The Bureau of Labor Statistics (BLS) issued its Job Openings and Labor Turnover report for February on Tuesday, April 9th, 2013.. The data was mixed with preliminary figures for all non-farm jobs increasing from 3.62 million jobs in January to 3.93 million jobs in February. This was the highest mont...

The Bureau of Labor Statistics (BLS) issued its Job Openings and Labor Turnover report for February on Tuesday, April 9th, 2013.. The data was mixed with preliminary figures for all non-farm jobs increasing from 3.62 million jobs in January to 3.93 million jobs in February. This was the highest mont...

To refinance a mortgage means to pay off your existing loan and replace it with a new one.

There are many reasons why homeowners opt to refinance, from obtaining a lower interest rate, to shortening the term of the loan, to switching mortgage loan types, to tapping into home equity.

Each has its consi...

As part of the federal Truth-in-Lending Act, refinancing homeowners are granted a 3-day "cooling off" period post-closing during which they retain the right to rescind, or "cancel", their recent refinance without penalty or cost.

As part of the federal Truth-in-Lending Act, refinancing homeowners are granted a 3-day "cooling off" period post-closing during which they retain the right to rescind, or "cancel", their recent refinance without penalty or cost.

The Right To Cancel is protection against surprises...

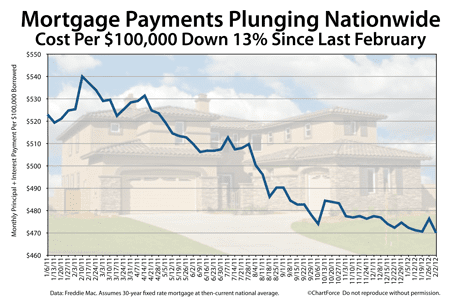

According to Freddie Mac's weekly mortgage rate survey, for 13 straight weeks, the average 30-year fixed rate mortgage has held below 4.000% for mortgage applicants willing to pay up to 0.8 discount points plus a full set of closing costs.

These are the lowest mortgage rates in history and now -- wit...

Falling mortgage rates make owning a home more affordable. Mortgage rates are directly tied to monthly mortgage payment so as mortgage rates drop, so does the cost of home-ownership.

It's a money-saving time to buy a home in Richmond -- or to refinance one. Mortgage rates have never been this ...

(1)

(3)

(8)

(1)

(5)

(9)

(3)

(227)

(2)

(1)

(3)

(1)

(50)

(185)

(5)

(1)

(57)

(1)

(7)

(13)

(29)

(373)

(4)

(14)

(20)

(8)

(22)

(53)

(3)

(7)

(37)