The stock market continued its gains today while the long end of the yield curve (10s, 20s, 30s and MBSs) also improved. The 10 finds technical support when it has moved up to 2.90% area and equally resistance when it has moved below 2.80%. Since April 2nd when the 10 rate fell to 2.72% its rate had...

The stock market continued its gains today while the long end of the yield curve (10s, 20s, 30s and MBSs) also improved. The 10 finds technical support when it has moved up to 2.90% area and equally resistance when it has moved below 2.80%. Since April 2nd when the 10 rate fell to 2.72% its rate had...

|

|

Published Date 9/26/2017

In the pre-open trade this morning, the stock indexes were better, the 10-yr. note yield up 1 bps to 2.23% from yesterday’s close. No direct new threats from NK, and investors still driving stock indexes higher. Slightly weaker yesterday but no follow-through today, a pa...| Date | TimeET | Event /Report /Statistic | For | Market Expects | Prior | ...

____________________________________________________

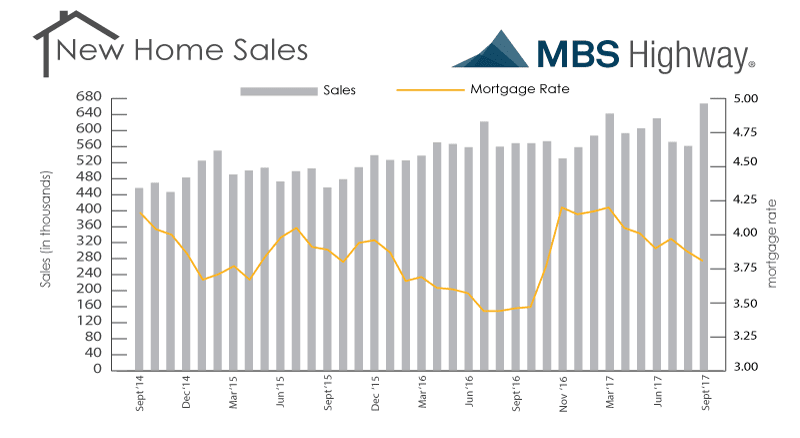

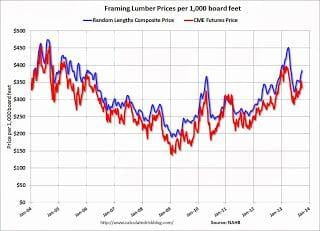

Another sign of rising home prices and a healthier housing market (from Calculated Risk)

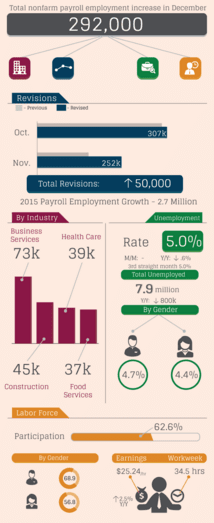

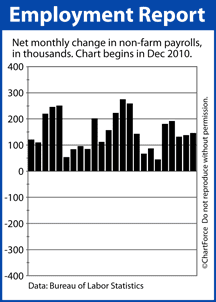

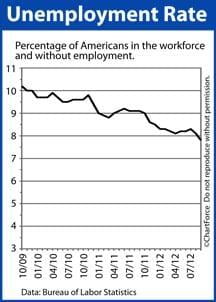

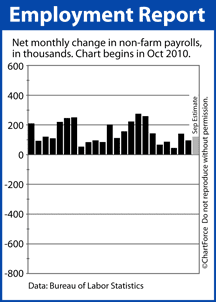

According to the Bureau of Labor Statistics (BLS) and its November 2012 Non-Farm Payrolls report, the U.S. economy added 146,000 net new jobs last month.

According to the Bureau of Labor Statistics (BLS) and its November 2012 Non-Farm Payrolls report, the U.S. economy added 146,000 net new jobs last month.

November's job growth exceeded Wall Street expectations of 90,000 jobs added for the month, and was a small increase from October's 138,000 jobs ad...

Floating a mortgage rate? Consider getting locked Thursday.

Floating a mortgage rate? Consider getting locked Thursday.

