The past week was active for economic news and mortgage rates. After a rising significantly earlier in the week mortgage interest rates ended the week almost unchanged from the close of the prior week. Here's the scoop on last week's activity affecting real estate markets: Tuesday's Case...

The past week was active for economic news and mortgage rates. After a rising significantly earlier in the week mortgage interest rates ended the week almost unchanged from the close of the prior week. Here's the scoop on last week's activity affecting real estate markets: Tuesday's Case... Mortgage rates continued their upward trend last week. Comments by Fed chairman Ben Bernanke after Wednesday’s FOMC meeting caused havoc in financial markets as investors anticipated the potential effects of any rollback of the Fed’s policy of quantitative easing (QE). Chairman Bernanke said ...

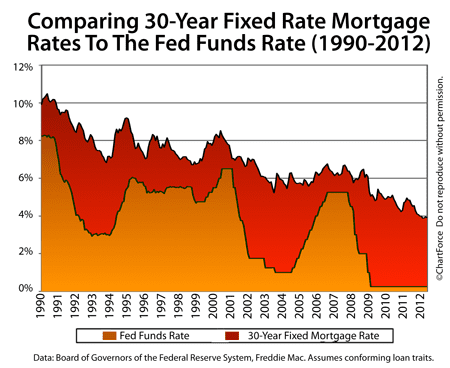

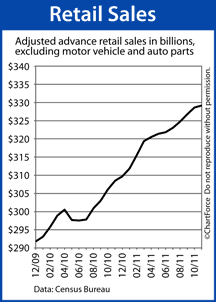

Mortgage rates continued their upward trend last week. Comments by Fed chairman Ben Bernanke after Wednesday’s FOMC meeting caused havoc in financial markets as investors anticipated the potential effects of any rollback of the Fed’s policy of quantitative easing (QE). Chairman Bernanke said ... Mortgage rates dropped last week despite positive employment reports, which typically causes mortgage rates to rise. As of Thursday, Freddie Mac reports that the average mortgage rate for a 30-year fixed rate mortgage was 3.63 percent with borrowers paying their closing costs and 0.8 percent in disc...

Mortgage rates dropped last week despite positive employment reports, which typically causes mortgage rates to rise. As of Thursday, Freddie Mac reports that the average mortgage rate for a 30-year fixed rate mortgage was 3.63 percent with borrowers paying their closing costs and 0.8 percent in disc... The Federal Open Market Committee (FOMC) released minutes from its January meeting last Wednesday, as it generally does three weeks following the most recent meeting.

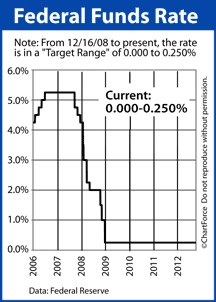

The Federal Open Market Committee (FOMC) released minutes from its January meeting last Wednesday, as it generally does three weeks following the most recent meeting.

The FOMC is a committee within the Federal Reserve System tasked with overseeing the purchase and sale of US Treasury securitie...

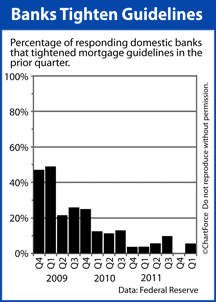

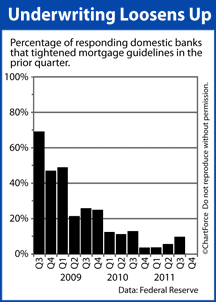

According to the Federal Reserve's quarterly Senior Loan Officer Survey, it's getting easier to get approved for a home loan.

According to the Federal Reserve's quarterly Senior Loan Officer Survey, it's getting easier to get approved for a home loan.

Between July - September 2012, fewer than 6% of banks tightened mortgage guidelines -- the fourth straight quarter that's happened-- and roughly 10% of banks actually loosened...

Sandy is upsetting the financial markets today, and possibly tomorrow. The NY stock exchanges are closed today with talk they may be down again tomorrow as the storm takes aim on Wall Street and NY. NY transit systems closed with concerns that the subways will flood. This morning the stock index fut...

Sandy is upsetting the financial markets today, and possibly tomorrow. The NY stock exchanges are closed today with talk they may be down again tomorrow as the storm takes aim on Wall Street and NY. NY transit systems closed with concerns that the subways will flood. This morning the stock index fut... Mortgage markets improved last week as the Federal Reserve introduced new economic stimulus. The move trumped bond-harming action from the Eurozone, and a series better-than-expected U.S. economic data.

Mortgage markets improved last week as the Federal Reserve introduced new economic stimulus. The move trumped bond-harming action from the Eurozone, and a series better-than-expected U.S. economic data.

The 30-year fixed rate mortgage rate dropped last week for most loan types, including for conformi...

Mortgage markets improved last week for the second consecutive week. With no news coming from Europe, Wall Street was focused U.S. economic data and Federal Reserve Chairman Ben Bernanke's planned public speech from the Fed's annual retreat in Jackson Hole, Wyoming. Rate shoppers and home buyers in...

Mortgage markets improved last week for the second consecutive week. With no news coming from Europe, Wall Street was focused U.S. economic data and Federal Reserve Chairman Ben Bernanke's planned public speech from the Fed's annual retreat in Jackson Hole, Wyoming. Rate shoppers and home buyers in... Mortgage markets improved last week. Mixed data highlighted the U.S. economy's slow, steady expansion; the Federal Reserve changed market expectations for the new stimulus; and, sovereign debt concerns moved back to the forefront in Europe. Conforming mortgage rates fell last week for the first time...

