Mortgage rates this week

09.01.17 05:00 PM By Paul Cantor

The major stock market indexes began the New Year’s holiday-shortened week in an optimistic fashion with the Dow Jones Industrial Average coming within a fraction of a point at 19,999.63 of the elusive 20,000 landmark on an intraday basis Friday before pulling back. Meanwhile, the bond market managed to record minor gains in the face of the stock market’s advance. The minutes from the Federal Reserve’s latest Federal Open Market Committee meeting helped to lift prices of intermediate and long-term Treasuries to send their yields lower during the week. The minutes revealed Fed officials continue to stress the pace of future interest rate hikes would be “gradual,” and investors took this as a “dovish” sign. Stock investors were encouraged by a combination of good economic news and future prospects of improving quarterly corporate earnings reports. Better than forecast readings in manufacturing activity in Great Britain, China, and the U.S. on Tuesday set a positive tone for the stock market for the week. The Institute of Supply Management's Purchasing Managers' Index (PMI) for December showed a healthy expansion in manufacturing activity with a reading of 54.7 compared to a forecast of 52.8 with the New Orders Index advancing by its largest margin in seven years. Expectations for improved corporate earnings are also sustaining the stock market with data and analytics firm FactSet reporting earnings for corporations in the S&P 500 Index as a whole will increase about 3% year-over-year for the fourth quarter of 2016 while other analysts polled by the Wall Street Journal expect earnings to increase by 11% for the first quarter of 2017. The week’s most significant economic news arrived on Friday with the release of the December Employment Situation Summary from the Department of Labor’s Bureau of Labor Statistics. This report showed a headline jobs gain of 156,000 that missed the consensus forecast of 178,000, but November's initially reported 178,000 jobs were upwardly revised to 204,000. However, it was a larger than expected 0.4% month-over-month jump and 2.9% year-over-year increase in Hourly Earnings that triggered a year-on-year sharp sell-off in bonds on Friday. The increase was the fastest pace of the recovery to date suggesting the Fed may have to hike interest rates quicker than anticipated to keep personal consumption expenditure (PCE) inflation close to its 2% target. In housing, mortgage application data for the prior two weeks was released by the Mortgage Bankers Association (MBA) showing their overall seasonally adjusted Market Composite Index declined by 12.0%. The seasonally adjusted Purchase Index decreased 2.0% from the prior week, while the Refinance Index plunged 22.0% for a 13.0% decline on a year-over-year basis. Overall, the refinance portion of mortgage activity increased to 52.2% of total applications from 51.8%. The adjustable-rate mortgage share of activity accounted for 5.4% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance decreased from 4.45% to 4.39% with points increasing to 0.43 from 0.39. For the week, the FNMA 3.5% coupon bond gained 7.8 basis points to end at $102.52 while the 10-year Treasury yield fell 1.10 basis points to end at 2.421%. Stocks ended the week higher with the Dow Jones Industrial Average gaining 201.20 points to end at 19,963.80. The NASDAQ Composite Index added 137.94 points to close at 5,521.06, and the S&P 500 Index advanced 38.15 points to close at 2,276.98. Year to date, and exclusive of any dividends, the Dow Jones Industrial Average has gained 1.01%, the NASDAQ Composite Index has added 2.50%, and the S&P 500 Index has advanced 1.68%. This past week, the national average 30-year mortgage rate decreased to 4.15% from 4.21% while the 15-year mortgage rate decreased to 3.35% from 3.40%. The 5/1 ARM mortgage rate fell to 3.02% from 3.05%. FHA 30-year rates were unchanged at 3.75% and Jumbo 30-year rates decreased to 4.20% from 4.23%. Economic Calendar - for the Week of January 9, 2016 Economic reports having the greatest potential impact on the financial markets are highlighted in bold. | Date | TimeET | Event /Report /Statistic | For | Market Expects | Prior |

| Jan 09 | 15:00 | Consumer Credit | Nov | $18.0B | $16.0B |

| Jan 10 | 10:00 | JOLTS - Job Openings | Nov | NA | 5.534M |

| Jan 10 | 10:00 | Wholesale Inventories | Nov | 0.9% | -0.4% |

| Jan 11 | 07:00 | MBA Mortgage Applications Index | 01/06 | NA | 0.1% |

| Jan 11 | 10:30 | Crude Oil Inventories | 01/06 | NA | -7.100M |

| Jan 12 | 08:30 | Export Prices excluding agriculture | Dec | NA | 0.2% |

| Jan 12 | 08:30 | Import Prices excluding oil | Dec | NA | -0.1% |

| Jan 12 | 08:30 | Initial Jobless Claims | 01/07 | 255,000 | 235,000 |

| Jan 12 | 08:30 | Continuing Jobless Claims | 12/31 | NA | 2,112K |

| Jan 12 | 14:00 | Treasury Budget | Dec | NA | -$14.4B |

| Jan 13 | 08:30 | Producer Price Index (PPI) | Dec | 0.3% | 0.4% |

| Jan 13 | 08:30 | Core PPI | Dec | 0.1% | 0.4% |

| Jan 13 | 08:30 | Retail Sales | Dec | 0.7% | 0.1% |

| Jan 13 | 08:30 | Retail Sales excluding automobiles | Dec | 0.6% | 0.2% |

| Jan 13 | 10:00 | Business Inventories | Nov | 0.6% | -0.2% |

| Jan 13 | 10:00 | Univ. of Michigan Consumer Sentiment Index | Jan | 98.5 | 98.2 |

