This past week the financial markets responded to a stunning upset by Donald Trump in the presidential election. Wall Street assumed Hillary Clinton would win the election. When it appeared Donald Trump would win late Tuesday night, stock index futures plunged with the Dow Jones Industrial futures falling close to 900 points at one point while those for the S&P 500 Index and NASDAQ 100 Index were over 5% lower. Bond prices were primed to move higher with a potentially plunging stock market, but Trump’s win increased investor anxiety that the federal government would go on another economic stimulus spending spree.

http://player.cnbc.com/p/gZWlPC/cnbc_global?playertype=synd&byGuid=3000567079&size=530_298 However, Trump delivered a remarkable conciliatory speech beginning at 2:50 a.m. ET Wednesday morning when he promised to work to "bind the wounds of division" and bring all Americans together and the stock index futures markets responded by erasing most of their deficits by the cash market open. The stock market did end up opening marginally lower Wednesday morning, but then significantly improved from opening levels and turned positive in late morning trading. Equity traders likely figured out that a Trump presidency shouldn’t be bad for certain sectors of the stock market in the long-term after all. Regardless, when the stock market refused to crater, the bond market sold off hard with yields spiking higher. Stocks continued to move higher during the remainder of the week while investors sold Treasuries and other bonds, including mortgage bonds, following the election as the possibility of larger government deficits and rising inflation under a Trump administration made bonds less attractive. According to the Wall Street Journal, the 10-year Treasury note yield reached 2.15%, its highest level since January. Additionally, the financial markets are continuing to price in a 25 basis point rate hike in December. There is currently an 81.1% probability the Fed will come through with a rate hike when their Federal Open Market Committee (FOMC) meets on December 14. In economic news, the Mortgage Bankers Association (MBA) released their latest Mortgage Application Data for the week ending November 4 showing the overall seasonally adjusted Market Composite Index fell 1.2%. The seasonally adjusted Purchase Index rose 1.0% from the prior week, while the Refinance Index decreased 3.0% to its lowest level since May. Overall, the refinance portion of mortgage activity fell to 62.3% of total applications from 62.7%. The adjustable-rate mortgage share of activity accounted for 4.5% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased from 3.75% to 3.77% with points increasing to 0.38 from 0.36. Elsewhere, St. Louis Fed President and FOMC voter James Bullard stated the Fed won’t be swayed by the presidential election and that a December rate hike would still be reasonable. Bullard went on to say that the recently seen market volatility has not been extreme enough to affect the Fed’s economic outlook. Also, Richmond Fed President and non-FOMC voter Jeffrey Lacker said the case for a rate hike in December remains strong and the Fed would likely raise interest rates more quickly if the federal government enacted further fiscal stimulus. For the week, the FNMA 3.0% coupon bond plunged 201.5 basis points to end at $101.09 while the 10-year Treasury yield increased 35.9 basis points to end at 2.1378%. Stocks ended the week higher with the Dow Jones Industrial Average gaining 929.53 points to end at 18,817.81. The NASDAQ Composite Index rose 188.55 points to close at 5,046.37, and the S&P 500 Index added 79.44 points to close at 2,085.18. Year to date, and exclusive of any dividends, the Dow Jones Industrial Average has gained 7.40%, the NASDAQ Composite Index has added 4.35%, and the S&P 500 Index has advanced 5.58%. This past week, the national average 30-year mortgage rate increased to 3.85% from 3.59% while the 15-year mortgage rate increased to 3.13% from 2.90%. The 5/1 ARM mortgage rate rose to 2.92% from 2.89%. FHA 30-year rates increased to 3.62% from 3.40% and Jumbo 30-year rates increased to 4.00% from 3.75%.

