Last week was another volatile week for mortgage rates. Wall Street alternately sought risk and shunned it, causing mortgage-backed bonds to rise and fall rapidly. There was a lot to move markets, too, including banking concerns across Europe, inflation figures within the U.S., and a public speech by Fed Chairman Ben Bernanke. Conforming rates in Virginia rose to their highest levels of the week Wednesday afternoon, then receded into the weekend. 3 30-year fixed rates remain above their all-time lows set 2 weeks ago. 5-year ARMs are at all-time lows. This week, mortgage rates figure to be equally jumpy. As well as a full slate of economic data, because of Labor Day, bond markets will be light on volume. When volume is light, pricing gets volatile. The week's calendar of data includes:

Last week was another volatile week for mortgage rates. Wall Street alternately sought risk and shunned it, causing mortgage-backed bonds to rise and fall rapidly. There was a lot to move markets, too, including banking concerns across Europe, inflation figures within the U.S., and a public speech by Fed Chairman Ben Bernanke. Conforming rates in Virginia rose to their highest levels of the week Wednesday afternoon, then receded into the weekend. 3 30-year fixed rates remain above their all-time lows set 2 weeks ago. 5-year ARMs are at all-time lows. This week, mortgage rates figure to be equally jumpy. As well as a full slate of economic data, because of Labor Day, bond markets will be light on volume. When volume is light, pricing gets volatile. The week's calendar of data includes: Monday:

8:30 am July personal income and spending (as reported, income up 0.3%, spending +0.8%)

10:00 am June pending home sales (as reported -1.3%)

Tuesday:

9:00 am June Case/Shiller 20 city price index (-4.7%)

10:00 am Aug consumer confidence index (52.0 frm 59.5)

Wednesday:

7:00 am weekly MBA mortgage applications

8:15 am Aug ADP private jobs estimate (+100K)

9:45 am Chicago purchasing mgrs index (53.0 frm 58.8)

10:00 am July factory orders (+1.8%)

Thursday:

8:30 am weekly jobless claims (-10K to 407K)

Q2 productivity (-0.5%)

Q2 unit labor costs (+2.4%)

10:00 am Aug ISM manufacturing index (48.5 frm 50.9)

July construction spending (0.0%)

Friday:

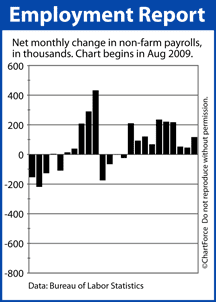

8:30 am Aug employment data (unemployed 9.1%, non-farm jobs +73K, non-farm private jobs +110K)

.

Of all the reports, though, it's Friday's Non-Farm Payrolls that might move mortgage markets the most. Jobs are crucial to the ongoing economic recovery and, from Wall Street to Capitol Hill, it's top of mind. If the jobs report shows more jobs created than expected, or a positive forward trend, expect bond markets to fall, pushing mortgage rates up. On the other hand, if the jobs report is soft, mortgage rates may improve. We can't know what rates in Richmond will do on any given day, so the best strategy for a shopper is to shop with purpose. Know what you want, and be ready to lock when you see it. If you wait too long, the rate will be gone.