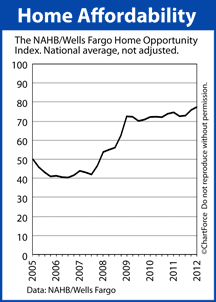

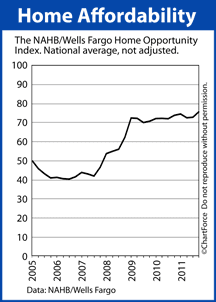

Rising home prices are taking a toll on today's home buyers. For the first time in 4 quarters -- and despite falling mortgage rates -- home affordability is sinking.

Rising home prices are taking a toll on today's home buyers. For the first time in 4 quarters -- and despite falling mortgage rates -- home affordability is sinking.

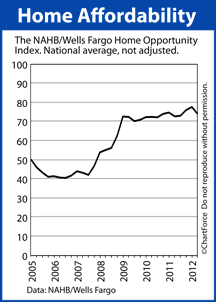

Earlier this week, the National Association of Home Builders reported the Home Opportunity Index, a measure of home affordab...

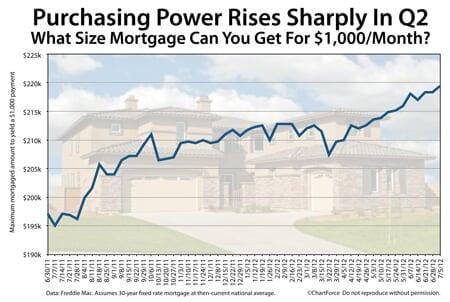

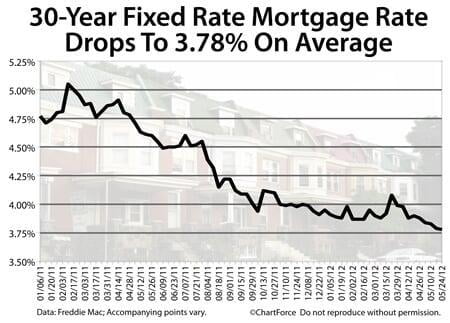

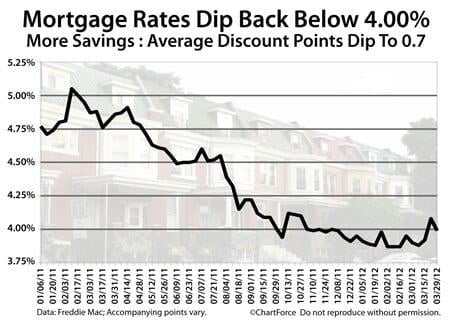

With mortgage rates down to all-time lows, you can buy a lot more home for your money. Home affordability is at an all-time high. According to last week's Freddie Mac mortgage rate survey, the average 30-year fixed rate mortgage has dropped to 3.62% nationwide. This is down from 4.08% in March, and...

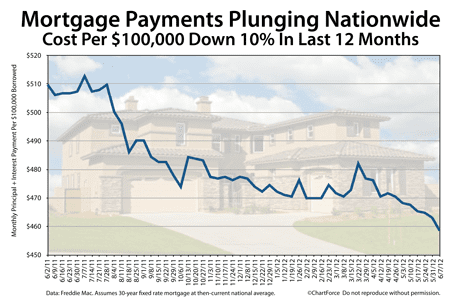

With mortgage rates down to all-time lows, you can buy a lot more home for your money. Home affordability is at an all-time high. According to last week's Freddie Mac mortgage rate survey, the average 30-year fixed rate mortgage has dropped to 3.62% nationwide. This is down from 4.08% in March, and... It's a money-saving time to be a Midlothian home buyer. Historically, mortgage rates of all types -- conventional, FHA, VA and USDA -- have never been lower and low mortgage rates make for low monthly payments. According to Freddie Mac's weekly mortgage rate survey, the average 30-year fixed rate m...

It's a money-saving time to be a Midlothian home buyer. Historically, mortgage rates of all types -- conventional, FHA, VA and USDA -- have never been lower and low mortgage rates make for low monthly payments. According to Freddie Mac's weekly mortgage rate survey, the average 30-year fixed rate m...

For the fifth consecutive week, conforming 30-year fixed rate mortgage rates have dropped to new all-time lows.

According to this week's Primary Mortgage Market Survey from Freddie Mac, "prime" mortgage applicants willing to pay 0.8 discount points plus closing costs can secure a mortgage r...