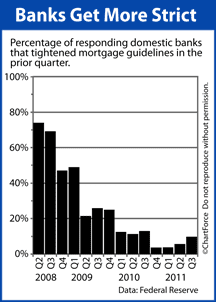

Mortgage markets improved last week. Mixed data highlighted the U.S. economy's slow, steady expansion; the Federal Reserve changed market expectations for the new stimulus; and, sovereign debt concerns moved back to the forefront in Europe. Conforming mortgage rates fell last week for the first time... As another signal of an improving U.S. economy, the nation's biggest banks have started to loosen mortgage lending guidelines.

As another signal of an improving U.S. economy, the nation's biggest banks have started to loosen mortgage lending guidelines.

As reported by the Federal Reserve, last quarter, no "big banks" reported stricter mortgage standards as compared to the quarter prior and "modest fractions...

Mortgage markets booked major losses last week after European leaders spoke of their determination to preserve the European Union. Mortgage rates jumped Thursday and Friday as investors sold positions of relative safety, including bonds, and moved their money into stock markets. Mortgage rates close...

Mortgage markets booked major losses last week after European leaders spoke of their determination to preserve the European Union. Mortgage rates jumped Thursday and Friday as investors sold positions of relative safety, including bonds, and moved their money into stock markets. Mortgage rates close... Mortgage markets improved last week on slowing economic growth worldwide and investor thirst for "safe" investments. China's economy posted to its weakest growth since 2009 and economic activity in the Eurozone continued to sag. Both events resulted in a broad-based sell-off of equities an...

Mortgage markets improved last week on slowing economic growth worldwide and investor thirst for "safe" investments. China's economy posted to its weakest growth since 2009 and economic activity in the Eurozone continued to sag. Both events resulted in a broad-based sell-off of equities an... Despite an improving U.S. economy, the nation's banks remain cautious about what they will lend, and to whom.

Despite an improving U.S. economy, the nation's banks remain cautious about what they will lend, and to whom.

Last quarter, by a margin of 3-to-2, more banks tightened residential mortgage lending standards for "prime borrowers" than did loosen them.

A "prime borrower" is defined a...

The Federal Open Market Committee begins a 2-day meeting today in the nation's capitol. It's the group's third of 8 scheduled meetings this year. Mortgage rates are expected to change upon the Fed's adjournment.

Led by Chairman Ben Bernanke, the FOMC is a 12-person, Federal Reserve sub-committee...

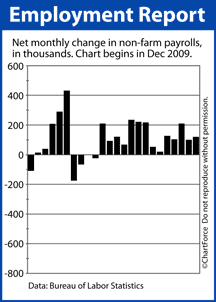

Mortgage markets were mostly unchanged last week despite a series of positive developments. In addition to Greece successfully reaching a deal with its private creditors, the U.S. economy turned out strong reports -- most notably with respect to Non-Farm Payrolls. In February, the U.S. economy added...

Mortgage markets were mostly unchanged last week despite a series of positive developments. In addition to Greece successfully reaching a deal with its private creditors, the U.S. economy turned out strong reports -- most notably with respect to Non-Farm Payrolls. In February, the U.S. economy added...

After a half-decade of tightening mortgage guidelines, banks are starting to "loosen up".

The Federal Reserve conducts a quarterly survey of its member banks and, last quarter, not a single responding bank reported having tightened its mortgage guidelines for prime borrowers.

A "pr...

Mortgage markets improved last week, pushing mortgage rates in Virginia lower for the second straight week. Conforming fixed and adjustable-rate mortgage cut new, all-time lows, and FHA mortgage rates did the same. In a holiday-shortened trading week, stronger-than-expected U.S. economic data and on...

Mortgage markets improved last week, pushing mortgage rates in Virginia lower for the second straight week. Conforming fixed and adjustable-rate mortgage cut new, all-time lows, and FHA mortgage rates did the same. In a holiday-shortened trading week, stronger-than-expected U.S. economic data and on... Mortgage markets were mostly unchanged for the 6th consecutive week last week as Wall Street's uncertainty regarding the future of U.S. and global economies remain. Mortgage bonds made gains made through the early part of the week, which caused mortgage rates in Virginia to drop Monday through Wedne...

Mortgage markets were mostly unchanged for the 6th consecutive week last week as Wall Street's uncertainty regarding the future of U.S. and global economies remain. Mortgage bonds made gains made through the early part of the week, which caused mortgage rates in Virginia to drop Monday through Wedne... Mortgage markets made little change last week for the fifth time in as many weeks.

Mortgage markets made little change last week for the fifth time in as many weeks.

As Wall Street watched both the Eurozone and the U.S. regain their respective footing, expectations for a new Fed-led stimulus increased, which prevented mortgage rates from rising.

According to Freddie Mac, the average...

As part of its quarterly survey to member banks nationwide, the Federal Reserve asked senior loan officers whether last quarter's "prime" residential mortgage guidelines have tightened, loosened, or remained as-is.

A "prime" borrower is defined as one with a well-documented, high-...

(1)

(3)

(8)

(1)

(5)

(9)

(3)

(227)

(2)

(1)

(3)

(1)

(50)

(185)

(5)

(1)

(57)

(1)

(7)

(13)

(29)

(373)

(4)

(14)

(20)

(8)

(22)

(53)

(3)

(7)

(37)