The average family puts 10-15 percent of its monthly spending toward food, according to the Bureau of Labor Statistics and Department of Agriculture, with most of that food purchased at a supermarket.

The amount spent on food is less than the typical amount spent on housing each month but what makes ...

Mortgage rates have been on steady decline in Virginia since the start of 2012 as uncertainty for the future of the Eurozone and questions about the soundness of the U.S. economy have led investors into mortgage bonds in droves, lowering the 30-year fixed rate mortgage to its lowest point in history...

Should you lease a new car, or should you buy one? Like most financial questions, the answer depends on your situation. For some people, leasing a car presents distinct economic advantages. For others, buying a car is the way to go.

There's plenty of online material to help you choose your optimal pa...

Planning to make a late-August purchase closing? Keep an eye on your calendar. The last Friday of this month coincides with Labor Day Weekend, which may make for a complicated, end-of-month closing.

Planning to make a late-August purchase closing? Keep an eye on your calendar. The last Friday of this month coincides with Labor Day Weekend, which may make for a complicated, end-of-month closing.

If you're planning to close on, or around, August 31, 2012, plan ahead. Leaving anything to the p...

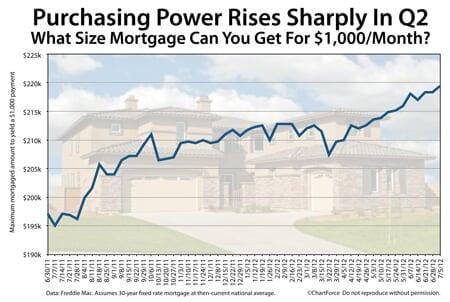

With mortgage rates down to all-time lows, you can buy a lot more home for your money. Home affordability is at an all-time high. According to last week's Freddie Mac mortgage rate survey, the average 30-year fixed rate mortgage has dropped to 3.62% nationwide. This is down from 4.08% in March, and...

With mortgage rates down to all-time lows, you can buy a lot more home for your money. Home affordability is at an all-time high. According to last week's Freddie Mac mortgage rate survey, the average 30-year fixed rate mortgage has dropped to 3.62% nationwide. This is down from 4.08% in March, and... With home values slow to rise and mortgage rates at all-time lows, there's never been a more affordable time to own a home.

With home values slow to rise and mortgage rates at all-time lows, there's never been a more affordable time to own a home.

However, there is more to the cost of living than just a mortgage payment. There's the cost of groceries, gasoline and routine medical care, too.

Not surprisingly, where we live ...

Insurance is protection against unexpected expenses and insurance policies are available for nearly any scenario you can envision -- even your own ransom. But just because an insurance policy is available, that doesn't mean you should buy it.

Some insurance policies give you good bang for the buck. O...

Planning to close on your home at the end of May? Plan ahead. Memorial Day is coming and the holiday may delay your closing.

Planning to close on your home at the end of May? Plan ahead. Memorial Day is coming and the holiday may delay your closing.

Memorial Day marks the unofficial start of summer and the 3-day Memorial Day weekend is a popular vacation time in real estate-related industries.

Real estate agents tend to tak...

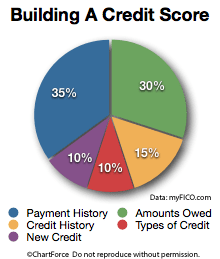

Credit scores play a huge role in today's mortgage market -- larger than at any time in recent history. Blame it on the high default rates of the last half-decade. Lenders are reserving their lowest rates for the customers most likely to make on-time repayments.

Mortgage rates are at an all-time low ...

Will your home gain value over the next 12 months? Nobody can know for sure, of course, but should recent housing trends continue, there's concrete cause for optimism.

The housing economy has suffered since 2007, knocking home values down nearly 20% nationwide. And while some areas have fared better ...

With Halloween behind us, retailers are in the Holiday Spirit. Businesses know that consumers spent a median $556 on holiday gifts last year and they want this year to be just as strong.

With Halloween behind us, retailers are in the Holiday Spirit. Businesses know that consumers spent a median $556 on holiday gifts last year and they want this year to be just as strong.

That's why it's barely November and, already, Black Friday ads clog our mailboxes and the airwaves. Retailers want...

A home appraisal is an independent opinion of your home's value, performed by a licensed home appraiser. Appraisals are part of the traditional home purchase process, and lenders require them for most refinances, too.

A home appraisal is an independent opinion of your home's value, performed by a licensed home appraiser. Appraisals are part of the traditional home purchase process, and lenders require them for most refinances, too.

Appraisers are trained professionals. First, they derive a base for your home'...

Last week, the Federal Reserve pledged to leave the Fed Funds Rate near 0.000 percent until at least mid-2013. For credit card holders in Virginia who carry a monthly balance, this is good news. Because of the Fed's call, credit card rates are unlikely to rise before mid-2013.

But cardholders can sav...

Home sales have heated up, according to the National Association of REALTORS®.

Home sales have heated up, according to the National Association of REALTORS®.

More homes are going under contract this summer than went during the winter or spring seasons. Many of these homes are scheduled for late-August/early-September closings.

If your home is among them, plan ahead....

It's a fact: It's more expensive to live in some cities than others. Beyond just the costs of buying a home, different cities also carry a different Cost of Living. For households relocating from Virginia and across state lines, the change in "life costs" can be jarring.

It's a fact: It's more expensive to live in some cities than others. Beyond just the costs of buying a home, different cities also carry a different Cost of Living. For households relocating from Virginia and across state lines, the change in "life costs" can be jarring.

Depending on ...

(1)

(3)

(8)

(1)

(5)

(9)

(3)

(227)

(2)

(1)

(3)

(1)

(50)

(185)

(5)

(1)

(57)

(1)

(7)

(13)

(29)

(373)

(4)

(14)

(20)

(8)

(22)

(53)

(3)

(7)

(37)