Falling mortgage rates and stagnant home prices are making a positive effect on home affordability nationwide. Never before in recorded history have so many homes been affordable to households earning a moderate annual income.

Falling mortgage rates and stagnant home prices are making a positive effect on home affordability nationwide. Never before in recorded history have so many homes been affordable to households earning a moderate annual income.

Last week, the National Association of Home Builders reported the Home Opp...

Been shopping for a mortgage rate? You may want to lock something down. Tomorrow morning, mortgage rates are expected to change. Unfortunately, we don't know in which direction they'll move.

It's a risky time for Virginia home buyers to be without a locked mortgage rate.

The action begins at 8:3...

After a brief run-up two weeks ago, mortgage rates are back below 4 percent. It's good news for home buyers and mortgage rate shoppers of Richmond because with lower mortgage rates come lower mortgage payments. According to Freddie Mac's weekly Primary Mortgage Market Survey, the national, average ...

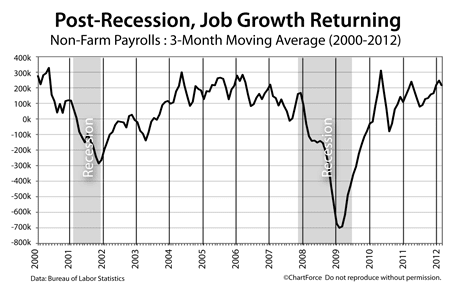

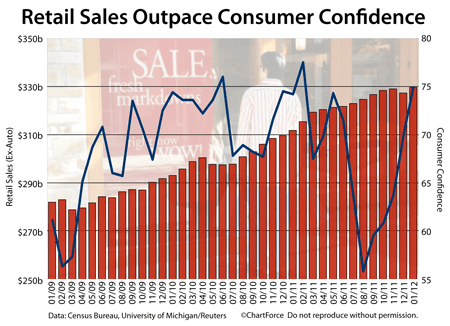

After a brief run-up two weeks ago, mortgage rates are back below 4 percent. It's good news for home buyers and mortgage rate shoppers of Richmond because with lower mortgage rates come lower mortgage payments. According to Freddie Mac's weekly Primary Mortgage Market Survey, the national, average ... The U.S. economy is expanding, fueled by a renewed consumer optimism and increased consumer spending.

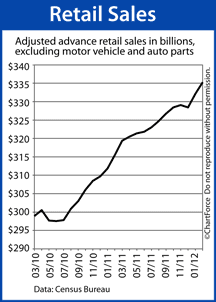

The U.S. economy is expanding, fueled by a renewed consumer optimism and increased consumer spending.

As reported by the Census Bureau, Retail Sales in February, excluding cars and auto parts, rose 1 percent to $335 billion as 11 of 13 retail sectors showed improvement last month.

February market...

Home affordability moved higher last quarter, boosted by the lowest mortgage rates in history, a rise in median income, and slow-to-recover home prices throughout Virginia and the country.

Home affordability moved higher last quarter, boosted by the lowest mortgage rates in history, a rise in median income, and slow-to-recover home prices throughout Virginia and the country.

According to the National Association of Home Builders, the quarterly Home Opportunity Index read 75.9 in 2...

The U.S. economy continues to show signs of a rebound. According to the Census Bureau, Retail Sales climbed to $329 billion last month on a seasonally-adjusted basis, excluding automobiles. January's data marks the 18th time in 19 months that Retail Sales rose, a run that's increased total sal...

The U.S. economy continues to show signs of a rebound. According to the Census Bureau, Retail Sales climbed to $329 billion last month on a seasonally-adjusted basis, excluding automobiles. January's data marks the 18th time in 19 months that Retail Sales rose, a run that's increased total sal... Home affordability slipped slightly last quarter, dragged down by rising mortgage rates and recovering home prices in Virginia and nationwide.

Home affordability slipped slightly last quarter, dragged down by rising mortgage rates and recovering home prices in Virginia and nationwide.

The National Association of Home Builders reports a Q2 2011 Home Opportunity Index reading of 72.6. This means that nearly 3 of 4 homes sold last quarter were...

(1)

(3)

(8)

(1)

(5)

(9)

(3)

(227)

(2)

(1)

(3)

(1)

(50)

(185)

(5)

(1)

(57)

(1)

(7)

(13)

(29)

(373)

(4)

(14)

(20)

(8)

(22)

(53)

(3)

(7)

(37)