This past week, the national average 30-year mortgage rate rose to 4.28% from 4.23%; the 15-year mortgage rate increased to 3.65% from 3.59%; the 5/1 ARM mortgage rate increased to 3.34% from 3.29% and the FHA 30-year rate climbed to 4.05% from 4.00%. Jumbo 30-year rates increased to 4.41% from 4.36%. Economic Calendar - for the Week of January 29, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.  Mortgage Rate Forecast with Chart - FNMA 30-Year 3.5% Coupon Bond The FNMA 30-year 3.5% coupon bond ($101.281, +1.5 bp) traded within a 45.3 basis point range between a weekly intraday high of $101.578 on Thursday and a weekly intraday low of $101.250 on Thursday before closing the week at $101.281 on Friday. The bond traded sideways during the past week between technical resistance at $101.66 and support at $101.25 and ended the week close to where it finished the prior week. A new sell signal was generated on Friday but the bond remains significantly “oversold.” This coming week’s market direction could be determined by economic news. The economic calendar is extensive this coming week and includes the always important January Employment Report. If the economic news is favorable for bonds we could see a rebound in bond prices with a slight improvement in rates. However, if the economic news is strong and continues to fuel the stock market, we could see bond prices slide lower with rates moving slightly higher.

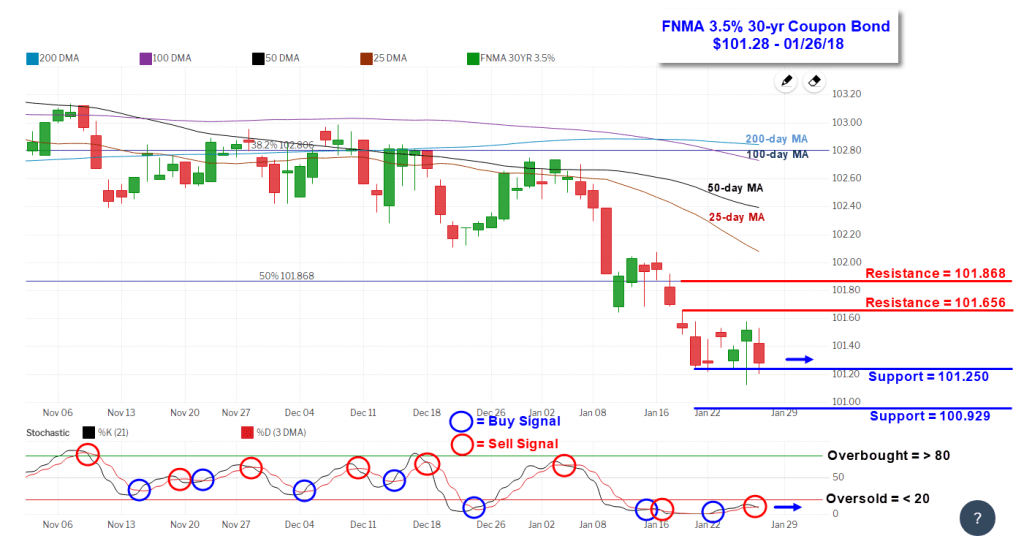

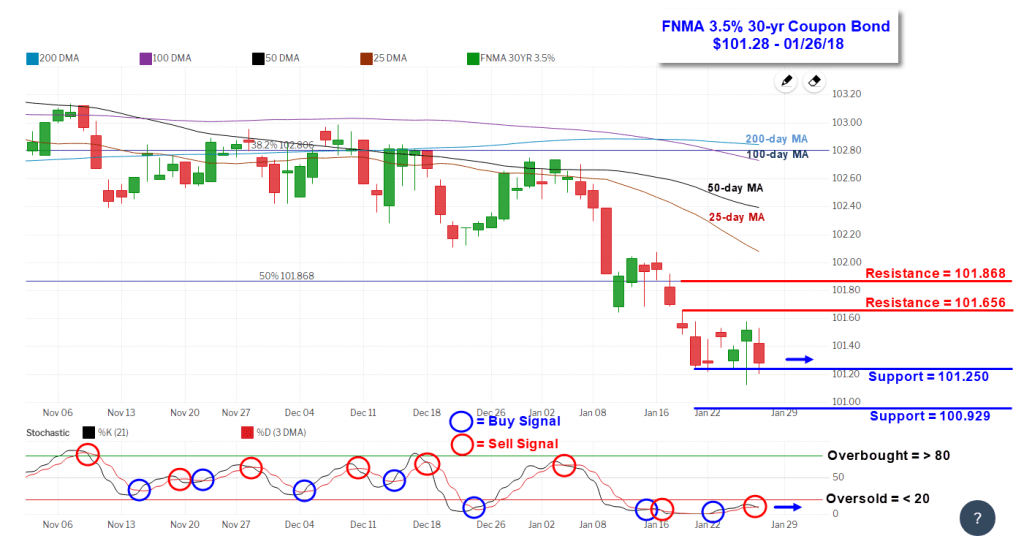

Mortgage Rate Forecast with Chart - FNMA 30-Year 3.5% Coupon Bond The FNMA 30-year 3.5% coupon bond ($101.281, +1.5 bp) traded within a 45.3 basis point range between a weekly intraday high of $101.578 on Thursday and a weekly intraday low of $101.250 on Thursday before closing the week at $101.281 on Friday. The bond traded sideways during the past week between technical resistance at $101.66 and support at $101.25 and ended the week close to where it finished the prior week. A new sell signal was generated on Friday but the bond remains significantly “oversold.” This coming week’s market direction could be determined by economic news. The economic calendar is extensive this coming week and includes the always important January Employment Report. If the economic news is favorable for bonds we could see a rebound in bond prices with a slight improvement in rates. However, if the economic news is strong and continues to fuel the stock market, we could see bond prices slide lower with rates moving slightly higher.