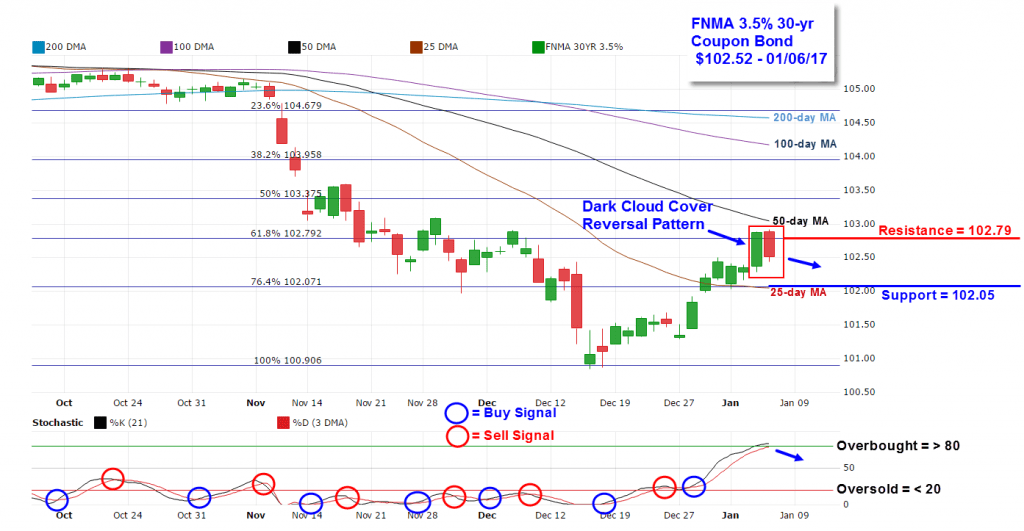

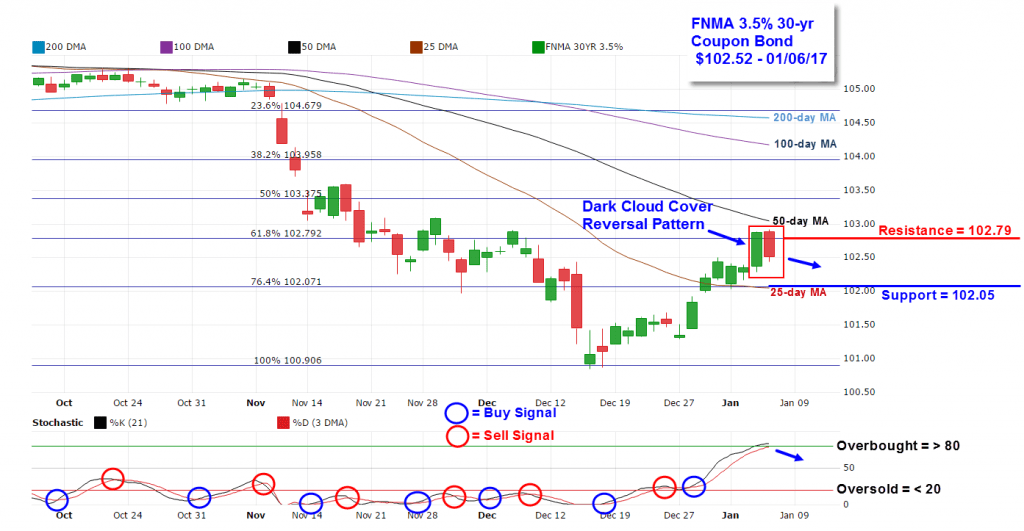

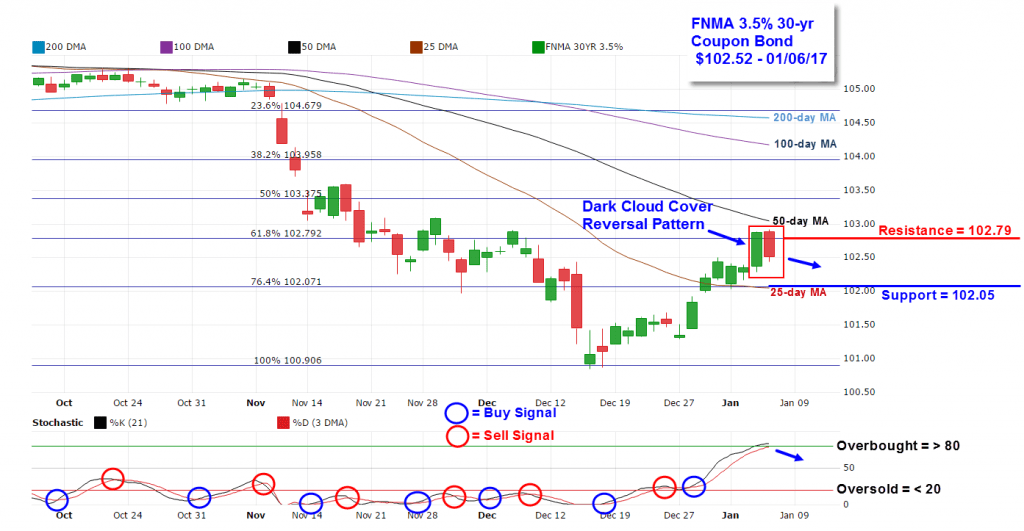

Mortgage Rate Forecast with Chart - FNMA 30-Year 3.5% Coupon Bond  Bond prices shot higher to break above resistance at the 61.8% Fibonacci retracement level at $102.79 on Thursday only to fall back below this level on Friday. The FNMA 30-year 3.5% coupon bond ($102.52, +7.8 basis points) traded within a narrower 89 basis point range between a weekly intraday low of $102.03 on Tuesday and a weekly intraday high of $102.92 on Friday before closing the week at $102.52. The chart is showing a Dark Cloud Cover candlestick pattern resulting from Friday’s price pull-back. This is a reversal pattern suggesting prices will fall back toward support located at the 25-day moving average at $102.05 and the 76.4% Fibonacci retracement level at $102.07. Should this expected price action take place, we could see a slight worsening in mortgage rate

Bond prices shot higher to break above resistance at the 61.8% Fibonacci retracement level at $102.79 on Thursday only to fall back below this level on Friday. The FNMA 30-year 3.5% coupon bond ($102.52, +7.8 basis points) traded within a narrower 89 basis point range between a weekly intraday low of $102.03 on Tuesday and a weekly intraday high of $102.92 on Friday before closing the week at $102.52. The chart is showing a Dark Cloud Cover candlestick pattern resulting from Friday’s price pull-back. This is a reversal pattern suggesting prices will fall back toward support located at the 25-day moving average at $102.05 and the 76.4% Fibonacci retracement level at $102.07. Should this expected price action take place, we could see a slight worsening in mortgage rates in the coming week.

Bond prices shot higher to break above resistance at the 61.8% Fibonacci retracement level at $102.79 on Thursday only to fall back below this level on Friday. The FNMA 30-year 3.5% coupon bond ($102.52, +7.8 basis points) traded within a narrower 89 basis point range between a weekly intraday low of $102.03 on Tuesday and a weekly intraday high of $102.92 on Friday before closing the week at $102.52. The chart is showing a Dark Cloud Cover candlestick pattern resulting from Friday’s price pull-back. This is a reversal pattern suggesting prices will fall back toward support located at the 25-day moving average at $102.05 and the 76.4% Fibonacci retracement level at $102.07. Should this expected price action take place, we could see a slight worsening in mortgage rates in the coming week.

