A few factors potentially impacting mortgage rates right now include:

Last week was jam-packed with economic news; here are some highlights with emphasis on housing and mortgage related news: Monday: Retail sales for April increased to -0.1 percent from the March reading of -0.5 percent and also surpassed Wall Street's downward forecast of -0.6 percent. Retail sales a...

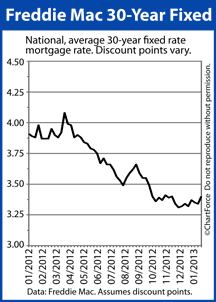

Last week was jam-packed with economic news; here are some highlights with emphasis on housing and mortgage related news: Monday: Retail sales for April increased to -0.1 percent from the March reading of -0.5 percent and also surpassed Wall Street's downward forecast of -0.6 percent. Retail sales a... Mortgage rates rose last week with average rates a 30-year fixed rate mortgage rising from last week's 3.35 percent to 3.42 percent with buyers paying all closing costs and 0.7 percent in discount points.

Mortgage rates rose last week with average rates a 30-year fixed rate mortgage rising from last week's 3.35 percent to 3.42 percent with buyers paying all closing costs and 0.7 percent in discount points.

Average rates for a 15-year fixed rate mortgage rose from 2.56 percent to 2.61 percent with buye...

Mortgage rates fell last week and approached or reached record low levels.

Mortgage rates fell last week and approached or reached record low levels.

According to Freddie Mac, the average rate for a 30-year fixed rate mortgage (FRM) fell from 3.40 percent to 3.35 percent. Average rates for a 15-year FRM moved from 2.61percent to 2.56 percent.

Average rates for a 5/1 adjustab...

Mortgage rates fell again last week and are again near record lows.

Mortgage rates fell again last week and are again near record lows.

According to Freddie Mac, the average rate for a 15-year fixed rate mortgage did achieve a record low of 2.61 percent as compared to 3.1 percent one year ago.

The average rate for a 30-year fixed rate mortgage fell to 3.40 percent and...

Mortgage rates dropped last week despite positive employment reports, which typically causes mortgage rates to rise. As of Thursday, Freddie Mac reports that the average mortgage rate for a 30-year fixed rate mortgage was 3.63 percent with borrowers paying their closing costs and 0.8 percent in disc...

Mortgage rates dropped last week despite positive employment reports, which typically causes mortgage rates to rise. As of Thursday, Freddie Mac reports that the average mortgage rate for a 30-year fixed rate mortgage was 3.63 percent with borrowers paying their closing costs and 0.8 percent in disc... In what we have been describing as a bear market in bond and mortgage markets, today there is strong selling taking the 10 yr note yield to 1.92% at one point about 8:45 this morning and MBS prices down as much as 40 basis points from yesterday’s 25 bp sell-off. As of 9:00 this morning 20 yr 3.0 FNM...

In what we have been describing as a bear market in bond and mortgage markets, today there is strong selling taking the 10 yr note yield to 1.92% at one point about 8:45 this morning and MBS prices down as much as 40 basis points from yesterday’s 25 bp sell-off. As of 9:00 this morning 20 yr 3.0 FNM... Mortgage rates improved slightly last week during a week of sparse economic news. Thursday's weekly jobless claims report showed 371,000 new claims, which was 1,000 fewer jobless claims than for the prior week. Wall Street expectations of 365,000 new jobless claims turned out to be too optimistic. T...

Mortgage rates improved slightly last week during a week of sparse economic news. Thursday's weekly jobless claims report showed 371,000 new claims, which was 1,000 fewer jobless claims than for the prior week. Wall Street expectations of 365,000 new jobless claims turned out to be too optimistic. T...(1)

(3)

(8)

(1)

(5)

(9)

(3)

(227)

(2)

(1)

(3)

(1)

(50)

(185)

(5)

(1)

(57)

(1)

(7)

(13)

(29)

(373)

(4)

(14)

(20)

(8)

(22)

(53)

(3)

(7)

(37)