Economic Calendar - for the Week of November 14, 2016 Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

| Date | TimeET | Event /Report /Statistic | For | Market Expects | Prior |

| Nov 15 | 08:30 | Retail Sales | Oct | 0.6% | 0.6% |

| Nov 15 | 08:30 | Retail Sales excluding automobiles | Oct | 0.5% | 0.5% |

| Nov 15 | 08:30 | Export Prices excluding agriculture | Oct | NA | 0.4% |

| Nov 15 | 08:30 | Import Prices excluding oil | Oct | NA | 0.0% |

| Nov 15 | 08:30 | New York Empire State Manufacturing Index | Nov | -0.5 | -6.8 |

| Nov 15 | 10:00 | Business Inventories | Sept | 0.2% | 0.2% |

| Nov 16 | 07:00 | MBA Mortgage Index | 11/12 | NA | -1.2% |

| Nov 16 | 08:30 | Producer Price Index (PPI) | Oct | 0.3% | 0.3% |

| Nov 16 | 08:30 | Core PPI | Oct | 0.2% | 0.2% |

| Nov 16 | 09:15 | Industrial Production | Oct | 0.2% | 0.1% |

| Nov 16 | 09:15 | Capacity Utilization | Oct | 75.5% | 75.4% |

| Nov 16 | 10:00 | NAHB Housing Market Index | Nov | 64 | 63 |

| Nov 16 | 10:30 | Crude Oil Inventories | 11/12 | NA | NA |

| Nov 16 | 16:00 | Net Long-Term TIC Flows | Sept | NA | $48.3B |

| Nov 17 | 08:30 | Consumer Price Index (CPI) | Oct | 0.4% | 0.3% |

| Nov 17 | 08:30 | Core CPI | Oct | 0.2% | 0.1% |

| Nov 17 | 08:30 | Housing Starts | Oct | 1,178K | 1,047K |

| Nov 17 | 08:30 | Building Permits | Oct | 1,200K | 1,225K |