Bond prices shot higher to break above resistance at the 61.8% Fibonacci retracement level at $102.79 on Thursday only to fall back below this level on Friday. The FNMA 30-year 3.5% coupon bond ($102.52, +7.8 basis points) traded within a narrower 89 basis point range between a weekly intraday low of $102.03 on Tuesday and a weekly intraday high of $102.92 on Friday before closing the week at $102.52. The chart is showing a Dark Cloud Cover candlestick pattern resulting from Friday’s price pull-back. This is a reversal pattern suggesting prices will fall back toward support located at the 25-day moving average at $102.05 and the 76.4% Fibonacci retracement level at $102.07. Should this expected price action take place, we could see a slight worsening in mortgage rates in the coming week.  Bond prices shot higher to break above resistance at the 61.8% Fibonacci retracement level at $102.79 on Thursday only to fall back below this level on Friday. The FNMA 30-year 3.5% coupon bond ($102.52, +7.8 basis points) traded within a narrower 89 basis point range between a weekly intraday low of $102.03 on Tuesday and a weekly intraday high of $102.92 on Friday before closing the week at $102.52. The chart is showing a Dark Cloud Cover candlestick pattern resulting from Friday’s price pull-back. This is a reversal pattern suggesting prices will fall back toward support located at the 25-day moving average at $102.05 and the 76.4% Fibonacci retracement level at $102.07. Should this expected price action take place, we could see a slight worsening in mortgage rates in the coming week.

Bond prices shot higher to break above resistance at the 61.8% Fibonacci retracement level at $102.79 on Thursday only to fall back below this level on Friday. The FNMA 30-year 3.5% coupon bond ($102.52, +7.8 basis points) traded within a narrower 89 basis point range between a weekly intraday low of $102.03 on Tuesday and a weekly intraday high of $102.92 on Friday before closing the week at $102.52. The chart is showing a Dark Cloud Cover candlestick pattern resulting from Friday’s price pull-back. This is a reversal pattern suggesting prices will fall back toward support located at the 25-day moving average at $102.05 and the 76.4% Fibonacci retracement level at $102.07. Should this expected price action take place, we could see a slight worsening in mortgage rates in the coming week.