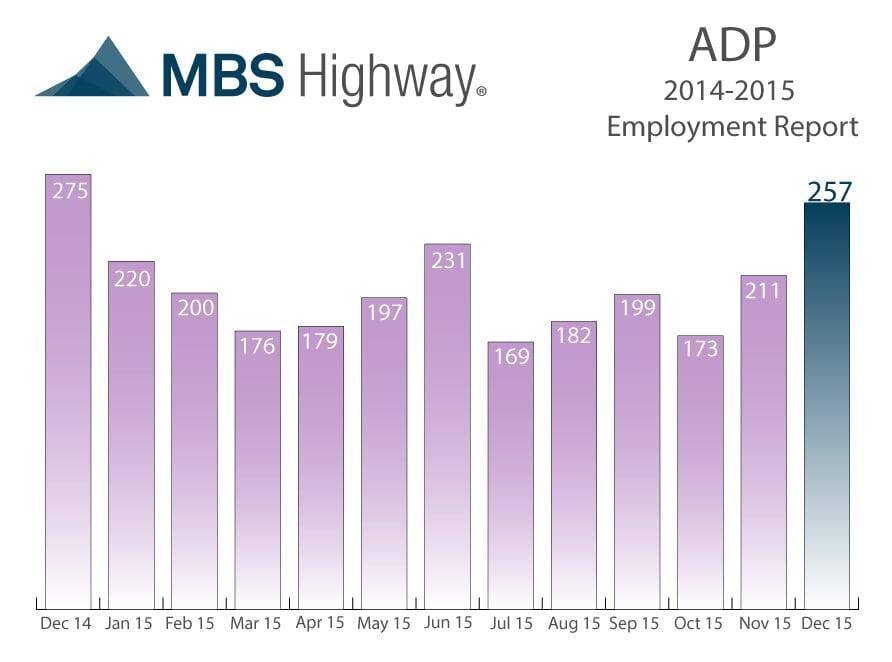

ADP released its November 2012 Employment Report Wednesday in which the payroll-processing firm reported 118,000 new jobs created last month.

The company said the service sector created 114,000 new positions, the construction sector created 2...

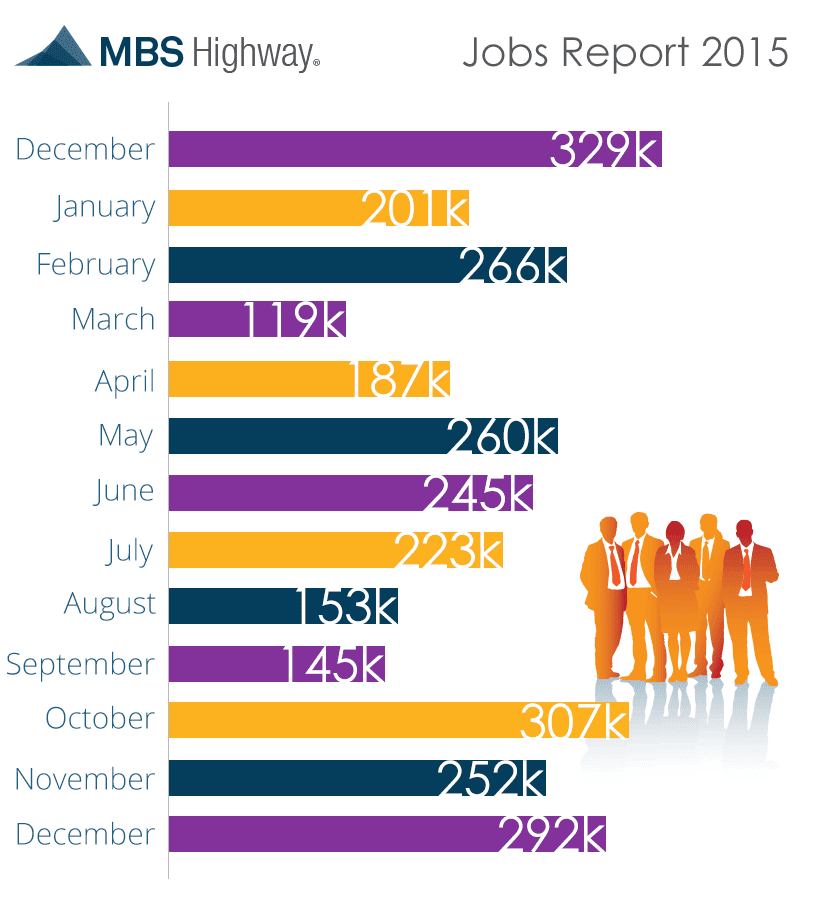

Another month, another good showing for the U.S. economy.

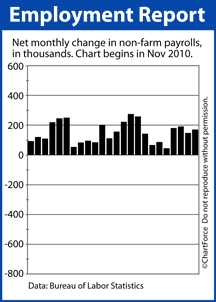

Mortgage rates are performing surprisingly well after Friday's release of the October 2012 Non-Farm Payrolls report. The Bureau of Labor Statistics' monthly report beat Wall Street expectations, while also showing a giant revision to the previ...

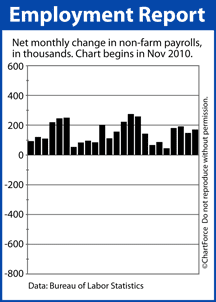

Friday morning, the government's Bureau of Labor Statistics will release its Non-Farm Payrolls report, more commonly called the "jobs report".

Friday morning, the government's Bureau of Labor Statistics will release its Non-Farm Payrolls report, more commonly called the "jobs report".

Depending on how the jobs data reads, FHA and conforming mortgage rates may rise, or fall. This is because today’s mortgage market is closely t...

It's a dangerous time for home buyers in Midlothian to be without a locked mortgage rate.

Friday morning, at 8:30 AM ET, the government releases its Non-Farm Payrolls report for September. More well-known as "the jobs report", Non-Farm Payrolls data has the power to move mortgage rates up o...

(1)

(3)

(8)

(1)

(5)

(9)

(3)

(227)

(2)

(1)

(3)

(1)

(50)

(185)

(5)

(1)

(57)

(1)

(7)

(13)

(29)

(373)

(4)

(14)

(20)

(8)

(22)

(53)

(3)

(7)

(37)