| Nov 17 | 08:30 | Initial Jobless Claims | 11/12 | 257,000 | 254,000 |

| Nov 17 | 08:30 | Continuing Jobless Claims | 11/05 | NA | 2,041K |

| Nov 17 | 08:30 | Philadelphia Fed Manufacturing Index | Nov | 7.0 | 9.7 |

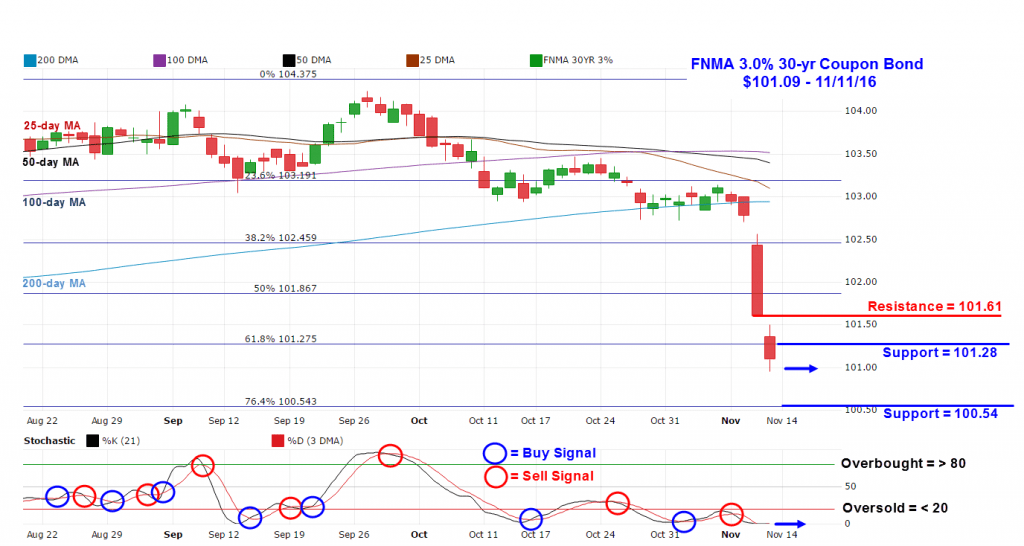

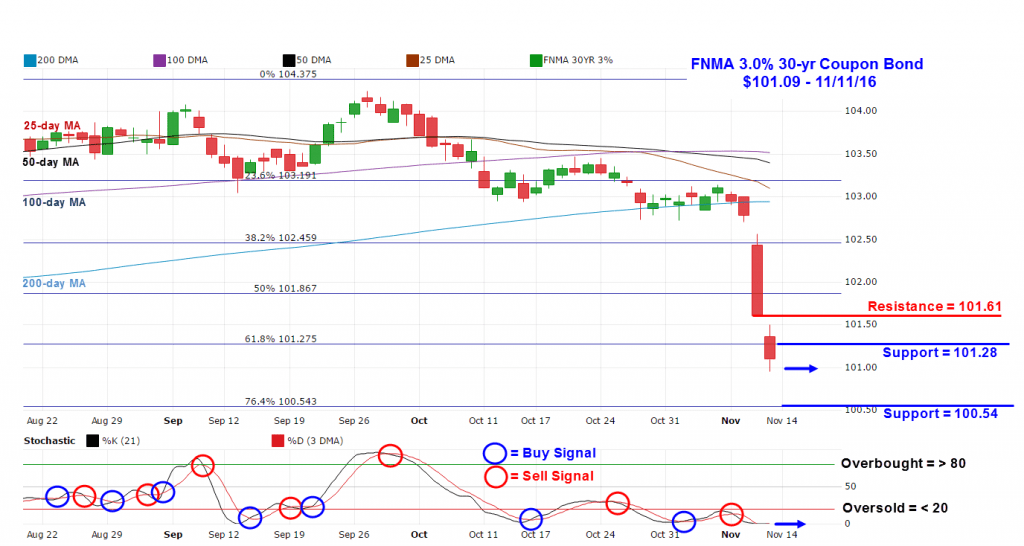

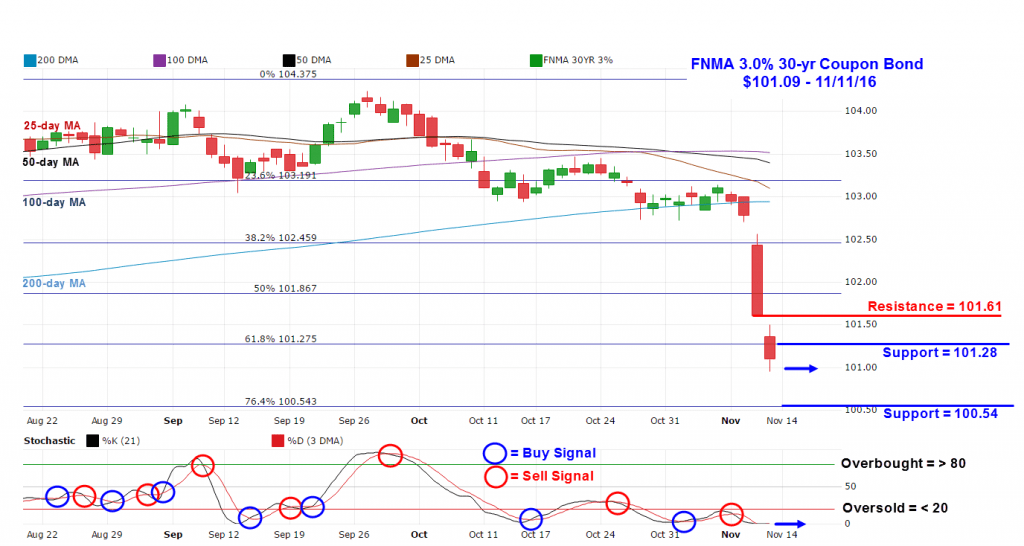

Mortgage Rate Forecast with Chart For the week, the FNMA 30-year 3.0% coupon bond ($101.09, -201.5 basis points) traded within a far wider 211 basis point range between a weekly intraday high of $103.06 on Monday and a weekly intraday low of $100.95 on Thursday before closing the week at $101.09. The bond plunged in price through several technical support levels following the presidential election as traders priced in the likelihood of increased government deficit spending and rising inflation. The slow stochastic oscillator remains at an extremely “oversold” level, and in fact can’t go any lower because its reading is at “zero” showing no upward momentum. If the stock market continues to show strength this week bond prices could continue to slip lower to pressure mortgage rates slightly higher. If stocks take a breather, bond prices should stabilize and find support which in turn would stabilize rates.

Chart: FNMA 30-Year 3.0% Coupon Bond