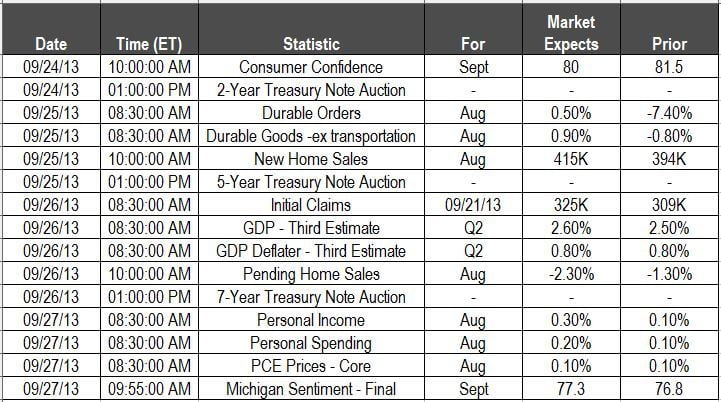

https://paulcantor.present.me/embed/625/300/3010 News impacting mortgage rates last week was dominated by the Fed’s decision to not start tapering the purchase of bonds. Other economic data mostly reported weaker than anticipated. Rates ended the week about 1.5 discount points cheaper than at the end of the previous week. (This reduction means a$200,000 mortgage at a rate of 4.5% would cost about $3,000 less.) This week Monday looks to be the quietest day for the markets. Data to look for later in the week include: Durable Goods, New Home Sales and Consumer Spending. The Fed’s decision to continue the current rate of bond purchases was not a unanimous decision and left the possibility open that tapering may begin later this year. It is a great time to take advantage of the recent dip in mortgage rates. The tapering issue continues loom over the financial markets