Also, the latest data from the Census Bureau and the Department of Housing and Urban Development showed a disappointing 9.3% decline in New Home Sales in December to a seasonally adjusted annual rate of 625,000. The consensus forecast had called for an annual rate of was 679,000. This was in addition to a large downward revision to November from an originally reported 733,000 to 689,000 in annual New Home Sales. The median sales price increased 2.6% year-over-year to $335,400 while the average sales price increased 4.3% to $398,900. Based on the current sales pace, the inventory of new homes for sale increased to a 5.7-months' supply versus 4.9 months in November and 5.6 months in the year-ago period. The number of mortgage applications showed an increase according to the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) increased by 4.5% during the week ended January 19, 2018. The seasonally adjusted Purchase Index increased 6.0% from a week prior while the Refinance Index advanced 1.0%. Overall, the refinance portion of mortgage activity decreased to 49.4% of total applications from 52.2% in the prior week. The adjustable-rate mortgage share of activity was unchanged at 5.2% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.36% from 4.33%, with points remaining unchanged at 0.54. For the week, the FNMA 3.5% coupon bond gained 1.5 basis points to close at $101.281 while the 10-year Treasury yield decreased 0.12 basis points to end at 2.6599%. The major stock indexes continued to move higher during the week. The Dow Jones Industrial Average climbed 544.99 points to close at 26,616.71. The NASDAQ Composite Index climbed 169.39 points to close at 7,505.77 and the S&P 500 Index gained 62.57 points to close at 2,872.87. Year to date on a total return basis, the Dow Jones Industrial Average has gained 7.68%, the NASDAQ Composite Index has advanced 8.73%, and the S&P 500 Index has added 7.45%. This past week, the national average 30-year mortgage rate rose to 4.28% from 4.23%; the 15-year mortgage rate increased to 3.65% from 3.59%; the 5/1 ARM mortgage rate increased to 3.34% from 3.29% and the FHA 30-year rate climbed to 4.05% from 4.00%. Jumbo 30-year rates increased to 4.41% from 4.36%. Economic Calendar - for the Week of January 29, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

Also, the latest data from the Census Bureau and the Department of Housing and Urban Development showed a disappointing 9.3% decline in New Home Sales in December to a seasonally adjusted annual rate of 625,000. The consensus forecast had called for an annual rate of was 679,000. This was in addition to a large downward revision to November from an originally reported 733,000 to 689,000 in annual New Home Sales. The median sales price increased 2.6% year-over-year to $335,400 while the average sales price increased 4.3% to $398,900. Based on the current sales pace, the inventory of new homes for sale increased to a 5.7-months' supply versus 4.9 months in November and 5.6 months in the year-ago period. The number of mortgage applications showed an increase according to the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) increased by 4.5% during the week ended January 19, 2018. The seasonally adjusted Purchase Index increased 6.0% from a week prior while the Refinance Index advanced 1.0%. Overall, the refinance portion of mortgage activity decreased to 49.4% of total applications from 52.2% in the prior week. The adjustable-rate mortgage share of activity was unchanged at 5.2% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.36% from 4.33%, with points remaining unchanged at 0.54. For the week, the FNMA 3.5% coupon bond gained 1.5 basis points to close at $101.281 while the 10-year Treasury yield decreased 0.12 basis points to end at 2.6599%. The major stock indexes continued to move higher during the week. The Dow Jones Industrial Average climbed 544.99 points to close at 26,616.71. The NASDAQ Composite Index climbed 169.39 points to close at 7,505.77 and the S&P 500 Index gained 62.57 points to close at 2,872.87. Year to date on a total return basis, the Dow Jones Industrial Average has gained 7.68%, the NASDAQ Composite Index has advanced 8.73%, and the S&P 500 Index has added 7.45%. This past week, the national average 30-year mortgage rate rose to 4.28% from 4.23%; the 15-year mortgage rate increased to 3.65% from 3.59%; the 5/1 ARM mortgage rate increased to 3.34% from 3.29% and the FHA 30-year rate climbed to 4.05% from 4.00%. Jumbo 30-year rates increased to 4.41% from 4.36%. Economic Calendar - for the Week of January 29, 2018 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.  Mortgage Rate Forecast with Chart - FNMA 30-Year 3.5% Coupon Bond The FNMA 30-year 3.5% coupon bond ($101.281, +1.5 bp) traded within a 45.3 basis point range between a weekly intraday high of $101.578 on Thursday and a weekly intraday low of $101.250 on Thursday before closing the week at $101.281 on Friday. The bond traded sideways during the past week between technical resistance at $101.66 and support at $101.25 and ended the week close to where it finished the prior week. A new sell signal was generated on Friday but the bond remains significantly “oversold.” This coming week’s market direction could be determined by economic news. The economic calendar is extensive this coming week and includes the always important January Employment Report. If the economic news is favorable for bonds we could see a rebound in bond prices with a slight improvement in rates. However, if the economic news is strong and continues to fuel the stock market, we could see bond prices slide lower with rates moving slightly higher.

Mortgage Rate Forecast with Chart - FNMA 30-Year 3.5% Coupon Bond The FNMA 30-year 3.5% coupon bond ($101.281, +1.5 bp) traded within a 45.3 basis point range between a weekly intraday high of $101.578 on Thursday and a weekly intraday low of $101.250 on Thursday before closing the week at $101.281 on Friday. The bond traded sideways during the past week between technical resistance at $101.66 and support at $101.25 and ended the week close to where it finished the prior week. A new sell signal was generated on Friday but the bond remains significantly “oversold.” This coming week’s market direction could be determined by economic news. The economic calendar is extensive this coming week and includes the always important January Employment Report. If the economic news is favorable for bonds we could see a rebound in bond prices with a slight improvement in rates. However, if the economic news is strong and continues to fuel the stock market, we could see bond prices slide lower with rates moving slightly higher.